Vertical Analysis

The proportional analysis of financial data

What is Vertical Analysis?

Vertical analysis is an accounting tool that enables proportional analysis of documents, such as financial statements. While performing a vertical analysis, every line item on a financial statement is entered as a percentage of another item. For example, on an income statement, every line item is stated in terms of the percentage of gross sales.

Similarly, in a balance sheet, every entry is made not in terms of absolute currency but as a percentage of the total assets. Performing a vertical analysis of a company’s cash flow statement represents every cash outflow or inflow relative to its total cash inflows.

When is Vertical Analysis Used?

Vertical analysis is most commonly used within a financial statement for a single reporting period, e.g., quarterly. It is done so that accountants can ascertain the relative proportions of the balances of each account.

Vertical analysis is exceptionally useful while charting a regression analysis or a ratio trend analysis. It enables the accountant to see relative changes in company accounts over a given period of time. The analysis is especially convenient to do so on a comparative basis.

Advantages of Vertical Analysis

- Vertical analysis simplifies the correlation between single items on a balance sheet and the bottom line, as they are expressed in a percentage. A company’s management can use the percentages to set goals and threshold limits. For example, management may consider shutting down a particular unit if profit per unit falls below a particular threshold percentage.

- It is a relatively more potent tool than horizontal analysis, which shows the corresponding changes in the finances of a particular unit/ account/department over a certain period of time.

- It is also useful in comparing a company’s financial statement to the average trends in the industry. It would be ineffective to use actual dollar amounts while analyzing entire industries. Common-size percentages solve such a problem and facilitate industry comparison.

- It is also highly effective while comparing two or more companies operating in the same industry but with different sizes. It is often tricky to compare the balance sheet of a $1 billion company to one that is valued at $500,000. Vertical analysis enables accountants to create common-size measures, which enable them to compare and contrast amounts of different magnitudes in a very efficient manner.

Practical Examples

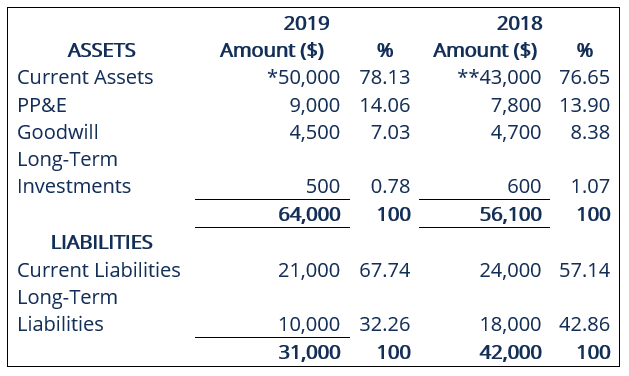

1. Comparative Balance Sheet with Vertical Analysis

*2019: ($50,000 / $64,000) × 100 = 78.13%

**2018: ($43,000 / $56,100) × 100 = 76.65%

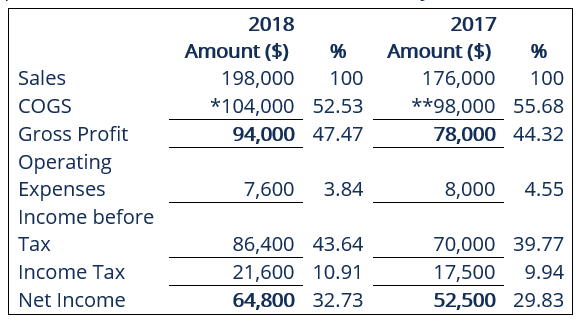

2. Comparative Income Statement with Vertical Analysis

*2018: ($104,000 / $198,000) × 100 = 52.53%

**2017: ($98,000 / $176,000) × 100 = 55.68%

Related Readings

Thank you for reading CFI’s guide to Vertical Analysis. To keep learning and advancing your career, the following resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?