Amortization of Intangible Assets

How to amortize intangibles

What is Amortization of Intangible Assets?

In this article, we will discuss the amortization of intangible assets. Intangible assets refer to assets of a company that are not physical in nature. They include trademarks, customer lists, goodwill, etc. Hence, they are not composed of parts or materials with a defined benefit or life span, which can be objectively determined.

This creates difficulties in properly estimating a periodic charge for these intangible assets. To such an end, the International Accounting Standards Board’s IAS 38 sets out rules on how intangibles should be amortized.

Classification of Intangibles

Intangible assets can be broadly classified into two categories:

1. Definite life

Definite-life intangible assets refer to assets with a finite life. For example, a license to produce a certain product for ten years. Here, the asset is given an identifiable contract life of ten years. These types of intangible assets are typically subject to asset amortization. They may also become impaired over time, at which point the company will recognize an impairment expense and reduce the value of the asset on its balance sheet.

2. Indefinite life

The life of such assets is unknown at inception. They may generate or contribute to revenue in perpetuity – for example, broadcasting rights that may be continuously renewed without much cost to the holder. Goodwill is another example of an indefinite-life intangible asset. These types of intangible assets are not typically subject to amortization but are subject to annual impairment tests.

Key Highlights

- Intangible assets refer to assets of a company that are not physical in nature. They include trademarks, customer lists, goodwill, etc.

- Intangible assets are classified into two different categories: definite life and indefinite life. Definite-life intangible assets are typically subject to amortization, whereas indefinite-life intangible assets are only subject to annual impairment tests (or when the impairment is determined).

- Amortization is typically calculated on a straight-line basis.

Determination of Life

The IAS 38 underlines certain factors that can be used to determine the life of an intangible asset, such as:

1. Expected usage

The length that the asset is expected to produce benefits for the business. it can also be the length of the contract that allows for the use of the intangible asset. For example, a copyright will take on a legal life of 50 years, but it is expected to be useful only for 10 years. The appropriate useful life for amortization then is 10 years.

2. Product life cycle

Some intangibles may be product-specific and should not have a life longer than that of the associated products.

3. Technical obsolescence

Any intangible asset associated with a product that is now technically obsolete should be considered impaired and amortized accordingly. For example, a patent on a mechanical watch would be considered obsolete, but a trademark might still possess some value due to the unique quality of the brand.

4. Competitor action

Some competitor actions can make the incumbent product obsolete, in which case IAS 38 requires that the incumbent business impair and amortize associated intangibles. For example, any intangibles related to the manufacturing or distribution of old-style tungsten light bulbs are rendered worthless in the accounting sense with the introduction of more efficient forms of lighting like LEDs.

5. Maintenance expenditure

Some intangibles require an amount of expenditure, such as a renewal fee, to keep them operational. If the maintenance expenditure is high enough that a business can no longer afford to pay, then the business may be required to write down or write off the asset.

The most common example of such an intangible is broadcasting rights. If broadcasting rights can be renewed easily, then they can be reported as an intangible asset with an indefinite life.

Amortization Methods

General Guidelines

IAS 38 provides general guidelines as to how intangible assets should be amortized:

1. The amortization of an asset should only start when the asset is brought into actual use, and not before, even if the requisite intangible asset has been acquired.

2. The level of amortization should be appropriate so that the book value of an asset is not under or overstated.

The method of amortization used should be commensurate with the use of the asset. If no method is determinable, then the asset must be amortized on a straight-line basis.

Revenue-Based Amortization

In line with the guidelines, revenue-based amortization aims to amortize the intangible in accordance with its contributions to the revenue. It leads to a variable amortization schedule. However, IAS 38 argues against the use of revenue-based methods because it is hard to quantify the contribution of an intangible to revenue. The standard recommends the use of the straight-line method in place of revenue-based amortization.

Indefinite Life Assets

Assets with an indefinite life, like goodwill, are not typically amortized in regular fashion as finite-life assets. Instead, every year the company conducts an impairment test on indefinite-life assets. If the asset is found to be impaired, the company will record an impairment expense on its income statement and a resulting reduction in the asset’s value on the balance sheet. However, some jurisdictions (like the United States), do allow goodwill to be amortized if the company is privately owned.

Straight-Line Method

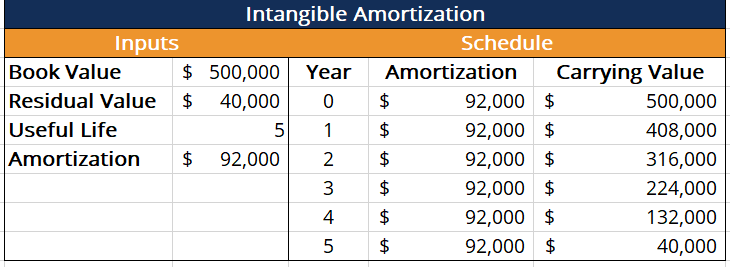

Under the straight-line method (SLM), an asset is amortized to zero or its residual value. The amount of amortization every year is given by:

Amortization = (Book Value – Residual Value) / Useful Life

The following table illustrates the straight-line method:

Related Readings

CFI is the official provider of the Financial Modeling & Valuation Analyst (FMVA)® certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.