Margin of Safety Formula

The margin of safety is the level of real sales above the breakeven point

What is Margin of Safety?

The margin of safety is the difference between the amount of expected profitability and the break-even point. The margin of safety formula is equal to current sales minus the breakeven point, divided by current sales.

Understanding Margin of Safety

There are two applications to define the margin of safety:

1. Budgeting

In budgeting and break-even analysis, the margin of safety is the gap between the estimated sales output and the level by which a company’s sales could decrease before the company becomes unprofitable. It signals to the management the risk of loss that may happen as the business is subjected to changes in sales, especially when a significant amount of sales are at risk of decline or unprofitability.

A low percentage of margin of safety might cause a business to cut expenses, while a high spread of margin assures a company that it is protected from sales variability.

2. Investing

In the principle of investing, the margin of safety is the difference between the intrinsic value of a stock against its prevailing market price. Intrinsic value is the actual worth of a company’s asset or the present value of an asset when adding up the total discounted future income generated.

When applied to investing, the margin of safety is calculated by assumptions, meaning an investor would only buy securities when the market price is materially below its estimated intrinsic value. Determining the intrinsic value or true worth of a security is highly subjective because each investor uses a different way of calculating intrinsic value, which may or may not be accurate.

The fair market price of the security must be known in order to use the discounted cash flow analysis method then to give an objective, fair value of a business.

What is the Margin of Safety Formula?

In accounting, the margin of safety is calculated by subtracting the break-even point amount from the actual or budgeted sales and then dividing by sales; the result is expressed as a percentage.

Margin of Safety = (Current Sales Level – Breakeven Point) / Current Sales Level x 100

The margin of safety formula can also be expressed in dollar amounts or number of units:

Margin of Safety in Dollars = Current Sales – Breakeven Sales

Margin of Safety in Units = Current Sales Units – Breakeven Point

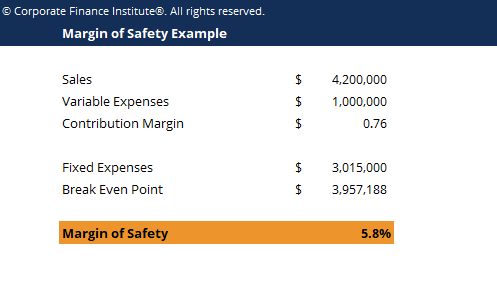

Practical Example

Ford Co. purchased a new piece of machinery to expand the production output of its top-of-the-line car model. The machine’s costs will increase the operating expenses to $1,000,000 per year, and the sales output will likewise augment.

After the machine was purchased, the company achieved a sales revenue of $4.2M, with a breakeven point of $3.95M, giving a margin of safety of 5.8%.

Download CFI’s Free Margin of Safety Template

Click the button below to download our free Margin of Safety template!

What is the Ideal Margin of Safety for Investing Activities?

The extent of margin of safety depends on investor preference and the type of investment he chooses. Some of the various scenarios an investor may find interest in with a substantial spread of margin are:

- Deep value investing – Buying stocks in seriously undervalued businesses. The main goal is to search for significant mismatches between current stock prices and the intrinsic value of these stocks. Such type of investing requires a large amount of margin to invest with and takes lots of guts, as it is risky.

- Growth at reasonable price investing – Choosing companies with positive growth trading rates that are somehow below the intrinsic value.

How Important is the Margin of Safety?

A high safety margin is preferred, as it indicates sound business performance with a wide buffer to absorb sales volatility. On the other hand, a low safety margin indicates a not-so-good position. It must be improved by increasing the selling price, increasing sales volume, improving contribution margin by reducing variable cost, or adopting a more profitable product mix.

For investors, the margin of safety serves as a cushion against errors in calculation. Since fair value is difficult to predict accurately, safety margins protect investors from poor decisions and downturns in the market.

Video Explanation of the Margin of Safety

Below is a short video tutorial that explains the components of the margin of safety formula, why the margin of safety is an important metric, and an example calculation.

Additional Resources

Thank you for reading CFI’s guide to the Margin of Safety Formula. Learn more about using margin of safety in these contexts:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?