Accounting Profit vs Economic Profit

How to differentiate the two types of cash flow

Accounting Profit vs. Economic Profit

Accounting profit is a company’s net earnings on its income statement, whereas economic profit is the value of cash flow that’s generated above all other opportunity costs. This guide will help you thoroughly understand accounting profit vs economic profit, and while they may sound similar, they are actually quite different.

What is Accounting Profit?

Accounting profit is the net income that a company generates, found at the bottom of its income statement. The figure includes all revenue the company generates and deducts all expenses to arrive at the bottom line.

Common sources of revenue include the sale of goods and services, receipt of dividends or interest, and rental income, to name a few.

Common types of expenses include the cost of goods sold (COGS), marketing and advertising expenses, salaries and benefits, travel, entertainment, sales commissions, rent, depreciation and amortization, interest, and taxes.

Learn more in CFI’s Free Accounting Crash Course.

Accounting Profit Example

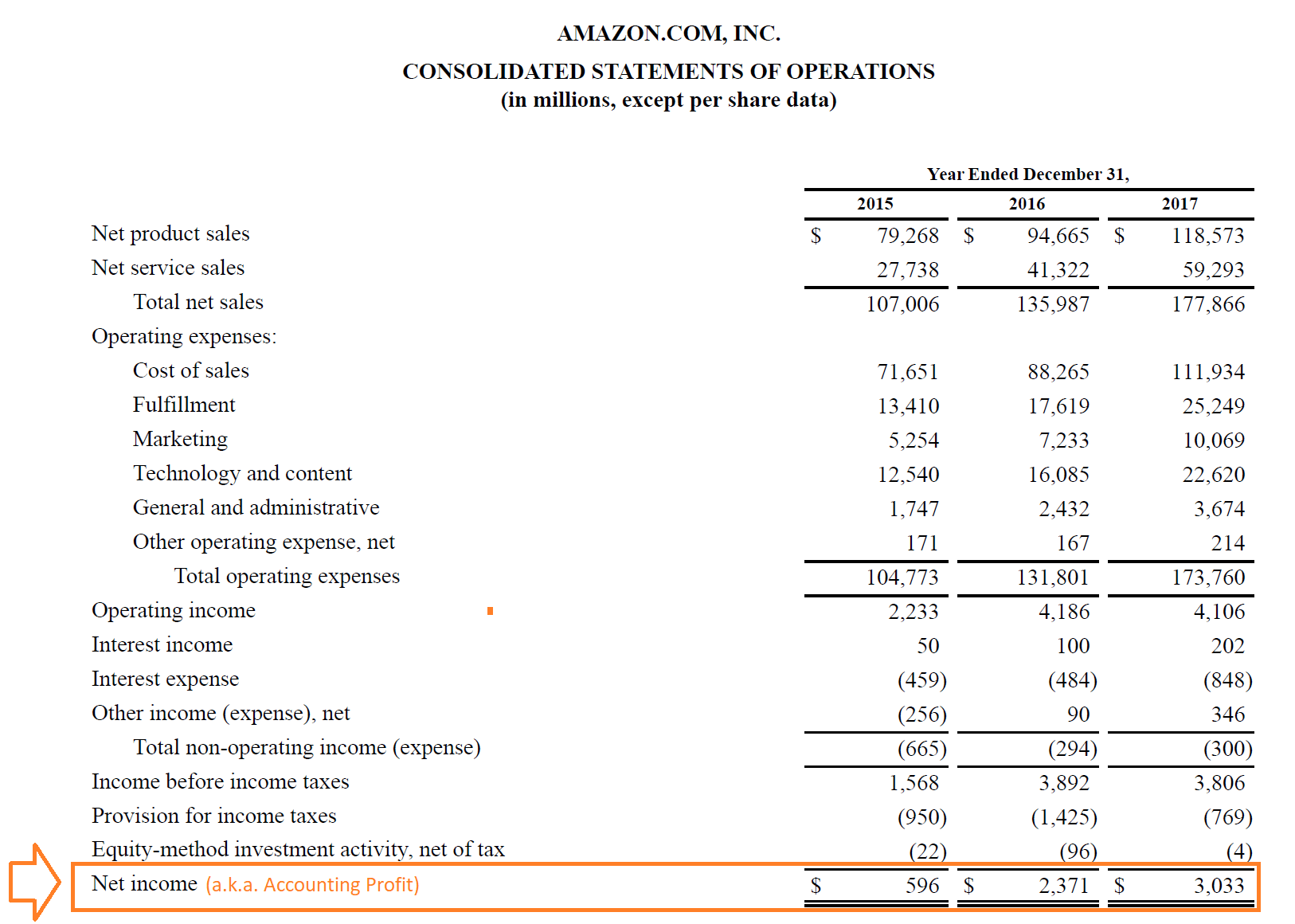

Below is an example showing Amazon’s 2017 consolidated statement of operations (also known as a statement of profit and loss or income statement).

In the example, you can clearly see how the statement starts with revenue (sales) and then deducts all expenses to arrive at net income (a.k.a. accounting profit). In 2017, the figure was $3.0 billion for Amazon.

Learn more in CFI’s Financial Analysis Course.

Economic Profit

Economic profit differs quite significantly from accounting profit. Instead of looking at net income, economic profit considers a company’s free cash flow, which is the actual amount of cash generated by a business. Due to accrual accounting principles, the figure is often materially different from accounting profit.

Furthermore, once the company’s free cash flow is calculated, it must then take into account the opportunity cost that managers of the business can expect to earn on comparable alternatives.

Learn more in CFI’s Economic Value Added Guide.

Economic Profit Example

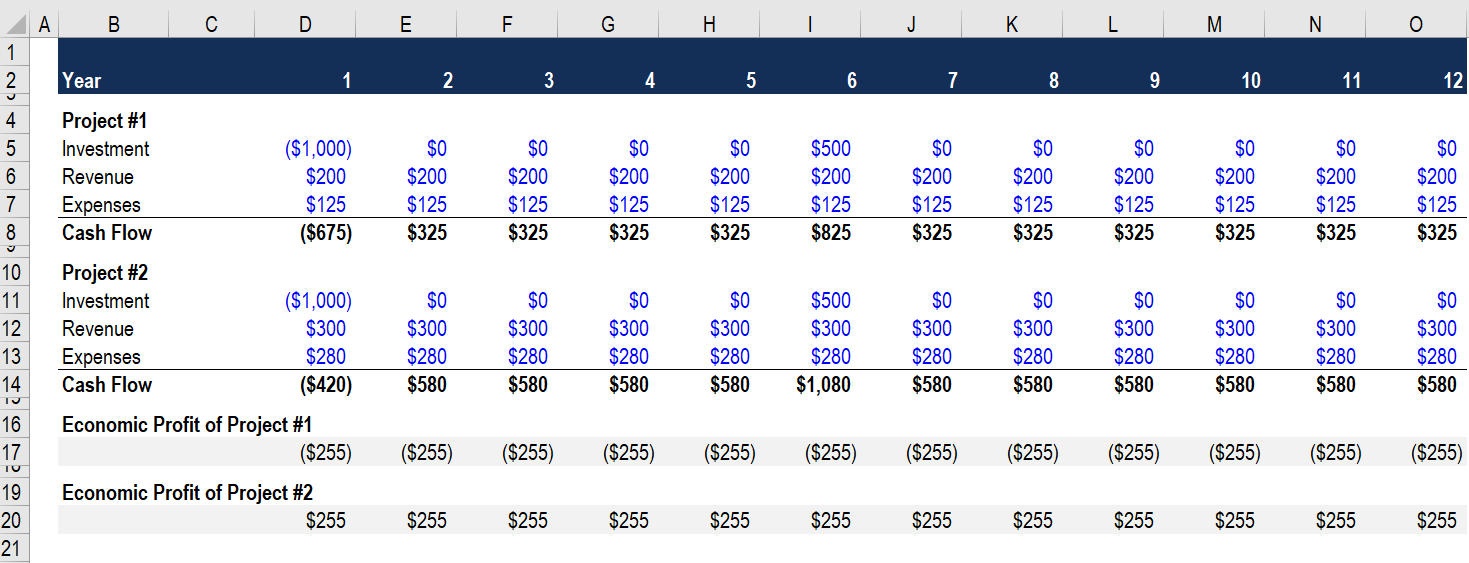

For example, imagine a company has two choices: Invest $1,000 into a new t-shirt product line (Project #1) or invest $1,000 into a new sock product line (Project #2). Project #1 will have revenues of $200 and costs of $125, while Project #2 will have revenues of $300 and costs of $280.

Below is an example (simplified) calculation of how to calculate the economic profit of each project.

The first step is to calculate the cash flow of each project. For a detailed explanation of how to perform the calculation, see CFI’s Ultimate Cash Flow Guide.

The next step is to take the difference between the cash flows of each project and compare them to see which generates more economic profit.

As you can see, Project #2 generates a positive economic profit, relative to Project #1. Learn more in CFI’s Financial Modeling Courses.

Additional Resources

Thank you for reading CFI’s guide to Accounting Profit vs Economic Profit. These additional CFI resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?