Flowchart Templates

Tools that can be used to describe business processes that contain large amounts of information

What are Flowchart Templates?

Flowcharts are great for describing business processes concisely without compromising on structure and detail. They allow users to summarize large amounts of information in a relatively little space. In addition, good flowcharts can improve the quality and accessibility of business reports. Below are four sample flowchart templates that should serve as a good starting point for an analyst looking to learn more information about some common flowcharts.

Summary:

- Flowcharts are great for describing business processes concisely without compromising on structure and detail. They allow analysts to summarize large amounts of information in relatively little space.

- Microsoft Word’s SmartArt section contains a large collection of flowchart templates that can be freely used by all users.

- A great free online tool for more specialized flowcharts is Draw.io.

Making Flowcharts using Flowchart Templates

Although no special tools or software is needed to make flowcharts (one can simply arrange shapes and arrows in a word processor such as Microsoft Word), certain tools can greatly reduce the time it takes to make them. Microsoft Word’s SmartArt section contains a large collection of flowchart templates that can be freely used by all users.

One great free online tool for more specialized flowcharts is Draw.io. The Multi-Level Single Process Flowchart, the Decision Tree Flowchart, and the Venn Diagram can be made using Draw.io.

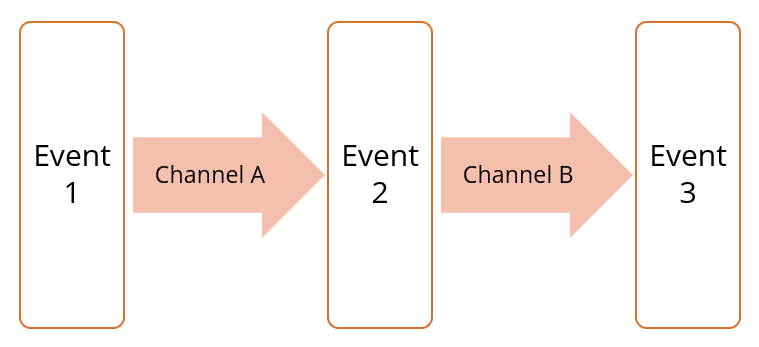

Multi-Stage Single Process Flowchart

The Multi-Stage Single Process Flowchart template can be found in Microsoft Word’s SmartArt section and is free to use. Event 1 leads to Event 2 via Channel A. Event 2 leads to Event 3 via Channel B. For example, an analyst wants to write about the link between high interest rates and high unemployment.

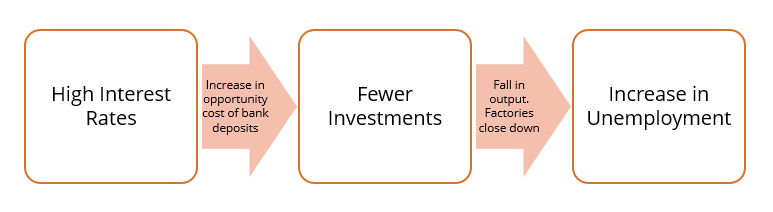

Decision Tree – Illustrative Example of Why We Should Use Flowcharts

Decision trees allow analysts to describe in detail how and when businesses make decisions. An investor just put in $1,000,000 in a tech startup. Six months after the initial investment, the start-up asks for more money. The investor needs to make a decision now: Should I invest more in the business? If yes, how much should I invest?

The decision tree below and the following paragraphs both provide a complete description of the investor’s investment plan. They take up roughly the same amount of space on the page, but the paragraphs contain a total of 256 words and are quite verbose.

- Invest $10,000,000 if the business has been profitable in the past six months and its profits are expected to increase by 10% or more in a year. Invest $7,000,000 if the business has been profitable in the past six months and its profits are expected to increase by less than 10% in a year. Invest $10,000,000 if the business has been profitable in the past six months and its profits are expected to increase by 20% or more in the future.

- Invest $6,000,000 if the business has been profitable in the past six months and its profits are expected to increase by less than 20% in the future. Invest $3,000,000 if the business has been profitable but its profits are not expected to increase. Invest $5,000,000 if the business has not been profitable in the past 6 months but is expected to make profits of more than $1,000,000 within a year. Invest $3,000,000 if the business has not been profitable in the past six months but is expected to make profits of less than $1,000,000 within a year.

- Invest $2,000,000 if the business has not been profitable in the past six months but is expected to make profits of more than $1,000,000 in the future. Invest $1,000,000 if the business has not been profitable in the past six months but is expected to make profits of less than $1,000,000 in the future. Don’t invest if the business has not been profitable in the past six months and is not likely to generate profits in the future.

Venn Diagram

Venn diagrams are another great graphical tool that should be part of every financial analyst’s repertoire. Below, we use a Venn diagram to distinguish between the necessary conditions for investment and the sufficient conditions for investment.

- Cyan and Orange: If a business is currently generating profits, is operating in an industry that has a favorable regulatory environment, but does not have a sustainable business model, then it should be considered a short-term investment and should be reviewed very often. An investor should invest $1,000,000.

- Cyan and Red: If a business is currently generating profits, has a sustainable business model, but is not operating in an industry with a favorable regulatory environment, then it should be considered a medium-term investment and should be reviewed less often than a short-term investment. An investor should invest $10,000,000.

- Orange and Red: If a business has a sustainable business model and is operating in an industry with a favorable regulatory environment, but is not currently generating profits, then it should be viewed as a potential long-term investment. An investor should invest $500,000.

- Cyan, Orange, and Red: A business that is currently generating profits, has a sustainable business model, and also operates in an industry with a favorable regulatory environment should be viewed as a long-term investment. An investor should invest $25,000,000.

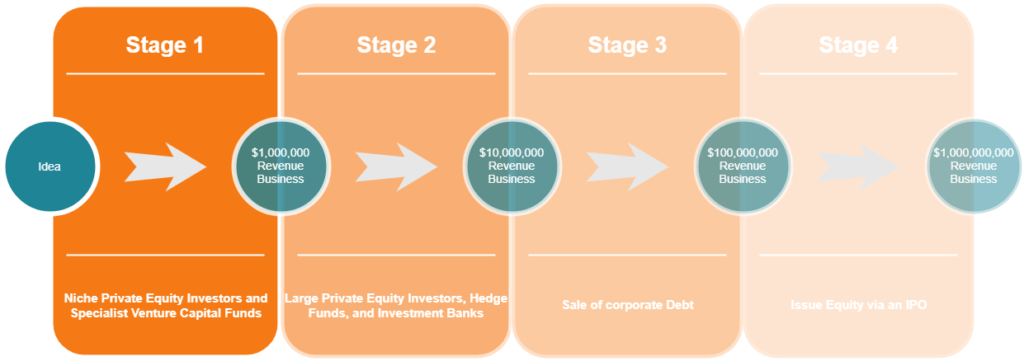

Multi-Level Single Process Flowchart

Funding Stage 1: A tech startup uses money from niche private equity investors and specialist venture capital funds to increase the size of their operation and generate revenues more than $1,000,000.

Funding Stage 2: The business then uses money from large private equity investors, hedge funds, and investment banks to increase the size of their operation and generate revenues more than $10,000,000.

Funding Stage 3: The business issues a large amount of corporate debt and uses this money to increase the size of their operations and generate revenues more than $100,000,000.

Funding Stage 4: The business lists itself on a stock exchange and issues shares to the public via an IPO. The business uses this money to increase the size of their operations and generate revenues of more than $1,000,000,000.

More Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful: