Consignment Sales

A trade agreement in which one party (the consignor) provides goods to another party (the consignee) to sell

What are Consignment Sales?

Consignment sales are a trade agreement in which one party (the consignor) provides goods to another party (the consignee) to sell. However, the consignee has the right to return unsold goods back to the consigner. In other words, a consignment sale is an agreement in which a third party is entrusted with selling goods on behalf of the owner. Consignment sales are also called goods on consignment.

Understanding Consignment Sales

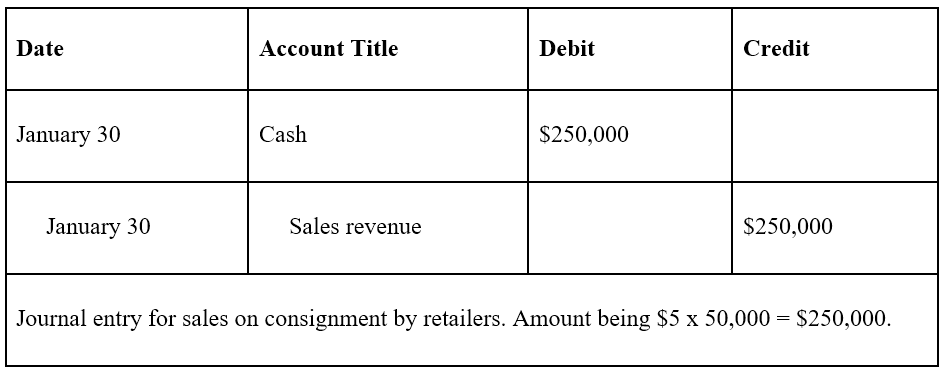

When the consignor sends goods to the consignee, a journal entry is not needed. However, when the consignee sells the goods received, they pay the consignor a predetermined sale amount. The consignor would then record a debit to cash and a credit to sales. They would also purge the related amount of inventory as a debit to cost of goods sold and a credit to inventory.

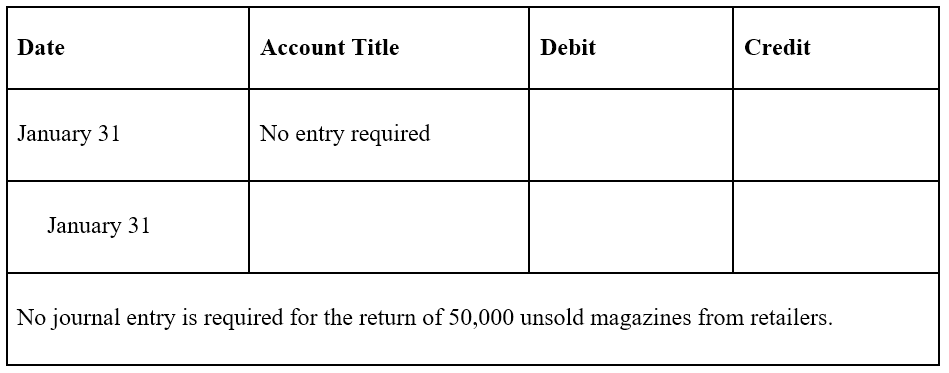

If the consignee is unable to sell all goods, they are able to return the goods to the consignor (before a specified date). Therefore, the consignor bears the risks and rewards of ownership, while the consignee is not required to pay for the goods until they are sold.

Example of Consignment Sales

On January 1st, Company A sends 100,000 copies of its magazines to retailers to sell on consignment. The company specifies that the deadline to return unsold goods is January 31st. In this scenario, Company A is the consignor, while the retailers are the consignee.

The retail price per magazine is $10 and the price charged by Company A selling to the retailers is $5. Throughout the month of January, the retailers manage to sell 50,000 copies (the retailers notify Company A on January 30th). Therefore, there were 50,000 unsold magazines, which the retailers returned to Company A on January 31st. Additionally, each magazine costs Company A $1 to make.

The journal entries for Company A would be as follows:

Advantages of Consignment Sales

Advantages to the consignor are:

- Saves on inventory holding costs by sending goods to the consignee

- Does not need to spend time creating listings to sell items

- Does not need to set up a retail storefront

- Makes it easier to convince consignee to stock their goods

Advantages to the consignee are:

- Does not need to pay upfront for the goods

- Unsold goods can be returned at no cost, thus reducing risk

- Does not need to pay for goods until the goods are sold to end-users

Disadvantages of Consignment Sales

Disadvantages to the consignor are:

- Receives less revenue than selling directly to end-users (the use of a consignee reduces the amount of revenue earned)

- Risk and ownership are retained and any unsold goods are returned at no cost to the consignee

- Goods on consignment may not be given enough promotion or visibility by consignees

Disadvantages to the consignee are:

- Inventory holding costs if a large number of goods are unsold

- Potential difficulty in managing inventory related to consignment

Other Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep learning and advancing your career, the additional CFI resources below will be useful: