- What is a Capital Expenditure (CapEx)?

- When to Capitalize vs. Expense

- CapEx on the Cash Flow Statement

- CapEx on the Balance Sheet

- How to Calculate Net Capital Expenditure

- Capital Expenditure and Depreciation

- Capital Expenditure in Free Cash Flow

- CapEx in Valuation

- Types of Capital Expenditures

- Importance of Capital Expenditures

- Challenges with Capital Expenditures

- Efficient Capital Expenditure Budgeting Practices

Capital Expenditure (CapEx)

Investments in Property, Plant and Equipment

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is a Capital Expenditure (CapEx)?

A capital expenditure (“CapEx” for short) is the payment with either cash or credit to purchase long-term physical or fixed assets used in a business’s operations. The expenditures are capitalized (i.e., not expensed directly on a company’s income statement) on the balance sheet and are considered an investment by a company in expanding its business.

CapEx is important for companies to grow and maintain their business by investing in new property, plant, equipment (PP&E), products, and technology. Financial analysts and investors pay close attention to a company’s capital expenditures, as they do not initially appear on the income statement but can have a significant impact on cash flow.

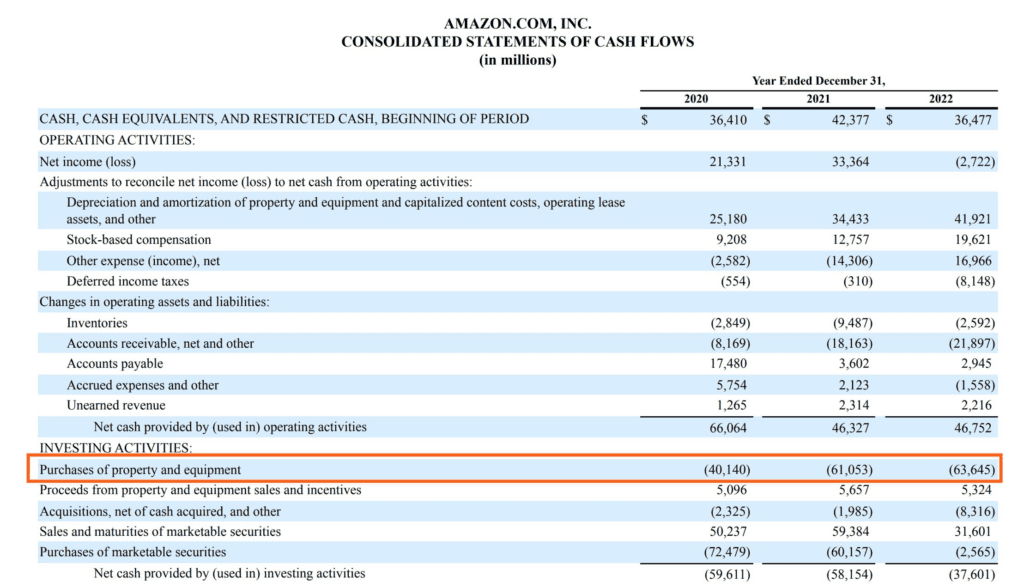

Source: Amazon.com

Capital expenditures normally have a substantial effect on the short-term and long-term financial standing of an organization. Therefore, making wise capex decisions is of critical importance to the financial health of a company. Many companies usually try to maintain the levels of their historical capital expenditures to show investors that they are continuing to invest in the growth of the business.

Key Highlights

- A capital expenditure, or CapEx, is the purchase of long-term physical or fixed assets used in a business’s operations.

- Financial analysts and investors pay close attention to a company’s capital expenditures, as they do not initially appear on the income statement but can have a significant impact on cash flow.

- The calculation of free cash flow deducts capital expenditures. Free cash flow is one of the most important calculations in finance and serves as the basis for valuing a company.

When to Capitalize vs. Expense

The decision of whether to expense or capitalize an expenditure is based on how long the benefit of that spending is expected to last. If the benefit is less than 1 year, it must be expensed directly on the income statement. If the benefit is greater than 1 year, it must be capitalized as an asset on the balance sheet.

For example, the purchase of office supplies like printer ink and paper would not fall under investing activities on the cash flow statement but would instead be an operating expense on the income statement.

The purchase of a building, by contrast, would provide a benefit of more than 1 year and would thus be deemed a capital expenditure.

Learn more about when to capitalize on the IFRS website.

CapEx on the Cash Flow Statement

Capital expenditures can be found on a company’s cash flow statement under “investing activities.” As you can see in the screenshot above from Amazon’s 2022 annual report (10-k), in 2022, Amazon had $63,645 million of capital expenditure related to “purchases of property and equipment.”

Since this spending is considered an investment, it does not appear on the income statement.

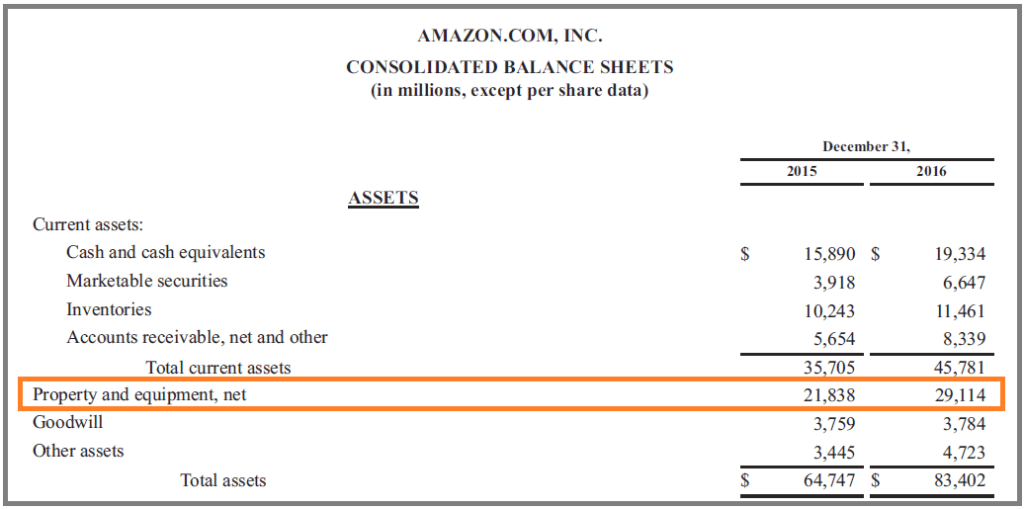

CapEx on the Balance Sheet

CapEx flows from the cash flow statement to the balance sheet. Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via depreciation expense.

How to Calculate Net Capital Expenditure

Net CapEx can be calculated either directly or indirectly. In the direct approach, an analyst must add up all of the individual items that make up the total expenditures, using a schedule or accounting software. In the indirect approach, the value can be inferred by looking at the value of assets on the balance sheet in conjunction with depreciation expense.

Direct Method

- Amount spent on asset #1

- Plus: Amount spent on asset #2

- Plus: Amount spent on asset #3

- Less: Value received for assets that were sold

- = Net CapEx

Indirect Method

- PP&E Balance in the current period

- Less: PP&E balance in the previous period

- Plus: Depreciation in the current period

- = Net CapEx

Read more about the CapEx Formula.

Capital Expenditure and Depreciation

As a recap of the information outlined above, when an expenditure is capitalized, it is classified as an asset on the balance sheet. In order to move the asset off the balance sheet over time, it must be expensed and moved through the income statement.

Accountants expense assets onto the income statement via depreciation. There is a wide range of depreciation methods that can be used (straight line, declining balance, etc.) based on the preference of the management team.

Over the life of an asset, total depreciation will be equal to the net capital expenditure. If a company regularly has more CapEx than depreciation, its asset base is growing.

Here is a guideline to see if a company is growing or shrinking (over time):

- CapEx > Depreciation = Growing Assets

- CapEx < Depreciation = Shrinking Assets

Capital Expenditure in Free Cash Flow

Free Cash Flow is one of the most important metrics in corporate finance. Analysts regularly evaluate a company’s ability to generate cash flow and consider it one of the main ways a company can create shareholder value.

The formula for Free Cash Flow (FCF) is:

FCF = Cash from Operations – Capital Expenditures

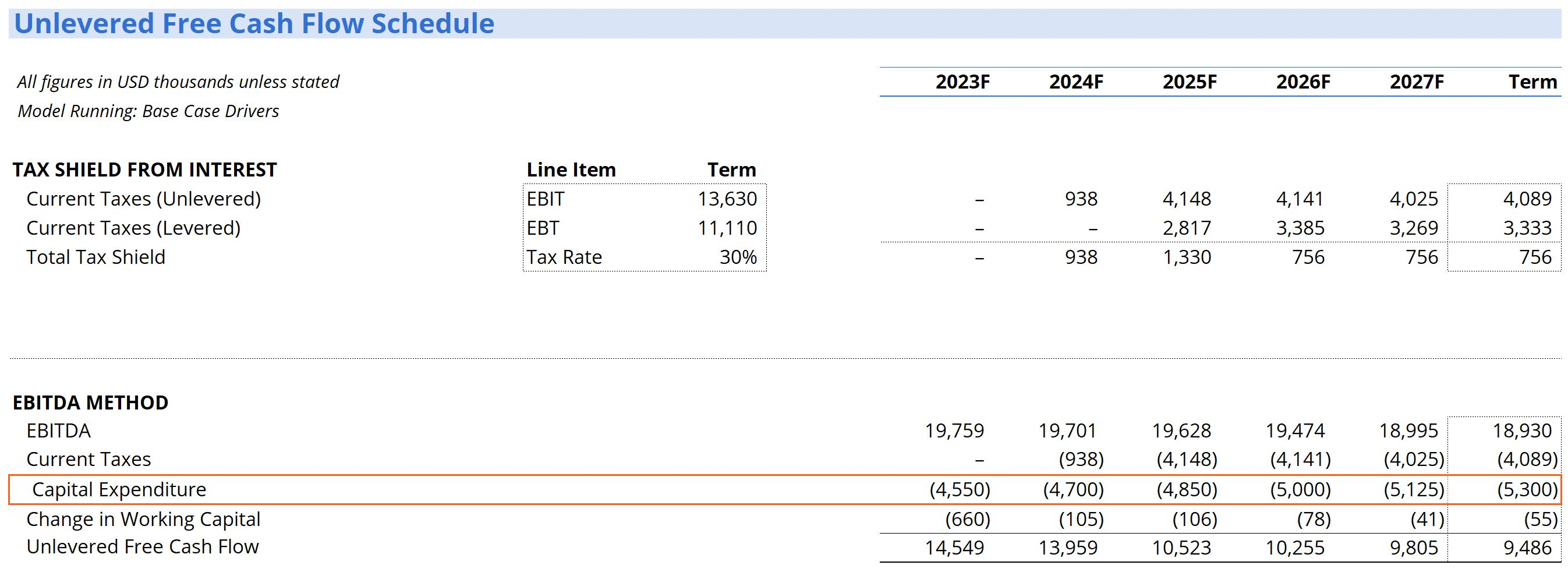

CapEx in Valuation

In financial modeling and valuation, an analyst will build a DCF model to determine the net present value (NPV) of the business. The most common approach is to calculate a company’s unlevered free cash flow (free cash flow to the firm) and discount it back to the present using the weighted average cost of capital (WACC).

Below is a screenshot of a financial model calculating unlevered free cash flow, which is impacted by capital expenditures.

Source: CFI’s Financial Modeling Course

Types of Capital Expenditures

There are normally two forms of capital expenditures:

- Maintenance capex: Expenditures to maintain current levels of a company’s operations

- Growth capex: Expenditures that will enable an increase in future growth

It is important to note that funds spent on repair or in conducting normal maintenance on assets are not considered capital expenditures and should be expensed on the income statement.

Importance of Capital Expenditures

Decisions on how much to invest in capital expenditures can often be extremely vital decisions made by an organization. They are important because of the following reasons:

1. Long-term Effects

The effect of capital expenditure decisions usually extends into the future. The range of current production or manufacturing activities is mainly a result of past capital expenditures. Similarly, the current decisions on capital expenditures will have a major influence on the future activities of the company.

Capital investment decisions are a driver of the direction of the organization. The long-term strategic goals, as well as the budgeting process of a company, need to be in place before authorization of capital expenditures.

2. Irreversibility

Capital expenditures are often difficult to reverse without the company incurring losses. Most forms of capital equipment are customized to meet specific company requirements and needs. The market for used capital equipment is generally very poor.

3. High Initial Costs

Capital expenditures are characteristically very expensive, especially for companies in industries such as manufacturing, telecom, utilities, and oil exploration. Capital investments in physical assets like buildings, equipment, or property offer the potential to provide benefits in the long run but will need a large monetary outlay initially.

4. Depreciation

Capital expenditures have an initial increase in the asset accounts of an organization. However, once capital assets start being put in service, depreciation begins, and the assets decrease in value throughout their useful lives.

Challenges with Capital Expenditures

Even though capital expenditure decisions are very critical, they create more complexity:

1. Measurement Problems

The accounting process of identifying, measuring, and estimating the costs relating to capital expenditures may be quite complicated.

2. Unpredictability

Organizations making large investments in capital assets hope to generate predictable outcomes. However, such outcomes are not guaranteed, and losses may be incurred. The costs and benefits of capital expenditure decisions are usually characterized by a lot of uncertainty. Even the best forecasters sometimes make mistakes. During financial planning, organizations need to account for risks to mitigate potential losses, even though it is not possible to eliminate them.

Efficient Capital Expenditure Budgeting Practices

Major capital projects involving huge amounts of capital expenditures can get out of control quite easily if mishandled and end up costing an organization a lot of money. However, with effective planning, the right tools, and good project management, that doesn’t have to be the case. Here are some of the secrets that will ensure the budgeting of capital expenditures is efficient.

1. Structure Before You Start

Capital expenditure budgets need adequate preparations before commencement. Otherwise, they might go over budget. Before starting a project, you need to find the scope of the project, work out realistic deadlines, and ensure that the whole plan is reviewed and approved.

It is at this stage that you should think about how many internal resources will be required by the project, including manpower, materials, finances, and services. To have a more accurate budget, you should have more detail going into the project.

2. Think Long Term

At the start of your capital expenditure project, you need to decide whether you will purchase the capital asset with debt or set aside existing funds for the purchase. Saving money for the purchase usually implies that you will have to wait for a while before getting the asset you need.

However, borrowing money leads to increased debt and may also create problems for your borrowing ability in the future. Both choices can be good for your company, and different choices might be needed for different projects.

3. Use Good Budgeting Software

From the beginning of the project, you should choose a reliable, practical program to manage the budgeting. The type of budgeting software you choose will depend on such things as the scale of the project, the speed of the program, and the risk of error.

4. Capture Accurate Data

Accurate data is very crucial if you want to manage capital projects efficiently. To create a realistic budget and generate valuable reports, you need to gather reliable information.

5. Levels of Detail Should Be Optimal

Trying to put in too much detail will result in too much time being spent in gathering information to make the budget, which may be outdated by the time the budget is finished. However, too little detail will make the budget vague and, therefore, less useful. The right optimal balance needs to be found.

6. Form Clear Policies

Since the management of capital expenditures in a large organization may involve numerous employees, departments, or even regions, clear policies for everyone to follow should be put in place to put the budget on track.

Additional Resources

Thank you for reading CFI’s guide to Capital Expenditures. To keep advancing your career, these additional CFI resources will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in