Operating Risk

The risk related to a company’s cost structure

What is Operating Risk?

Operating risk is the risk related to a company’s cost structure. More specifically, it is the risk the company faces due to the level of fixed costs in its operations. Together with sales risk, operating risk is one of the two components of business risk.

Operating Risk as a Component of Business Risk

Business risk is the risk related to a company’s operating income. We can break up business risk into two components:

- Operating risk – Related to a company’s cost structure and level of fixed cost.

- Sales risk – Related to the uncertainty of generating sales due to the variability in the price and volume of the goods and services sold.

Operating Risk and Fixed Costs

The higher the level of fixed costs in a company’s operations, the higher the operating risk. Unlike variable costs, which depend on the level of production, fixed costs don’t change depending on the revenue generated.

- When fixed costs are high, it is more difficult for a company to adjust its costs according to the variation in sales.

- Substantial changes in sales can generate sharp increases in operating profits but also large operating losses.

Measuring Operating Risk

The measurement of operating risk can be done through the application of the concept of elasticity. More specifically, we can use indicators such as the degree of operating leverage (DOL), which is a very popular indicator of operating risk.

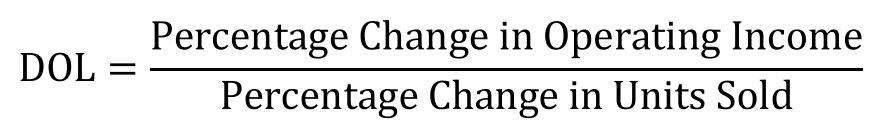

The degree of operating leverage measures the sensitivity of operating income to the variations in units sold. It is measured as the percentage change in operating income divided by the percentage change in units sold:

For example, if we calculated the degree operating leverage for Company A and found a value of 3, it means that Company A would experience a 3% increase in operating income for every 1% of growth in units sold.

The DOL is a Dynamic Measure

The degree of operating leverage is not a static measure, but its value changes based on the level of output.

- At levels of output for which operating income is negative, the degree of operating leverage is also negative.

- At levels of output for which operating income is very close to zero, the DOL is very sensitive to variations in units sold.

- At the level of output for which operating income is equal to 0, the DOL is undefined because the denominator in the formula is 0.

Practical Example – Measuring Operating Risk

Wonder Cars LLC manufactures components for the automotive industry. Being an industrial company with significant needs in terms of productive capacity, its cost structure is characterized by high fixed costs. More specifically, in the current conditions, Wonder Cars:

- Sells only one product with a unit price of $850;

- Bears variable costs of $250 for every piece produced; and

- Bears total fixed costs of $2,000,000 per year.

Assuming that the company is now producing and selling 10,000 pieces per year, let us calculate the degree of operating leverage when the company increases its production by 5%.

- With 10,000 units sold, Wonder Cars generates revenue of $8,500,000 and bears total costs of $4,500,000. It translates into an operating income of $4,000,000.

- With 10,500 units sold, Wonder Cars generates revenue of $8,925,000 and bears total costs of $4,625,000. It translates into an operating income of $4,300,000.

We can now calculate the degree of operating leverage:

- The numerator of the equation is equal to 7.5%, which is the percentage increase in operating income;

- The denominator of the equation is equal to 5%, which is the percentage increase in the units sold.

Therefore, the DOL is 1.5.

Another Example – Lower Fixed Costs

Let’s assume that Wonder Cars recently found an effective strategy to outsource part of its production to a supplier that would be paid on a per-unit basis. In other words, the company will be able to dismantle part of its productive capacity, reducing fixed costs while increasing variable costs.

More specifically, Wonder Cars will be able to produce 10,000 pieces per year with the following cost structure:

- $450 of variable costs for each unit produced; and

- Total fixed costs of $1,200,000.

For the production of 10,000 pieces, Wonder Cars bears total costs of $5,700,000. If the average selling price is unchanged, the company will be generating $2,800,000 in operating profit.

If the company increased its production and sales by 5% to 10,500 units per year, Wonder Cars would:

- Generate total revenue of $8,925,000 per year; and

- Bear $4,725,000 in variable costs and $1,200,000 in fixed costs, for a total of $5,925,000. It translates into an operating profit of $3,000,000.

In such conditions, Wonder Cars is surely earning less money, but the DOL, and therefore, the operating risk, becomes lower. It is because:

- The numerator of the equation is now equal to 7.14%, which is the percentage increase in operating income; and

- The denominator of the equation is equal to 5%.

Therefore, the degree of operating leverage goes down to 1.428, which is lower than 1.5 in the first example.

In other words, Wonder Cars’ operating income becomes less sensitive to changes in sales, which means that the company’s operating risk goes down also.

The Right Level of Operating Risk

A company should neither generally minimize the level of operating risk nor maximize it. The right level of operating risk depends on several factors, such as:

- The characteristics of the industry: Businesses in some industries may need to bear a certain level of fixed costs to be efficient.

- The balance sheet’s health: Companies with bad balance sheets will approach operating risk differently from financially more stable companies.

- The overall strategy and level of risk aversion: As a higher level of operating risk amplifies both losses and profits, the management of some companies may willingly decide to take on higher operating risk, structurally or opportunistically, when some favorable conditions are identified.

More Resources

CFI offers the Financial Modeling & Valuation Analyst (FMVA®) certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?