IB Pitchbook – Business Model, Forecast, Ownership

Download our free Investment Banking Pitchbook Template

Business Model, Operating Forecast, Shareholder Ownership

Business Model

Every company’s business model is unique, and their execution of key activities is how a company derives its competitive advantage. It is imperative that an investment banker gains a strong understanding of the business, how it generates a competitive advantage, and most importantly, how to frame all of these in a way that makes the company look as attractive as possible.

To analyze the business model, it is valuable to consider the company’s position in the industry value chain. Is the company further upstream, providing value to other companies that are customer-facing? Or is the company further downstream, providing value to customers? What are the key activities that the company performs as part of their business strategy?

Download the Free Template

Once we understand the company’s role in the industry that it operates in, we will achieve a clearer understanding of the potential existing opportunities that can create further value for the company. Two key concepts to consider are horizontal integration and vertical integration. A company may be interested in vertical integration if we find that the company’s suppliers are squeezing them too hard, or if certain distribution channels are causing sales friction. A company may be interested in horizontal integration if they find that an emerging competitor is a significant threat, or if there are significant synergies to be found in companies that operate in the same lines of business.

Any M&A transaction that your bank pitches will be derived from this type of analysis. Demonstrating a strong understanding of the company’s business model is critical in gaining the trust of the management team and ultimately winning the bid to be the bookrunner on a transaction.

Operating Forecast

When we think about a company’s financial model, we know that revenue drivers are the first step in determining the rest of the forecasted financials. Therefore, a strong understanding of the business model implies a strong understanding of the company’s operating drivers. To use an example, Netflix operates three segments – International Subscribers, Domestic Subscribers, and Domestic DVD. The company owes its overall growth in recent years to its international subscription segment, while its domestic DVD rental service is in structural decline. It would make sense for an investment bank to pitch a horizontal integration of international content instead of vertically integrating their DVD business.

The operations of a company will depend on key metrics and drivers. These drivers may be simple (i.e. growth rate, unit x volume, etc.) or they may be more complicated (i.e. backlog, ASM, natural resource models). Furthermore, cost drivers may be used as well. Essentially, we want to highlight what the company can expect regarding their profitability going forward and where the major opportunities lie.

Shareholder Ownership

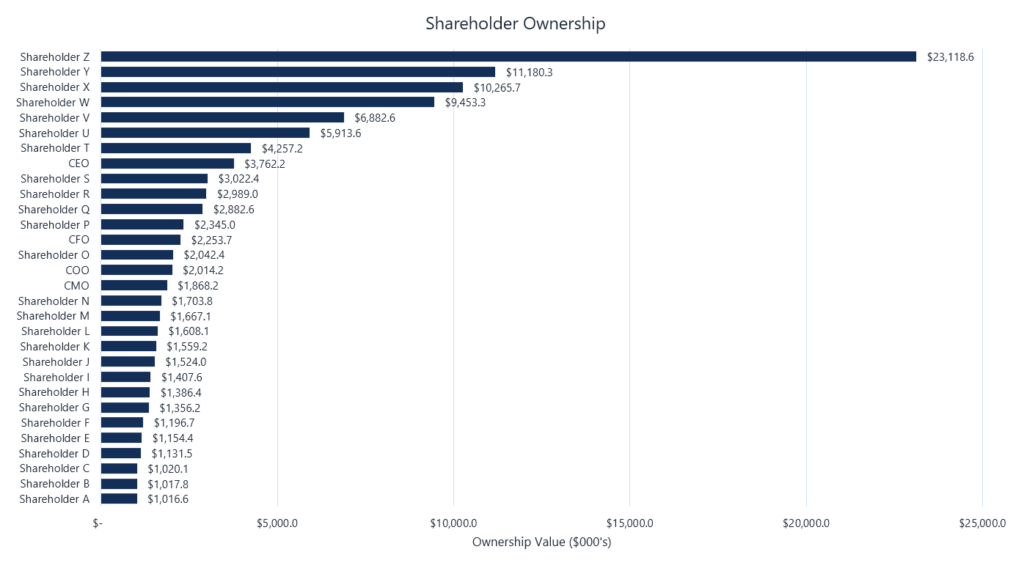

There are key implications to consider when we look at the ownership breakdown of the company. The main implications include majority shareholders, institutional versus retail ownership and insider ownership.

If there is any majority shareholder ownership, the motivations of a majority shareholder must be addressed prior to pursuing transactions. For example, if a majority shareholder happens to be highly conservative, but the management decides to pursue a risky transformative transaction, this opens up the risk of shareholder activism. It is critical to consider the interests of any majority shareholder prior to acting on a transaction opportunity.

The breakdown of institutional versus retail ownership is important when considering transaction opportunities. Institutional shareholders may hold shares of the company based on a particular investing style, and M&A transactions can significantly affect the ownership base, especially if the transaction offers the potential to significantly shift company fundamentals. Furthermore, the growing trend of ETF investing can influence the company’s ETF rebalancing and stock performance.

Insider share ownership can also influence the company’s stock, specifically regarding trading liquidity and voting rights. In terms of liquidity, the difference between the float amount compared to the total shares outstanding could be stagnant shares held by company insiders. A high proportion of insider ownership may restrict the overall trading liquidity and float turnover of the stock. Furthermore, company insiders may retain the voting rights of a company, which gives insiders complete control of proxies.

Additional Resources

Thank you for downloading CFI’s free investment banking pitchbook template. To keep learning and advancing your career, the following resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?