Net Identifiable Assets

Purchase Price Allocation and calculation of Goodwill in M&A

What is Net Identifiable Assets?

Net Identifiable Assets (NIA) consists of the assets acquired from a company whose value can be measured at a given point of time and its future benefit to the company is recognizable. NIA is used for Purchase Price Allocation (PPA) and the calculation of Goodwill in Mergers and Acquisitions (M&A). The prefix “Net” here means after deducting the liabilities that also come along with the acquisition.

Components of Net Identifiable Assets

Identifiable assets are assets that the acquired company includes in the list of balance sheet items. The asset amount that is not on the balance sheet is to be put under “Goodwill.” The amount of the goodwill is relative to the amount that an acquiring company paid and is essentially based on the perception and assumptions of the acquiring company. This is the reason that Goodwill is not considered a part of Net Identifiable Assets.

Example – Calculation of Net Identifiable Assets and Goodwill

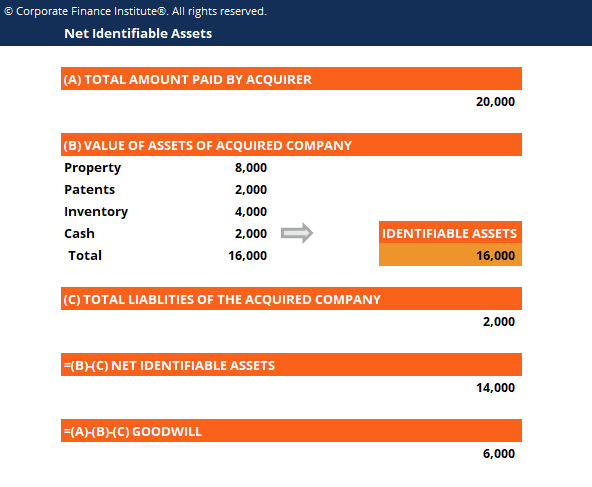

Let us see the concept of Net Identifiable Assets and Goodwill through an example:

An acquirer has paid $20,000 to purchase another company.

The assets that are posted on the acquired company are all identifiable assets. The amount paid over and above the value of Net Identifiable Assets – i.e., the value of total assets less total liabilities, is the amount of Goodwill.

Goodwill is not included on the acquired company’s balance sheet because it is not an “Identifiable Asset” and is only reported on the balance sheet when acquired.

The value of Goodwill is not empirically verifiable, and thus, remains an unidentifiable asset even after the acquisition. Its value is incidental to the amount the acquirer pays during the acquisition, which might differ from case to case.

Download the Free Template

Net Identifiable Assets Template

Download the free Excel template now to advance your finance knowledge!

Identifiable Intangible Assets and Goodwill

As per the CON5 asset recognition criteria, an asset is recognized if it meets the definition of an asset, has a relevant attribute measurable with sufficient reliability, and the information about it is representationally faithful, verifiable, neutral (i.e., it is reliable), and capable of making a difference in user decisions (i.e., it is relevant).

For intangible assets to be separately identified from goodwill, the abovementioned criterion along with the ones below must be fulfilled:

- Legal (or Contractual) – Control over the future economic benefits of the asset results from contractual or other legal rights (regardless of whether those rights are transferable or separable from other rights and obligations); or

- Separability – The asset is capable of being separated or divided and sold, transferred, licensed, rented, or exchanged (regardless of whether there is an intent to do so or whether a market currently exists for that asset), or, if it cannot be individually sold, etc., it is capable of being sold, transferred, licensed, rented or exchanged along with a related contract, asset, or liability.

All intangible assets acquired from other enterprises or individuals, whether singly, in groups, or as part of a business combination, are recognized initially and are measured based on their respective fair values. Under the provisions of ASC 350, however, a serious effort must be directed to identifying the various intangibles acquired.

Additional Resources

Thank you for reading CFI’s guide to Net Identifiable Assets. To keep advancing your career, the additional CFI resources below will be useful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.