Current Debt

Borrowings with a maturity of less than one year

What is Current Debt?

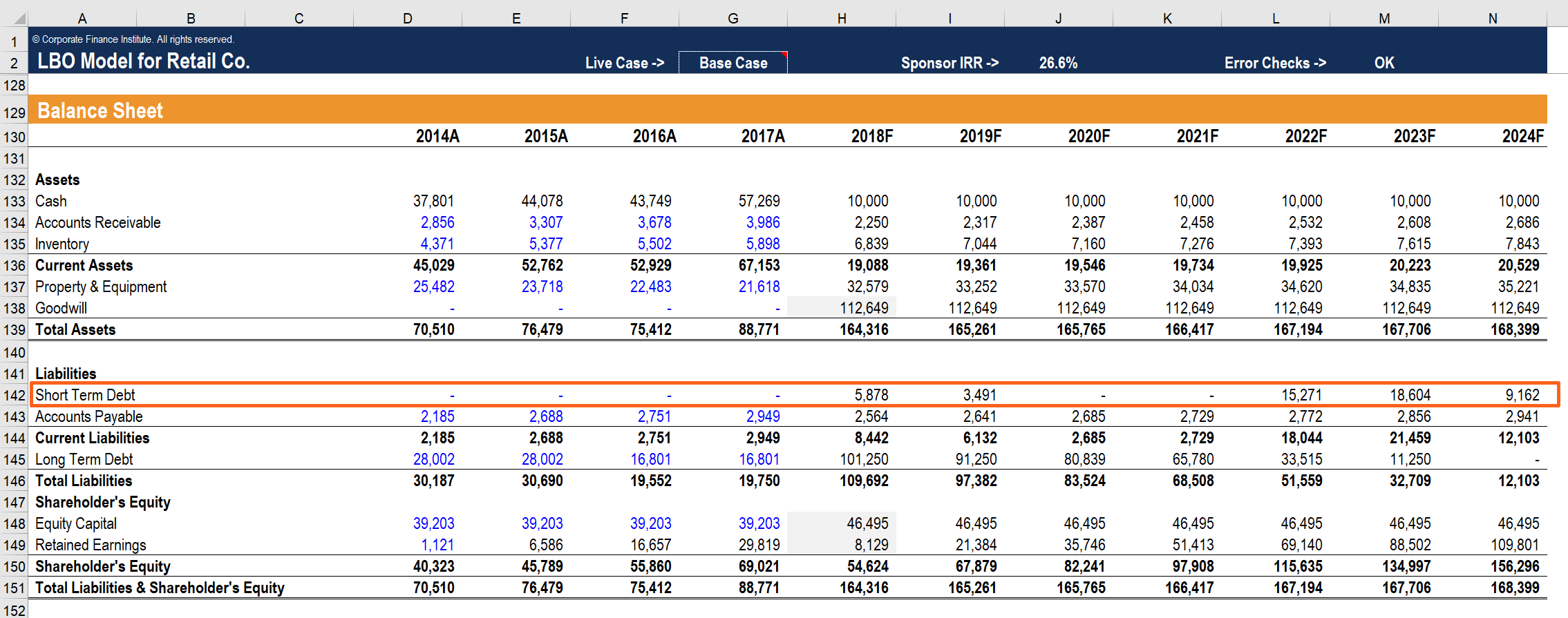

Current debt includes the formal borrowings of a company outside of accounts payable. This appears on the balance sheet as an obligation that must be paid off within a year’s time. Thus, current debt is classified as a current liability. This is not to be confused with the current portion of long-term debt, which is the portion of long-term debt due within a year’s time.

Not all companies have a current debt line item, but those that do use it explicitly for loans incurred with a maturity of less than a year. Some firms call this “notes payable.” This differs from accounts payable, as accounts payable refers to goods or services purchased on credit. Notes payable, on the other hand, refers to funds or cash borrowed.

Current Ratio

Current debt is often assessed using the current ratio. The current ratio is a liquidity metric that compares current assets to current liabilities. This ratio is used to gauge the ability of a company to pay off its financial obligations for the next year. If a company has current assets of $500,000 and current liabilities of $250,000, then it has a current ratio of 2:1.

Generally speaking, a company should always have a current ratio of at least 1:1 or higher to indicate that it is financially sound. A ratio of less than 1:1 indicates the company has more financial obligations than its current assets can cover.

To get a good reading of a company’s relative financial stability, it is best to compare its current ratio to the average current ratio of similar companies operating in the same industry. You can also compare it to the company’s own current ratio in previous years, to identify whether the company is trending toward a higher or lower ratio.

Related Readings

Thank you for reading this CFI guide to assets. CFI’s mission is to create world-class financial analysts via the Financial Modeling & Valuation Analyst (FMVA)® Certification Program. To continue learning and advancing your career, these additional CFI resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.