Multiple-Period Dividend Discount Model

How to calculate the intrinsic value of a stock that will be held for a finite number of periods

What is the Multiple-Period Dividend Discount Model?

A multiple-period dividend discount model is a variation of the dividend discount model. It is often used in situations when an investor is expecting to buy a stock and hold it for a finite number of periods and sell the stock at the end of the holding period.

Similar to the general dividend discount model, the multiple-period model is based on the assumption that the intrinsic value of a stock equals the sum of all future cash flows discounted back to their present values.

In such a scenario, an investor expects to hold the stock for the multiple periods. Thus, the future cash flows from the stock will include several dividend payments, as well as the expected selling price of the stock.

Subsequently, the current intrinsic value of a stock may be calculated by finding the sum of the future dividend payments and the anticipated selling price discounted back to their present values.

Formula for the Multiple-Period Dividend Discount Model

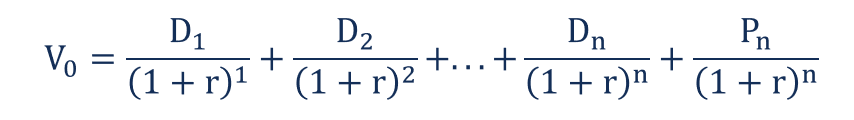

The mathematic formula that helps to calculate the fair value of a stock using the multiple-period dividend discount formula is given below:

Where:

- V0 – the current fair value of a stock

- Dn – the dividend payment in the nth period from now

- Pn – the stock price in the nth period from now

- r – the estimated cost of equity capital

Example of Multiple-Period Dividend Discount Model

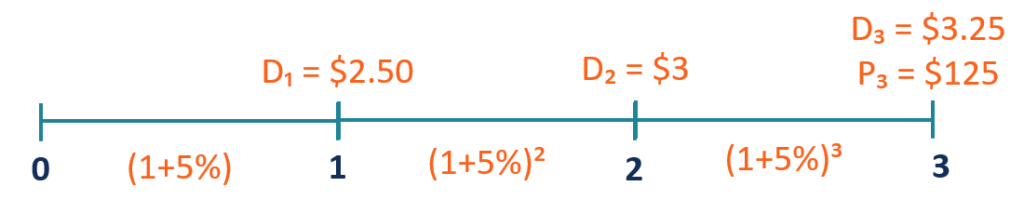

You are an investment analyst. Your client asked you to assess the viability of the investment in ABC Corp. The client expects to hold the investment for three years and sell it at the end of the holding period (end of the third year).

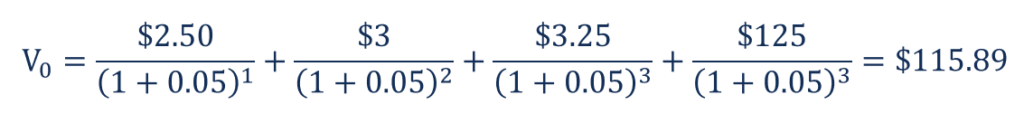

You’ve forecasted that ABC Corp. will pay dividends of $2.50 in the first year, $3 in the second year, and $3.25 in the third year. You expect that at the end of the third year, the selling price of the company’s stock will be $125 per share. The estimated cost of capital is 5%. The current stock price is $110 per share.

In order to assess the viability of the investment, you should determine the intrinsic value of the company’s stock. It can be found using the multiple-period dividend discount model. By inputting the known variables into the formula, the intrinsic stock value can be calculated in the following way:

The intrinsic value of the company’s stock is $115.89, which is more than its current stock price ($110). Therefore, we can say that the stock is currently undervalued.

Additional Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?