Initial Outlay Calculation

The cost associated with pursuing corporate development projects

What is an Initial Outlay?

An initial outlay refers to the initial investments needed in order to begin a given project. For instance, if opening a new factory, a company would need to purchase new land and machinery in order to get the project going.

Usually, a company’s management will base their decision to pursue certain projects based on profitability metrics or strategic value. Nonetheless, they should also take into account the initial outlay of capital required to pursue the selected project, as well as which sources of capital they intend to draw upon. The initial outlay is used in the calculation of NPV.

How is Initial Outlay Calculated?

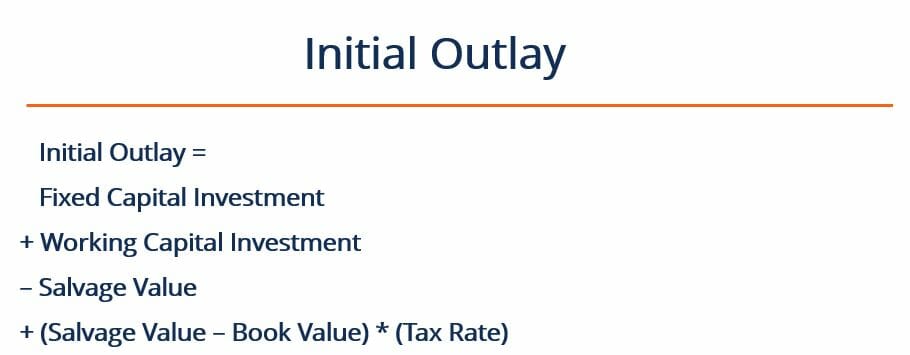

The initial outlay for projects can be calculated with the following formula:

Where:

- Fixed Capital Investment – refers to the investment made in order to purchase new equipment required for the project. This cost also encompasses installation and shipping costs involved with purchasing equipment. This is often considered to be a long-term investment.

- Working Capital Investment – refers to the investment made at the beginning of the project to cover the initial operating expenses of the project (for example, raw materials inventory). This part of the initial outlay is often considered to be a short-term investment.

- Salvage Value – refers to the cash proceeds collected from the sale of old equipment or assets. Such proceeds are only realized if a company actually decides to sell off older assets. For example, if the project was an overhaul of a production facility, this might involve selling off old equipment. However, if the project is centered around expanding into a brand new production facility, there may not be any older equipment to be sold. Thus, the term only applies in cases where there the company is selling off older fixed assets in connection with beginning the new project. The salvage value is often quite close to the prevailing market value for the particular asset.

- Book Value – refers to the net book value of the old assets. The book value refers to how much a given asset is worth on the company’s accounting records (i.e., how much it’s been depreciated). It is different from the salvage value, as it does not represent a cash inflow or outflow. It is only used to calculate any gains or losses from the sale of old assets.

- Tax Rate – refers to the effective tax rate in the jurisdiction where the company is reporting its earnings.

- (Salvage Value – Book Value) x (Tax Rate) – refers to any gains or losses realized on the sale of older equipment. For instance, if an old piece of machinery is sold for more than its book value, the company will realize a capital gain and be charged taxes on this gain. Conversely, if the piece of machinery is sold for less than its book value, the company will experience a loss but also a tax benefit.

Initial Outlay Example

Jane’s Kitchen sells freshly baked cookies on a busy street. Jane currently uses a single oven, which cannot keep up with the store’s demand. Jane is considering buying a new, better oven that will produce enough cookies to meet the demand. She also decides to sell off her old oven since it will no longer be needed.

The existing oven is currently worth $1,000. Jane negotiates a deal with a smaller bakery to sell them her old oven for its market price of $1,500. The new oven will cost Jane $5,000. In anticipation of increased production, Jane decides to stock up on ingredients and buys $800 worth of flour. Her business’ tax rate is 35%. What is her initial outlay?

Answer

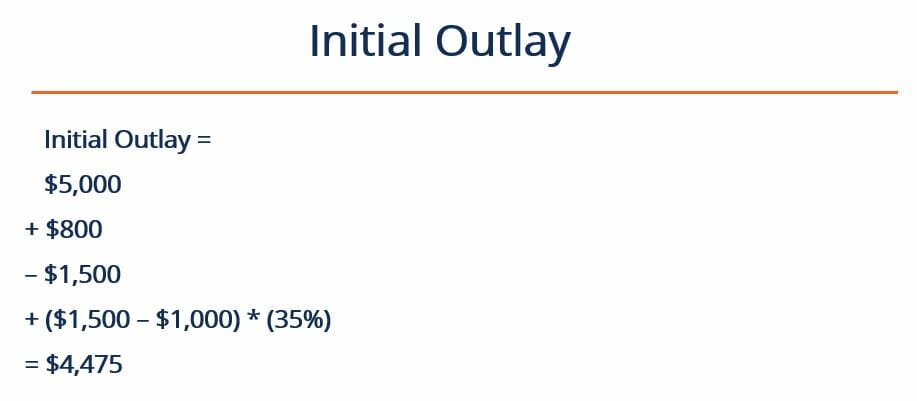

The first step is to identify the following numbers:

Fixed Capital Investment = $5,000

Working Capital Investment = $800

Salvage Value = $1,500

Book Value = $1,000

Tax Rate = 35%

Then, we can input the numbers into our formula:

Thus, the initial outlay is $4,475. Given all the information, Jane can go on to calculate the project’s NPV and other metrics. Then she can make an informed decision about whether or not to move forward with this project.

More Resources

Thank you for reading CFI’s guide to Initial Outlay Calculation. To learn more about related topics, check out the following CFI resources: