Behavioral Finance

How processing errors and biases impact investors

What is Behavioral Finance?

Behavioral finance is the study of the influence of psychology on the behavior of investors or financial analysts. It also includes the subsequent effects on the markets. It focuses on the fact that investors are not always rational, have limits to their self-control, and are influenced by their own biases.

Traditional Financial Theory

In order to better understand behavioral finance, let’s first look at traditional financial theory.

Traditional finance includes the following beliefs:

- Both the market and investors are perfectly rational

- Investors truly care about utilitarian characteristics

- Investors have perfect self-control

- They are not confused by cognitive errors or information processing errors

Learn more in CFI’s Behavioral Finance Course!

Behavioral Finance Theory

Now let’s compare traditional financial theory with behavioral finance.

Traits of behavioral finance are:

- Investors are treated as “normal” not “rational”

- They actually have limits to their self-control

- Investors are influenced by their own biases

- Investors make cognitive errors that can lead to wrong decisions

Decision-Making Errors and Biases

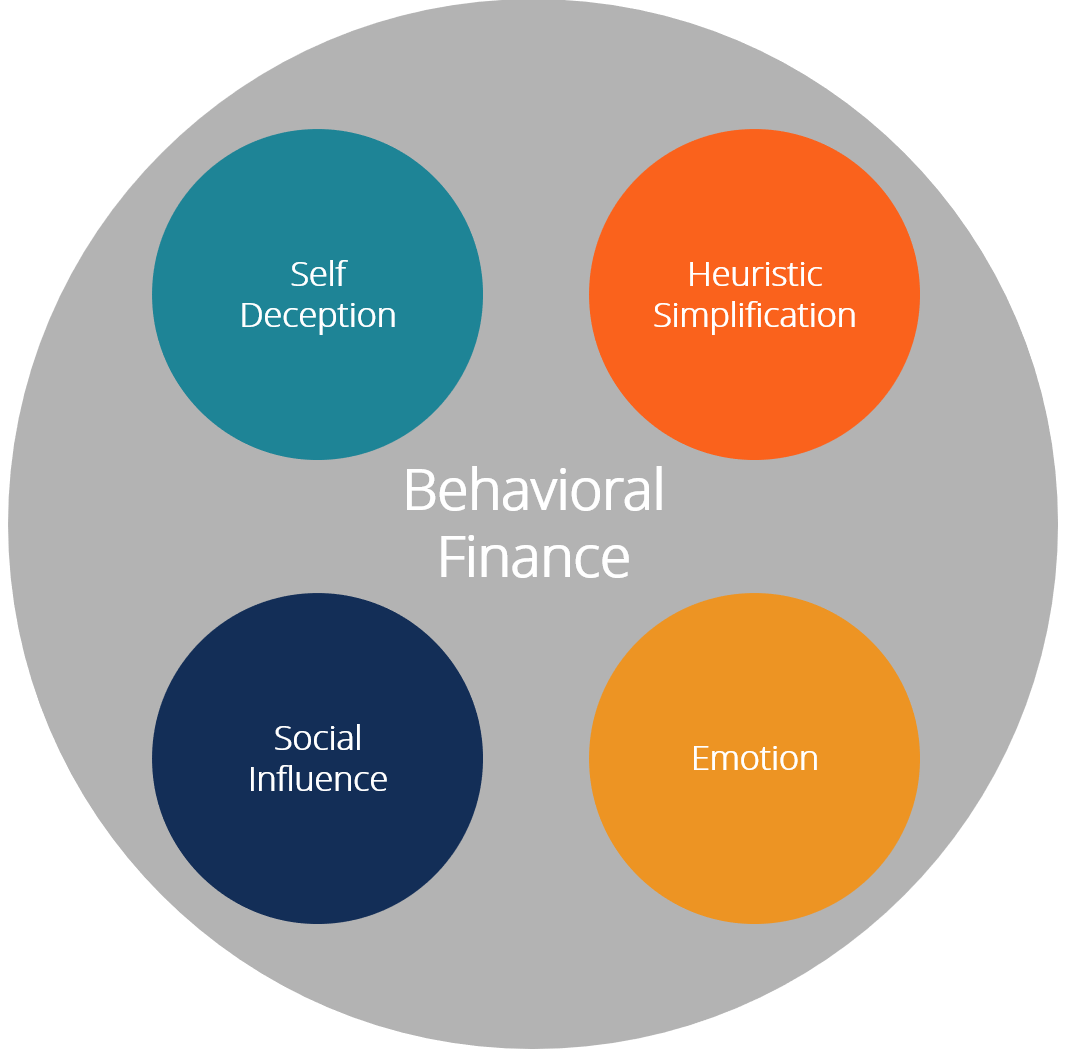

Let’s explore some of the buckets or building blocks that make up behavioral finance.

Behavioral finance views investors as “normal” but being subject to decision-making biases and errors. We can break down the decision-making biases and errors into at least four buckets.

Learn more in CFI’s Behavioral Finance Course!

#1 Self-Deception

The concept of self-deception is a limit to the way we learn. When we mistakenly think we know more than we actually do, we tend to miss information that we need to make an informed decision.

#2 Heuristic Simplification

We can also scope out a bucket that is often called heuristic simplification. Heuristic simplification refers to information-processing errors.

#3 Emotion

Another behavioral finance bucket is related to emotion, but we’re not going to dwell on this bucket in this introductory session. Basically, emotion in behavioral finance refers to our making decisions based on our current emotional state. Our current mood may take our decision-making off track from rational thinking.

#4 Social Influence

What we mean by the social bucket is how our decision-making is influenced by others.

Top 10 Biases in Behavioral Finance

Behavioral finance seeks an understanding of the impact of personal biases on investors. Here is a list of common financial biases.

Common biases include:

- Overconfidence and illusion of control

- Self Attribution Bias

- Hindsight Bias

- Confirmation Bias

- The Narrative Fallacy

- Representative Bias

- Framing Bias

- Anchoring Bias

- Loss Aversion

- Herding Mentality

Overcoming Behavioral Finance Issues

There are ways to overcome negative behavioral tendencies in relation to investing. Here are some strategies you can use to guard against biases.

#1 Focus on the Process

There are two approaches to decision-making:

- Reflexive – Going with your gut, which is effortless, automatic and, in fact, is our default option

- Reflective – Logical and methodical, but requires effort to engage in actively

Relying on reflexive decision-making makes us more prone to deceptive biases and emotional and social influences.

Establishing logical decision-making processes can help protect you from such errors.

Get yourself focused on the process rather than the outcome. If you’re advising others, try to encourage the people you’re advising to think about the process rather than just the possible outcomes. Focusing on the process will lead to better decisions because the process helps you engage in reflective decision-making.

#2 Prepare, Plan, and Pre-Commit

Behavioral finance teaches us to invest by preparing, by planning, and by making sure we pre-commit. Let’s finish with a quote from Warren Buffett.

“Investing success doesn’t correlate with IQ after you’re above a score of 25. Once you have ordinary intelligence, then what you need is the temperament to control urges that get others into trouble.”

Learn more in CFI’s Behavioral Finance Course!

Additional Resources

Thank you for reading CFI’s guide on Behavioral Finance. To continue learning, these resources will be useful: