Non-Operating Expense

Expenses that are not associated with the core business operations of a company

What is a Non-Operating Expense?

A non-operating expense is a business expense that is not related to a company’s core business operations. The most common items that fall under the category include interest expense and loss on the sale of assets. Other types of non-operating expenses include asset write-downs and one-time restructuring or legal expenses that do not regularly occur in the normal course of business.

Like other expenses, the items are expensed on the income statement. Financial analysts, accountants, and other professionals generally separate the operating expenses from the non-operating expenses to ignore the effects of capital structure choice and one-time expenses that might lead to non-representative financial metrics.

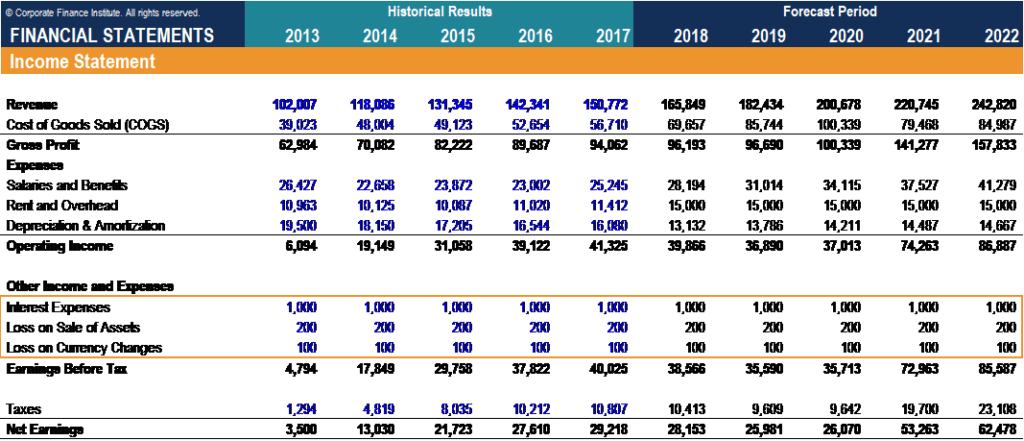

As you can see below, non-operating expenses like interest expense and losses generally fall under “Other Income and Expenses.” The items fall below the “Operating Income” or EBIT line of a business, as they are not related to the core business.

Summary

- Non-operating expenses are not associated with the core business operations of a company and are expensed on the income statement under “Other Income and Expenses.”

- Common items that fall under the category include interest expense, loss on the sale of assets, asset write-downs, and one-time legal/restructuring or other expenses.

- It is important to separate operating and non-operating expenses for financial analysis. Also, understanding the accounting treatment of common non-operating expenses is important.

Importance of Separating Operating and Non-Operating Expenses

Including non-operating expenses like interest and losses or one-time expenses in calculating operating income would understate the true financial performance of the business. For example, subtracting a one-time legal expense of $1,000 under operating expenses would understate EBITDA by $1,000. Furthermore, if one uses said EBITDA figure to calculate an EV/EBITDA multiple, one will get an inflated multiple. Similarly, it will lead to inaccuracy in financial forecasting, as EBITDA would be understated.

The opposite problem will arise if the company records a one-time gain from an asset sale or currency translation. In such cases, including the items before calculating operating income would overstate the company’s financial performance and negatively impact its valuation multiples.

The argument above is important in determining what expenses should be included or excluded while calculating valuation multiples. Let’s take enterprise value (EV) multiples as an example. Enterprise value is the value of the core business operations of a company that is available to all investors. Therefore, EV needs to be paired with a metric that:

- Only includes expenses and income associated with the company’s core business operations

- It is available to all investors

It is why EV multiples are calculated with EBIT and EBITDA and not net income. EBIT and EBITDA only include expenses and earnings associated with the company’s core business operations and is an amount available to distribute to all stakeholders (i.e. debtholders, government, shareholders).

Net income is linked with market capitalization, which represents the value of both core and non-core assets that are available to equity investors only. Therefore, market capitalization needs to use a metric that:

- Includes income and expenses from the core and non-core business operations

- It is available to equity investors only

Due to the above-mentioned reasons, it is extremely important to separate operating and non-operating expenses by determining nature and frequency. While calculating financial metrics for conducting financial analysis, it is important to reverse any one-time or non-operating items that impact EBIT and EBITDA.

Treatment of a Loss on Sale of Assets and Asset Write-Downs

Non-operating expenses like interest, loss on currency translation, and one-time legal/restructuring expenses are expensed on the income statement, as the transactions result in a direct cash impact. However, the accounting treatment and reporting for losses on the sale of assets and asset write-downs is slightly different, as there is no direct cash impact. The examples below on their accounting treatment generally show up as common interview questions for corporate finance roles.

Example 1: Plant of $100 sold at $80; 50% tax rate

Impact on financial statements:

- Loss of $20 is expensed on the income statement under other income and expenses

- Using a 50% tax rate, net income is down by $10

- $20 loss is non-cash and is added back under cash flow from operations

- CFO is up by $10

- Sale amount of $80 is recorded under investing activities, so cash at the bottom of the statement of cash flows is up by $90

- Assets are down by $10 (plant is down by $100 and cash + A/R is up by $90), and retained earnings are down by $10, making the balance sheet tally

Example 2: Plant of $100, written down to $20; 50% tax rate

Impact on financial statements:

- Loss of $80 is expensed on the income statement under other income and expenses

- Using a 50% tax rate, net income is down by $40

- $80 loss is non-cash, and is added back under cash flow from operations

- Cash is up by $40

- Assets are down by $40 (plant is down by $80 and A/R is up by $40), and retained earnings are down by $40, making the balance sheet tally

Learn More

CFI is the official provider of the Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below: