Limitations of Ratio Analysis

Factors that limit the efficacy of ratio analysis

What is Ratio Analysis?

Ratio analysis is a popular technique of financial analysis. It is used to visualize and extract information from financial statements. It focuses on ratios that reflect profitability, efficiency, financing leverage, and other vital information about a business. The ratios can be used for both horizontal analysis and vertical analysis. While they are a popular form of analysis, there are many limitations of ratio analysis that financial analysts should be aware of.

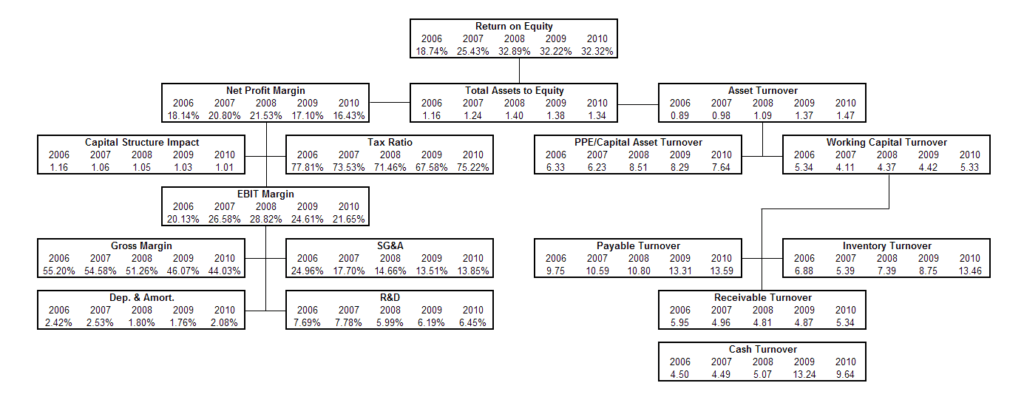

Image: Pyramid of Ratios from CFI’s Financial Analysis Course.

One of the key factors in ratio analysis is the comparison to the benchmark companies of an industry. This type of financial analysis can be useful to both internal management and outsider analysts of the company, as it provides significant insights from the financial statements.

As with any financial analysis technique, there are several limitations of ratio analysis. It is crucial to know these limitations to avoid misleading conclusions.

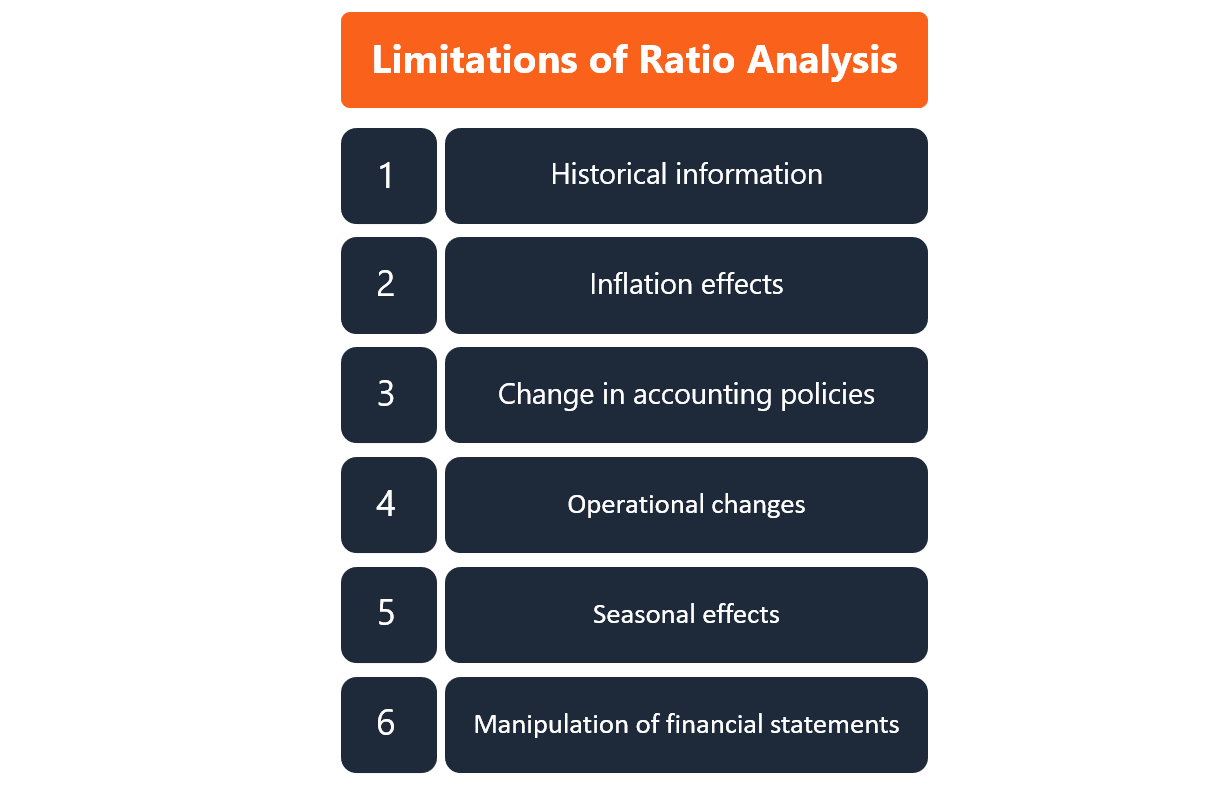

What are the Limitations of Ratio Analysis?

Some of the most important limitations of ratio analysis include:

- Historical Information: Information used in the analysis is based on real past results that are released by the company. Therefore, ratio analysis metrics do not necessarily represent future company performance.

- Inflationary effects: Financial statements are released periodically and, therefore, there are time differences between each release. If inflation has occurred in between periods, then real prices are not reflected in the financial statements. Thus, the numbers across different periods are not comparable until they are adjusted for inflation.

- Changes in accounting policies: If the company has changed its accounting policies and procedures, this may significantly affect financial reporting. In this case, the key financial metrics utilized in ratio analysis are altered, and the financial results recorded after the change are not comparable to the results recorded before the change. It is up to the analyst to be up to date with changes to accounting policies. Changes made are generally found in the notes to the financial statements section.

- Operational changes: A company may significantly change its operational structure, anything from its supply chain strategy to the product that they are selling. When significant operational changes occur, the comparison of financial metrics before and after the operational change may lead to misleading conclusions about the company’s performance and future prospects.

- Seasonal effects: An analyst should be aware of seasonal factors that could potentially result in limitations of ratio analysis. The inability to adjust the ratio analysis to the seasonality effects may lead to false interpretations of the results from the analysis.

- Manipulation of financial statements: Ratio analysis is based on information that is reported by the company in its financial statements. This information may be manipulated by the company’s management to report a better result than its actual performance. Hence, ratio analysis may not accurately reflect the true nature of the business, as the misrepresentation of information is not detected by simple analysis. It is important that an analyst is aware of these possible manipulations and always completes extensive due diligence before reaching any conclusions.

Additional Resources

Thank you for reading CFI’s guide to the limitations of ratio analysis. To keep learning and advancing your career, the following CFI resources will be helpful: