Funding Liquidity Risk

The risk that a company will not be able to meet its short-term financial obligations when due

What is Funding Liquidity Risk?

Funding liquidity risk refers to the risk that a company will not be able to meet its short-term financial obligations when due. In other words, funding liquidity risk is the risk that a company will not be able to settle its current outstanding bills.

Understanding Liquidity

Liquidity is defined as the ability to meet immediate and short-term obligations (within a year). As such, funding liquidity risk is the risk that a company is unable to meet its immediate and short-term obligations in a timely manner.

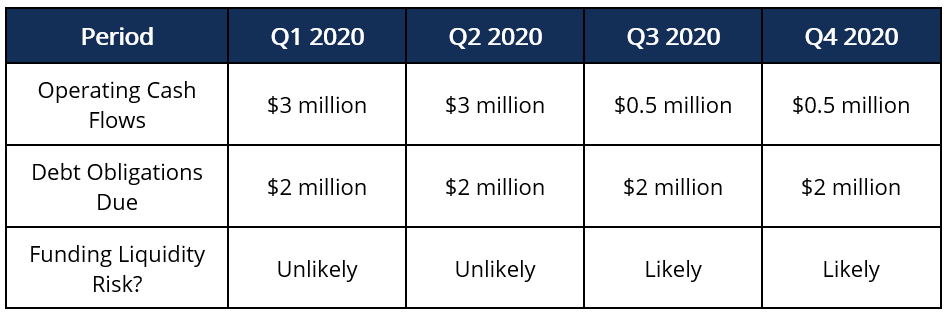

This risk is a major concern for cyclical companies where operating cash flows and debt obligation due dates might not match up perfectly. For example, a company may experience a season of strong performance followed by a season of weak performance. During the period of slowdown, the company may be exposed to funding liquidity risk if the obligations due during that time are greater than the operating cash flows generated. This can be illustrated below:

In Q3 2020 and Q4 2020, the company may not be able to generate enough cash flows (assuming that they do not keep a cash reserve) to satisfy its debt obligations.

When a company incurs a funding liquidity risk, it faces the potential of having to liquidate capital assets (or other operating assets) at a price lower than the market price to satisfy its debt obligations. Selling operating assets could result in severe repercussions on the future revenue generation capabilities of the company.

Factors that Increase Risk

Funding liquidity risk can be heightened through the following factors:

- Seasonal fluctuations in revenue generation

- Business disruptions

- Unplanned capital expenditures

- Increased operational costs

- Poor working capital management

- Poor matching of asset duration to debt duration

- Limited financing facilities

- Poor cash flow management

Measuring Liquidity Risk

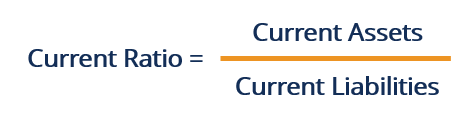

Liquidity ratios, such as the current ratio and quick ratio, can be used as an indicator of a company’s funding liquidity risk. The current ratio, the most common ratio used to measure such a risk, is shown below:

Where:

- Current Assets are assets that are expected to be converted into cash within a year.

- Current Liabilities are liabilities that are expected to be due within a year.

Additional ratios, such as the interest coverage ratio, debt to gross cash flows, quick ratio, etc., should be used to provide a better picture of a company’s funding liquidity risk.

Mitigants to Risk

To mitigate funding liquidity risk, a company should assess its liquidity position. For example, a company could assess the:

1. Extent of dependence on financing

Companies that rely heavily on financing are subject to higher funding liquidity risk. Therefore, it would be important to assess financing facilities and try to minimize unnecessary financing.

2. Seasonality of sales

Companies that are cyclical may face poor cash flows in certain periods. Therefore, it would be important to assess cyclical periods of poor cash flows and identify ways to decrease operational costs during those periods.

3. Availability of funds

A line of credit is a classic mitigant to funding liquidity risk. A credit line is a predetermined amount of credit that is extended to a borrower. The borrower is only charged interest on the amount taken from the line of credit. High availability of funds would help the company to meet debt obligations.

Example

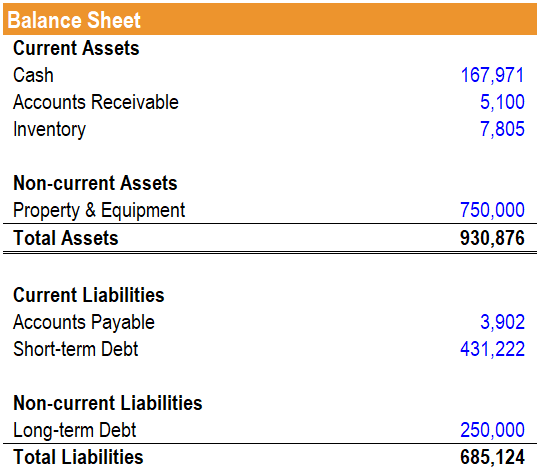

A company’s balance sheet is as follows:

From looking only at the balance sheet, what can an investor infer about the company’s funding liquidity risk?

The company shows a current ratio of 0.42x and a quick ratio of 0.40x. Therefore, it would imply that the company faces significant risk.

Related Readings

CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant CFI resources below: