- Understanding Dividends: Meaning, Types, and Why They Matter

- Types of Dividends: Cash and Stock

- Examples of Dividends

- 1. Cash Dividends

- 2. Stock Dividends

- 3. Special Dividends

- 4. Property Dividends

- 5. Preferred Dividends

- The Importance of Dividends for Investors

- How Do Dividends Work?

- Step 1: Company Announces a Dividend

- Step 2: Key Dividend Dates

- Step 3: Receiving Your Dividend Payment

- Step 4: Reinvesting Dividend Income for Growth

- Why Do Companies Pay Dividends?

- How are Dividend Amounts Determined?

- Understanding Dividend Yield and Its Significance

- Dividend Example: Microsoft

- How Dividends Appear in Financial Statements

- Impact of a Dividend on Valuation

- Dividends in Financial Modeling

- Get Certified for Financial Modeling and Valuation (FMVA®)

- FAQ: Common Dividend Questions

What Is a Dividend?

A dividend is a portion of a company’s profits paid to shareholders, offering a steady income stream and signaling financial health to the market.

Understanding Dividends: Meaning, Types, and Why They Matter

A dividend is a portion of a company’s profits that is paid out to its shareholders. Dividends are one of the most common ways companies distribute profits to shareholders. When a company earns a profit and accumulates retained earnings, it can either reinvest that money into the business or return it to shareholders in the form of dividends.

Investors often view dividend-paying stocks as a sign of a stable and mature company, particularly in sectors like utilities, consumer goods, and finance. Dividends also play a key role in investment income strategies, especially for those seeking long-term income from the stock market.

Key Highlights

- A dividend is a payment that a company makes to its shareholders, typically from its profits. It’s a way for companies to distribute a portion of their earnings back to investors.

- A dividend’s value is determined on a per-share basis and is paid equally to all shareholders of the same class. The payment must be approved by the Board of Directors.

- Dividend yield is the ratio of income shareholders earn from dividends relative to the current price of the stock, expressed as: Dividend Yield = Annual Dividend per Share ÷ Stock Price.

Types of Dividends: Cash and Stock

There are two primary types of dividends:

- Cash Dividends: Paid in cash directly to a shareholder’s brokerage account or bank account. These are typically issued quarterly, though some companies pay monthly dividends.

- Stock Dividends: Instead of cash, shareholders receive additional shares of stock, increasing their ownership stake without requiring a new investment.

Example:

If you own 50 shares of a company and it declares a $1 dividend, you’ll receive $50 in dividend income, usually deposited automatically into your account.

Examples of Dividends

Dividends can take several forms, depending on a company’s structure and financial policy. Below are common examples of dividends and how they work in real-world scenarios:

1. Cash Dividends

A company declares a quarterly dividend of $0.50 per share. If you own 200 shares, you receive $100 in dividend income deposited into your brokerage account. This is the most common type of dividend.

2. Stock Dividends

Instead of cash, a company issues a 5% stock dividend, meaning you receive 5 additional shares for every 100 you own. This increases your ownership without requiring a new investment.

3. Special Dividends

A company experiences a one-time surge in profits (e.g., asset sale or windfall gain) and issues a special dividend of $1.50 per share to reward shareholders. This is separate from the regular payout schedule.

4. Property Dividends

Although rare, some companies issue non-cash dividends in the form of physical assets or shares in a subsidiary business. These are typically disclosed with more complex tax implications.

5. Preferred Dividends

Holders of preferred stock receive fixed dividends before any dividends are paid to common shareholders. For example, a preferred stock may pay $2 annually, regardless of the company’s performance.

These examples highlight how companies structure dividend payments to meet different investor preferences and financial goals.

The Importance of Dividends for Investors

Dividends in finance are an essential part of many investors’ strategies, especially those who are looking for a steady income stream from their investments. Companies, mutual funds, and exchange-traded funds that pay regular dividends are often seen as stable and profitable, making them attractive to investors who prefer lower-risk opportunities.

How Do Dividends Work?

Understanding how dividend payments work is essential for anyone interested in investing in or analyzing dividend-paying businesses.

Step 1: Company Announces a Dividend

The first step in the dividend payment process begins with the company. When a company makes a profit, its board of directors decides whether to pay out a portion of these profits as dividends to shareholders. This decision is based on factors like the company’s financial health, future growth plans, and overall business strategy.

Once the decision is made, the company announces the dividend amount per share and the schedule for payment. This announcement informs shareholders about the expected dividend they will receive.

Step 2: Key Dividend Dates

There are several key dates to keep in mind when it comes to dividend payments:

- Declaration Date: This is the date when the company officially announces its intention to pay a dividend. The declaration includes the dividend amount, payment date, and other relevant details.

- Ex-Dividend Date: The ex-dividend date is the cutoff day to be eligible for the dividend. If you purchase shares on or after this date, you will not receive the upcoming dividend. The ex-dividend date is usually set one or two business days before the record date.

- Record Date: The record date is when the company looks at its records to determine who the eligible shareholders are. If you own shares on this date, you will receive the dividend.

- Payment Date: This is the date when the dividend is actually paid out to shareholders. On this day, you will receive the dividend income, either in cash or additional shares, depending on the type of dividend.

Step 3: Receiving Your Dividend Payment

Once the payment date arrives, the company distributes the dividend to all eligible shareholders:

- Cash dividends are credited to your account.

- Stock dividends are added to your share total.

Dividend income may be taxable depending on your jurisdiction and the classification as qualified dividends or ordinary income.

For example, if you own 100 shares of a company and they pay a $1 dividend per share, you will receive $100 in dividend income. This payment is often deposited directly into your brokerage account, so there’s no need to take any action on your part. However, dividend income can include a tax liability, such as capital gains tax or income tax, so it’s important to speak to a tax professional about any dividend-paying stocks you own and dividend payments received.

Step 4: Reinvesting Dividend Income for Growth

Many investors choose to reinvest their dividend income to buy more shares of the same stock. Reinvesting dividends can be a powerful way to grow your investment over time, as it allows you to benefit from compounding returns. Over the long term, this can significantly increase your stock holdings and potential future dividend income. Many companies offer dividend reinvestment plans (DRIP) to help shareholders reinvest dividends.

Why Do Companies Pay Dividends?

Companies pay dividends for several strategic and financial reasons that align with shareholder expectations and market positioning:

- Signal Strong Financial Health: Consistent dividend payments indicate that a company has stable earnings and reliable cash flow. It sends a positive signal to investors that the business is profitable and well-managed.

- Reward Shareholders: Dividends provide a direct return on investment, making them especially attractive to long-term shareholders seeking investment income. This payout reinforces investor trust and supports shareholder retention.

- Attract Long-Term and Income-Focused Investors: Dividend-paying stocks appeal to investors looking for reliable income, such as retirees or those building passive income portfolios. These companies often enjoy a loyal investor base.

- Enhance Market Perception: In sectors where dividend distribution is common, such as utilities, telecom, and consumer goods, not paying dividends may be viewed negatively. Paying dividends helps companies remain competitive in these industries

- Optimize Capital Allocation: Mature companies with limited reinvestment opportunities may choose to return capital to shareholders rather than holding excess cash. This can improve capital efficiency and shareholder value.

Mature businesses, especially those in low-growth industries, tend to prioritize dividends as a way to distribute excess cash. Rather than reinvesting all profits into expansion, they return a portion to shareholders, often as part of a larger dividend investing strategy. This approach also reduces idle capital and reflects management’s confidence in long-term profitability.

How are Dividend Amounts Determined?

The amount of a dividend is typically determined by the company’s leadership, usually the board of directors, after reviewing the company’s financial performance. The primary goal is to strike a balance between rewarding shareholders and retaining enough capital to support future growth and operations.

To set a dividend amount, the board assesses the company’s net income, or what’s left after all expenses have been paid. Then, the company decides how much to allocate toward dividends versus how much to reinvest in the business. This allocation reflects the company’s confidence in its financial health and future prospects.

Key Factors Influencing Dividend Payouts

Several key factors influence how much a company’s earnings it decides to pay in dividends, including:

- A company’s earnings and profit levels

- Business growth plans

- Industry norms

- Financial stability

Understanding Dividend Yield and Its Significance

Dividend yield is a key metric that investors use to assess a dividend’s value relative to its stock price. It is calculated by dividing the annual dividend per share by the current stock price and is expressed as a percentage.

Dividend Yield Formula

Dividend Yield = Annual Dividend per Share ÷ Stock Price

For example, if a company pays an annual dividend of $2 per share and its stock is priced at $40, the dividend yield would be 5% ($2 ÷ $40 = 0.05, or 5%). A higher yield can make an investment in a company’s stock more attractive to income-focused investors, as it indicates a higher return on their investment through dividends.

However, while a high dividend yield may seem appealing, it’s important to consider the sustainability of that yield. If the yield is high because the share price has dropped significantly, it could signal underlying issues within the company. Therefore, yield should be evaluated alongside other financial metrics to get a complete picture of the company’s health and prospects.

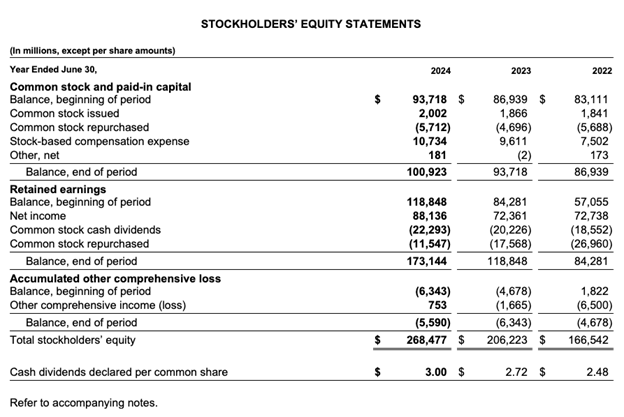

Dividend Example: Microsoft

The example below is Microsoft’s 2024 shareholders’ equity statement. The last item in this statement shows that Microsoft declared a dividend per common share of $3.00 in 2024, $2.72 in 2023, and $2.48 in 2022.

This figure can be compared to Earnings per Share (EPS) from continuing operations and Net Earnings for the same time period.

How Dividends Appear in Financial Statements

When a company pays a dividend, it is not considered an expense on the income statement since it is a payment made to the company’s shareholders. This differentiates it from a payment for a service to a third-party vendor, which would be considered a company expense.

Dividends:

- Do not appear as expenses on the income statement.

- Reduce retained earnings on the balance sheet.

- Flow through financing activities in the cash flow statement.

This is important for anyone building financial models or analyzing investments.

Dividends vs. Share Buybacks

Corporations have several types of distributions they can make to the shareholders. The two most common distribution types are dividends and share buybacks. A share buyback is when a company uses cash on the balance sheet to repurchase shares in the open market.

Both dividends and share buybacks return capital to shareholders, but in different ways:

Buybacks may appeal to companies aiming to increase EPS or boost stock price performance.

Share buybacks are a way to both return cash to shareholders and reduce the number of shares outstanding, which can help boost a company’s earnings per share (EPS). When the number of shares decreases, the denominator in EPS (net earnings/shares outstanding) decreases; thus, EPS increases.

Corporations are frequently evaluated on their ability to move share price and grow EPS, so they may be incentivized to use the buyback strategy.

Impact of a Dividend on Valuation

Paying dividends has no impact on the enterprise value of the business. However, it reduces the equity value of the business by the value of the dividend paid.

Dividends in Financial Modeling

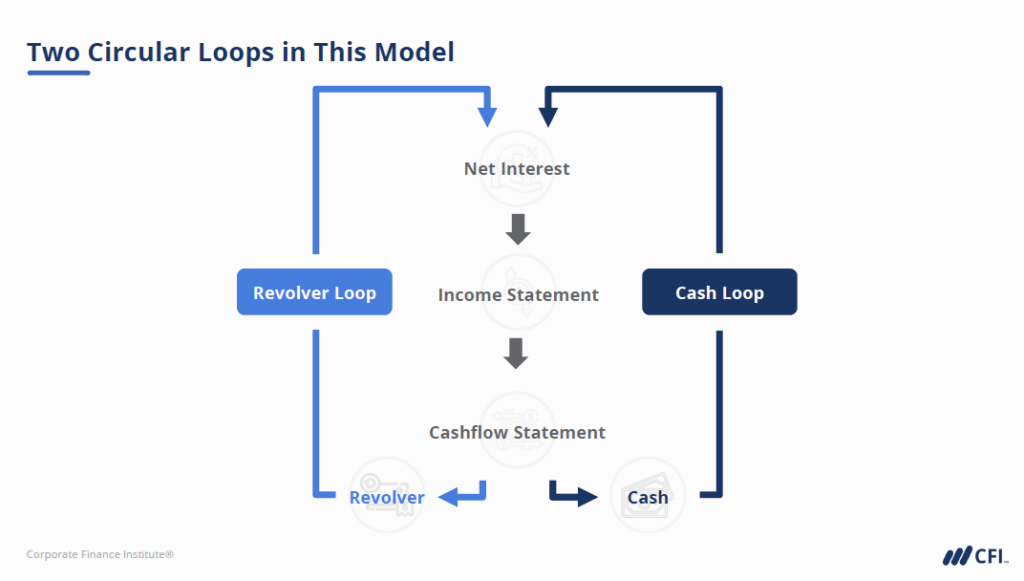

In financial modeling, it’s important to have a solid understanding of how a dividend payment impacts a company’s balance sheet, income statement, and cash flow statement. In CFI’s financial modeling courses, you’ll learn how to link the financial statements together so that any dividends paid flow through all the appropriate accounts.

A well-laid-out financial model will typically have an assumptions section where any return of capital decisions are contained. For example, if a company is going to pay a dividend in 2026, then there will be an assumption about what the dollar value will be, which will flow out of retained earnings and through the cash flow statement (financing activities), which will also reduce the company’s cash balance.

Additional Resources

Dividend vs Share Buyback/Repurchase

Analysis of Financial Statements

See all Financial Modeling resources

Get Certified for Financial Modeling and Valuation (FMVA®)

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.

FAQ: Common Dividend Questions

Do I pay tax on dividends?

Yes, in most cases. Qualified dividends are taxed at the capital gains rate, while others are taxed as ordinary income. Tax treatment depends on your location and holding period.

Are dividends free money?

Not exactly. While dividends provide income, they’re paid from the company’s profits, so the share price often adjusts down by the amount of the dividend after the payout.

How often do dividends pay out?

Most companies pay dividends quarterly, but some pay monthly or annually. The frequency depends on the company’s dividend policy and cash flow.

What is meant by dividend yield?

Dividend yield tells you how much cash return an investor receives from owning a stock relative to the stock’s current price. It’s calculated by taking a company’s annual dividend per share and dividing it by the current share price. For example, a dividend of $2 per share that trades at $40 has a dividend yield of 5%.