Non-Cash Expenses

What to beware of in financial statements

What are Non-Cash Expenses?

Non-cash expenses appear on an income statement because accounting principles require them to be recorded despite not actually being paid for with cash. The most common example of a non-cash expense is depreciation, where the cost of an asset is spread out over time even though the cash expense occurred all at once.

How Non-Cash Expenses Work

Here is an example of how a non-cash expense occurs:

- On July 1, 2017, a company purchases a computer for $2,500 with cash. The computer is estimated to have a useful life of five years, so an annual depreciation expense of $500 is created for the next five years.

- In 2017, the company will have a depreciation expense of $500 on the income statement, and an investment of $2,500 on the cash flow statement.

- In 2018, the company will have a depreciation expense of $500 on the income statement, and no investment recorded on the cash flow statement.

- This continues until 2022 when the depreciation from this computer is now $0 because it is fully depreciated.

As you can see, the $500 depreciation expense is actually a non-cash item, and the capital cost is recorded only once on the cash flow statement.

List of the Most Common Non-Cash Expenses

There are many types to watch out for, but the most common examples include:

- Depreciation

- Amortization

- Stock-based compensation

- Unrealized gains

- Unrealized losses

- Deferred income taxes

- Goodwill impairments

- Asset write-downs

- Provisions and contingencies for future losses

Why Non-Cash Charges Need to be Adjusted for in Financial Analysis

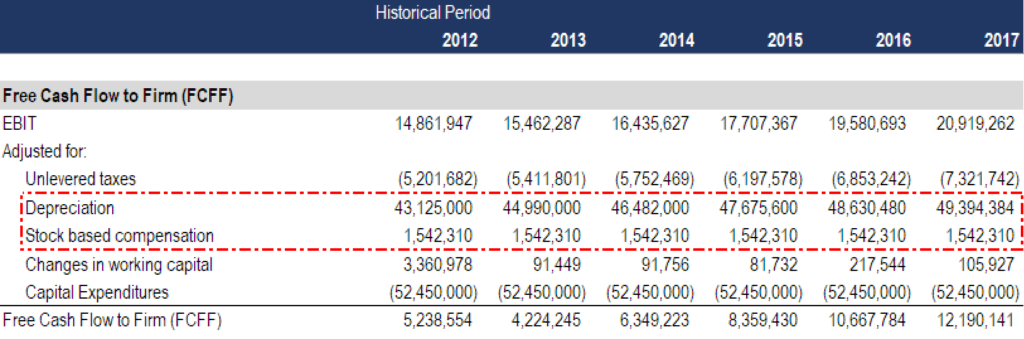

When performing a financial valuation of a company, an analyst typically performs a Discounted Cash Flow (DCF) analysis based on its Free Cash Flow (FCF). FCF is used because it demonstrates the true economic viability of a company.

Since analysts can’t use net income in a DCF model, they need to adjust net income for all the non-cash charges (and make other adjustments) to arrive at free cash flow.

Below is an example of how an analyst would make the above adjustments when building a financial model.

Source: CFI financial modeling courses.

Additional resources

Thank you for reading this guide to non-cash expenses and charges that need to be adjusted in financial modeling and valuation. CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.