Accrued Liability

Represents an expense incurred during a specific period but has yet to be billed for

What is an Accrued Liability?

An accrued liability represents an expense a business has incurred during a specific period but has yet to be billed for. Accrued liabilities are only reported under accrual accounting to represent the performance of a company regardless of their cash position. They appear on the balance sheet under current liabilities.

Summary

- An accrued liability represents an expense a business has incurred during a specific period but has yet to be billed for.

- There are two types of accrued liabilities: routine/recurring and infrequent/non-routine.

- Examples of accrued liabilities include accrued interest expense, accrued wages, and accrued services.

Understanding Accrued Liability

Accrued liabilities are expenses that have yet to be paid for by a company. They are recorded to better represent the financial position of the company regardless if a cash transaction has occurred.

Recording accrued liabilities is part of the matching accounting principle. Under the matching principle, all expenses need to be recorded in the period they are incurred to accurately reflect financial performance.

When an accrued liability is paid for, the balance sheet side is reversed, leaving a net zero effect on the account. Accrued liabilities can also be thought of as the opposite of prepaid expenses.

Accrued Liabilities – Types

There are two types of accrued liabilities: routine or recurring and infrequent or non-routine.

1. Routine/Recurring

Routine/Recurring occurs as a normal operational expense of the business. An example would be accrued wages, as a company knows they have to periodically pay their employees.

2. Infrequent/Non-Routine

Infrequent/Non-Routine is the opposite and does not occur as a normal operational part of the business. An example is a one-off purchase from a supplier where a bill is not immediately received. As the event isn’t recurring, it is considered an infrequent/non-routine accrued liability.

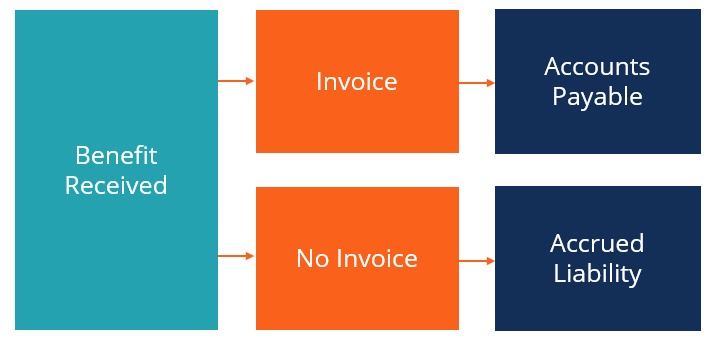

Accrued Liabilities vs. Accounts Payable

Accrued liabilities and accounts payable are both current liabilities. However, the difference between them is that accrued liabilities have not been billed, while accounts payable have. Accrued liabilities may not have been billed either because they are a regular expense that doesn’t require billing (i.e., payroll), or because the company hasn’t received a bill from the supplier.

For example, if a company has received a shipment from a supplier and has yet to receive a bill, they will record an accrued liability. However, if they were to receive the shipment and the bill before the end of the period, they would record an accounts payable.

Journal Entry

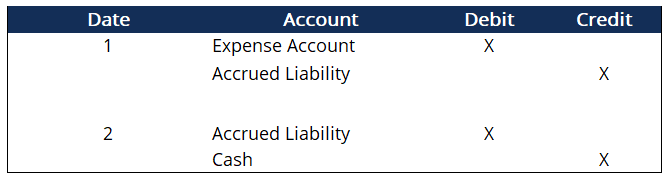

The journal entry is typically a credit to accrued liabilities and a debit to the corresponding expense account. Once the payment is made, accrued liabilities are debited, and cash is credited. At such a point, the accrued liability account will be completely removed from the books.

Accrued Liabilities – Examples

- Accrued interest expense: When a company owes interest on a loan but has yet to be billed by the lender.

- Accrued wages: Employees have not been paid for work completed because their payroll period falls after the reporting date.

- Accrued services: A supplier has provided a service but has yet to bill the customer

Practical Example

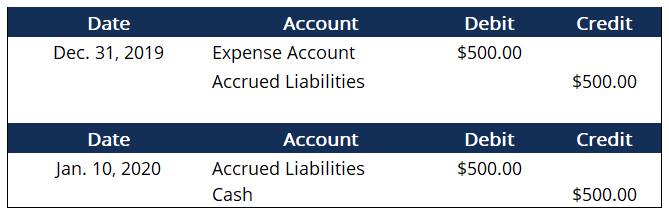

Company ABC has received product from their supplier on December 31st, costing $500. However, the supplier has yet to bill them. They receive the bill on January 10th and pay the same day.

Above are the journal entries for December 31st and January 10th. As you can see, the accrued liabilities account is net zero following the payment. The net effect on financial statements is an increase in the expense account and a decrease in the cash account. The purpose of accrued liabilities is to create a timeline of financial events.

Related Readings

Thank you for reading CFI’s explanation of Accrued Liability. To keep learning and advancing your career, the following resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?