Accounts Payable

A current liability generated by buying supplies on credit

What is Accounts Payable (AP)?

Accounts payable (AP) refers to the amount of money a business owes to its suppliers or vendors for goods and services received but not yet paid for. They are considered short-term liabilities and are typically due within 30 to 90 days.

AP is considered one of the most current forms of current liabilities on the balance sheet. It represents an obligation the company must fulfill, usually in cash, within a short period.

Although both are current liabilities, the distinction between accrued expenses vs accounts payable affects timing and recognition in financial statements.

Example of Accounts Payable

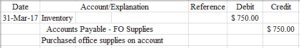

On March 31, 2017, Corporate Finance Institute decided to purchase $750 worth of inventory on account from FO Supplies. The terms of this transaction were 2/10, n/30. This is what it would look like in the journal entry:

This is what the initial purchase of inventory would look like in the journal entry. We excluded the terms in the description portion of our journal entry because it is optional. It is up to the individual whether or not they wish to include the terms of the transaction.

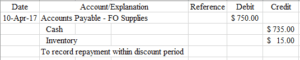

The next part is recording the discount if the account is paid back within the discount period. In order to determine the discount, we need to take the $750 and multiply it by 0.02 (2%). This is what it would look like in your journal entry:

Notice that we record the discount directly against inventory. This is because we are recognizing that we paid less for the inventory that we received. This is to prevent overstatement or understatement of the inventory amount at the end of the fiscal year in our financial statements, especially the balance sheet.

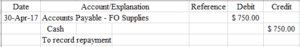

What happens if we do not pay it back within the discount period? Well, that’s simple, we simply record it as a regular repayment of accounts payable:

What is the Impact of AP on the Cash Balance?

Since AP represents the unpaid expenses of a company, as accounts payable increase, so does the cash balance (all else being equal). When AP is paid down and reduced, the cash balance of a company is also reduced by a corresponding amount. It is a very important concept to understand when performing a financial analysis of a company.

Learn more about Balance Sheet reporting standards at FASB.

What is Accounts Payable Turnover?

Accounts payable turnover is a key metric used in calculating the liquidity of a company, as well as in analyzing and planning its cash cycle. A related metric is AP days (accounts payable days). It is the number of days it takes a company, on average, to pay off its AP balance.

The cash cycle (or cash conversion cycle) is the amount of time a company requires to convert inventory into cash. It is tied to the operating cycle, which is the total of accounts receivable days and inventory days. The cash cycle, then, is the operating cycle minus AP days.

How to Calculate Accounts Payable in Financial Modeling

In financial modeling, it’s important to be able to calculate the average number of days it takes for a company to pay its bills.

The formula for calculating AP Days is:

AP Days = (Accounts Payable Value / Cost of Goods Sold) x 365

The formula for calculating the AP Value is:

AP Value = (Accounts Payable Days x Cost of Good Sold) / 365

Note: The above examples are based on a full-year 365-day period.

What are the Differences Between Accounts Payable and Accounts Receivable?

In accounting, confusion sometimes arises when working between accounts payable and accounts receivable. The two types of accounts are very similar in the way they are recorded, but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a liability account. Mixing the two up can result in a lack of balance in your accounting equation, which carries over into your basic financial statements.

While accounts payable (AP) and accounts receivable (AR) are both key components of a company’s working capital, they represent opposite sides of financial transactions.

Accounts Payable vs. Accounts Receivable: Key Differences at a Glance

| Definition | Money a company owes to suppliers | Money a company is owed by customers |

| Balance Sheet Location | Current liabilities | Current assets |

| Impact on Cash Flow | Delays cash outflow | Generates cash inflow |

| Recorded When | Goods/services are received, but not paid | Goods/services are delivered, but not paid for |

| Business Role | Represents credit extended to the company | Represents credit extended by the company |

| Typical Documents | Vendor invoices, purchase orders | Customer invoices, sales orders |

Why This Distinction Matters

Understanding the difference between AP and AR is crucial for:

-

Cash flow management – Delayed payables and collected receivables affect liquidity

-

Internal controls – Separate teams often handle AP and AR to prevent fraud

-

Financial analysis – Metrics like the cash conversion cycle rely on AP and AR efficiency

Summary

Accounts payable (AP) represents a company’s short-term obligations to pay suppliers for goods and services already received, typically due within 30–90 days. It is recorded as a current liability on the balance sheet and directly impacts cash flow, since rising AP increases available cash while repayment reduces it.

AP Turnover and AP Days measure how efficiently a company pays its bills, forming part of the cash conversion cycle. In financial modeling, AP is calculated using the cost of goods sold and payment days. Unlike accounts receivable (AR), which reflects money owed to the business, accounts payable tracks amounts the business owes.

Additional Resources

Thank you for reading this CFI accounting guide. CFI offers the Financial Modeling & Valuation Analyst (FMVA)® certification program for those looking to take their careers to the next level.

To keep learning and advancing your career, the following resources will be helpful: