Impairment

An abrupt decrease in an asset's fair value due to several factors

What is Impairment?

The impairment of a fixed asset can be described as an abrupt decrease in fair value due to physical damage, changes in existing laws creating a permanent decrease, increased competition, poor management, obsolescence of technology, etc. In the case of a fixed-asset impairment, the company needs to decrease its book value in the balance sheet and recognize a loss in the income statement.

All assets, either tangible or intangible, are prone to impairment. A tangible asset can be property, plant and machinery (PP&E), furniture and fixtures, etc., whereas intangible assets can be goodwill, patent, license, etc.

Indicators of Impairment Test

Companies must assess the external environment and look for the indicators below to decide when to impair assets. Given below are just some of the indicators relevant for impairment:

External factors:

- Drastic change in economic or legal factors affecting the company or its assets

- Significant fall in the market price of the asset

- Muted demand for a medium-term period due to global macroeconomic conditions

Internal factors:

- Asset as a part of a restructuring or held for disposal

- Obsolescence or physical damage to the asset

- Inability to bring in post-merger synergy benefits that were expected earlier

- Worse economic performance than what is expected

Exclusions as per IFRS IAS 36

IAS 36 applies to all assets except those for which other standards address impairment. The exceptions to this standard are:

- Assets from construction contracts

- Inventories

- Deferred tax assets

- Financial assets (within the scope of IFRS 9)

- Assets arising from employee benefits

- Agricultural assets carried at fair value (within the scope of IAS 41)

- Investment property carried at fair value

- Non-current assets held for sale

- Insurance contract assets

Advantages of Impairment

- Impairment charges provide investors and analysts with different ways to assess a company’s management and decision-making track record. Managers who write off or write down assets because of impairment might not have made good investment decisions or lacked the vision before making that kind of investment.

- Many business failures are heralded by a fall in the impairment value of assets. Such disclosures act as early warning signals to creditors and investors.

Disadvantages of Impairment

- It is generally difficult to know the measurement value that must be used to ascertain the impairment amount. A few of the popular ways of measuring impairment include finding out the current market value, current cost, NRV, or the sum of future net cash flows from the income-producing unit.

- The detailed guidance on treatment for impairing assets is not there, like when to recognize impairment, how to measure impairment, and how to disclose impairment.

Impairment vs. Amortization

Though both terms may seem similar, impairment relates more to a sudden and irreversible decrease in the value of an asset, for example, the breakdown of a machine due to an accident.

Generally, amortization is believed to be a systematic decrease in an intangible asset’s book value, based on the planned amortization plan. The total write-off is usually spread across the complete life of the asset, also considering its expected resale value.

Practical Example: Tata Steel & Corus Group

In 2006, Tata Steel Ltd, which ranks as one of India’s largest steel companies and in the world, made its biggest acquisition, purchasing Anglo-Dutch steelmaker Corus Group Plc. Corus was established in 1999 and was the second-largest steel company in Europe before its acquisition.

Tata Steel initially bid $13bn for Corus to tap the European market and secure technology benefits. Following a highly competitive auction process, Tata Steel was able to win after showing a quite optimistic view of the asset.

Some industry experts also believed the Indian steel company was quite optimistic and aggressive in the whole process. The entire story of the bidding and the synergy benefit was not well taken by the markets, and the share price of the company fell by 11% on the day of the announcement of the deal and by more than 20% in a month.

In 2013, after realizing the extent of the valuation they paid, Tata Steel chose to impair the acquired assets and reached a figure of $3bn by impairing goodwill and assets. The reason given by the management for such impairment was a weaker macroeconomic and market environment in Europe where apparently steel demand fell by almost 8% in 2013. The situation was expected to continue for the medium-term time frame, and thus management needed to revise the cash flow expectations.

Other Cases of Impairment

The Tata Steel example was not the only case where goodwill or other assets were written off. In 2012, Arcelor Mittal, the world’s largest steelmaker, wrote down its European business assets by $4.3bn after the eurozone debt crisis hampered demand. Other companies, such as Nippon Steel and Sumitomo, impaired certain assets for their Japanese operations.

Additional Resources

Thank you for reading CFI’s guide to Impairment. To keep advancing your career, the additional CFI resources below will be useful:

Analyst Certification FMVA® Program

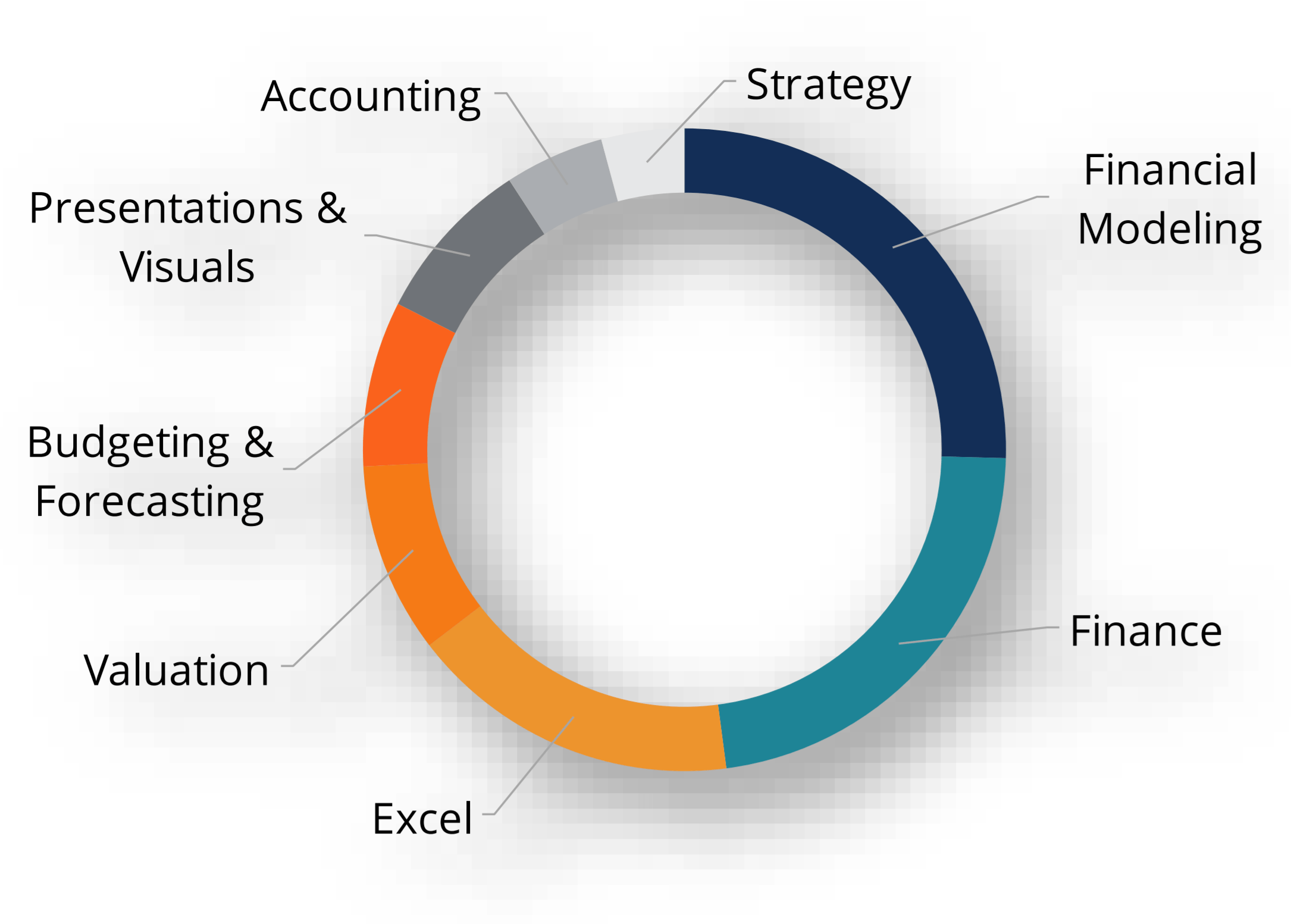

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?