Return on Capital Employed (ROCE)

A measure of how efficiently a company uses its capital

What is Return on Capital Employed (ROCE)?

Return on Capital Employed (ROCE), a profitability ratio, measures how efficiently a company is using its capital to generate profits. The return on capital employed metric is considered one of the best profitability ratios and is commonly used by investors to determine whether a company is suitable to invest in or not.

Formula for Return on Capital Employed

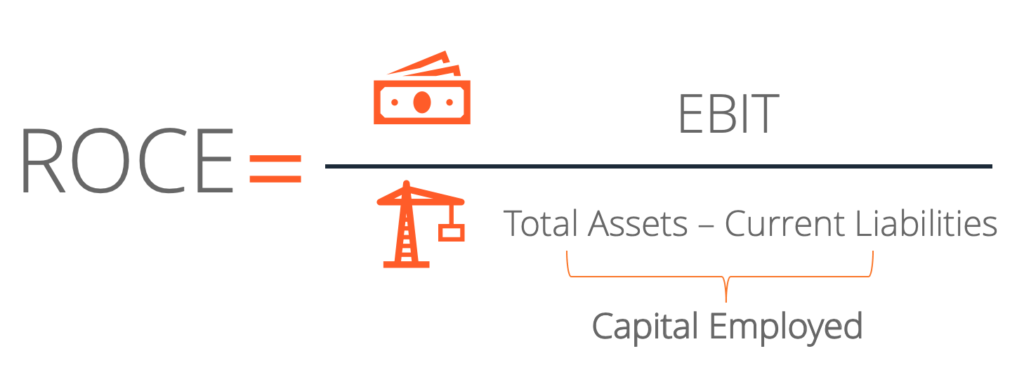

The formula for computing ROCE is as follows:

Where:

- Earnings before interest and tax (EBIT) is the company’s profit, including all expenses except interest and tax expenses.

- Capital employed is the total amount of equity invested in a business. Capital employed is commonly calculated as either total assets less current liabilities or fixed assets plus working capital.

Some analysts will use net operating profit in place of earnings before interest and taxes when calculating the return on capital employed.

Example of Return on Capital Employed

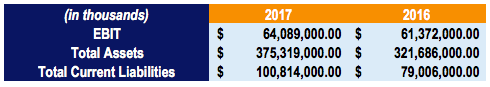

Let us compute the return on capital employed for Apple Inc. We will look at the financial statements of Apple for 2016 and 2017 and calculate the ROCE for each year.

The following information is taken from Apple’s financial statements:

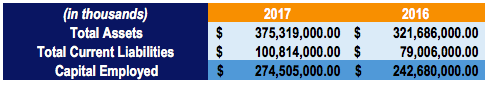

Apple’s capital employed is calculated as total assets minus total current liabilities:

Therefore:

- Capital employed in 2017: 375,319,000,000 – 100,814,000,000 = 274,505,000,000

- Capital employed in 2016: 321,686,000,000 – 79,006,000,000 = 242,680,000,000

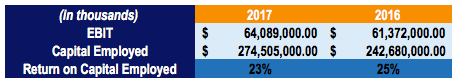

The returns on capital employed for Apple Inc. for 2016 and 2017 are as follows:

- ROCE in 2017: 64,089,000,000 / 274,505,000,000 = 0.23 = 23%

- ROCE in 2016: 61,372,000,000 / 242,680,000,000 = 0.25 = 25%

Download the Free Template

Interpretation of Return on Capital Employed

The return on capital employed shows how much operating income is generated for each dollar of capital invested. A higher ROCE is always more favorable, as it indicates that more profits are generated per dollar of capital employed.

However, as with any other financial ratios, calculating just the ROCE of a company is not enough. Other profitability ratios such as return on assets, return on invested capital, and return on equity should be used in conjunction with ROCE to determine whether a company is likely a good investment or not.

In the example with Apple Inc., a ROCE of 23% in 2017 means that for every dollar invested in capital, the company generated 23 cents in operating income. To determine whether Apple’s ROCE is good, it is important to compare it against its competitors and not across different industries.

Return on Capital Employed Comparisons

When comparing ROCE among companies, there are key things to keep in mind:

- Ensure that the companies are both in the same industry. Comparing the ROCE across industries does not offer much value.

- Ensure that the ROCE comparison between companies in the same industry uses numbers for the same accounting period. Companies sometimes follow different year ends and it is misleading to compare the ROCE of companies over different time periods.

- Determine the benchmark ROCE of the industry. For example, a company with a ROCE of 20% may look good compared to a company with a ROCE of 10%. However, if the industry benchmark is 35%, both companies are considered to have a poor ROCE.

Key Takeaways

Here are the key takeaways on return on capital employed:

- Return on capital employed is a profitability ratio used to show how efficiently a company is using its capital to generate profits.

- Variations of the return on capital employed use NOPAT (net operating profit after tax) instead of EBIT (earnings before interest and taxes).

- A higher return on capital employed is favorable, as it indicates a more efficient use of capital employed.

- The return on capital employed should be used in conjunction with other profitability ratios such as return on equity, return on assets, etc., when evaluating a company.

- This metric should only be compared for companies operating in the same industry – comparisons across industries offer very little value.

Other Resources

Thank you for reading CFI’s guide to Return on Capital Employed (ROCE). To keep learning and advancing your career, the following CFI resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?