Marketable Securities

Short-term securities that are easily liquidated

What are Marketable Securities?

Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company. The issuing company creates these instruments for the express purpose of raising funds to further finance business activities and expansion. Governments also issue debt securities of this type in the form of T-bills, used for funding of public projects and expenditures.

Characteristics of Marketable Securities

Some investors are more eager to grab this type of investment because of the short maturity periods, which tend to be less than a year. Converting or liquidating these investments into cash is much easier than is the case with longer-term securities.

Marketable securities are characterized by:

- A maturity period of 1 year or less

- The ability to be bought or sold on a public stock exchange or public bond exchange

- Having a strong secondary market that makes for liquid buy and sell transactions, as well as rendering an accurate price valuation for investors

- Have higher liquidity, effectively lowering risk

- NOT cash or cash equivalents (money market securities due within 3 months)

Naturally, the suitability of investments in marketable securities will depend on the investment strategy of the investor or the firm. Marketable securities will often have lower returns compared to longer-period or open-ended investments such as stocks. Since the marketable security is only held for a year or less, there is a lower maturity risk and liquidity risk built into the product.

Accounting for Marketable Securities

Short-term liquid securities are classified differently when it comes to their accounting, based on the purpose for which they are bought.

There are three different classifications of marketable securities:

- Available for sale

- Held for trading

- Held to maturity

These classifications are dependent on certain criteria, but also on the history of transactions any given investor or firm has employed in their past accounting practices.

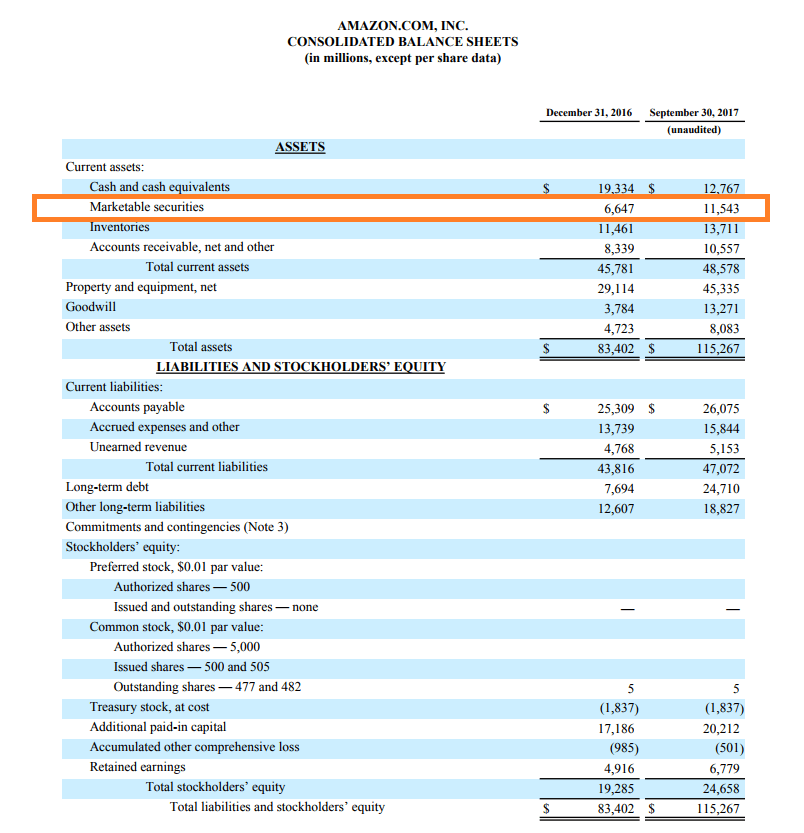

Example from Amazon’s Balance Sheet

When performing financial analysis, it’s important to know how to incorporate these types of short-term liquid investments. These investments will be listed under Current Assets on the balance sheet because they are due within a year, but will not be considered as part of Cash and Equivalents because they consist of equity securities and/or fixed-income securities that mature in more than 3 months.

Here is an example of Amazon.com’s balance sheet:

Additional Resources

Thank you for reading CFI’s guide on Marketable Securities. To keep learning and advancing your career as a financial analyst, these CFI resources will help you on your way: