- What is Dividend Per Share (DPS)?

- Dividend Per Share Formula

- Download CFI's Free Dividend Per Share Calculator

- Types of Dividends

- Dividend Per Share Example

- Calculating DPS from the Income Statement

- Sample Dividend Per Share Calculation

- Example of Dividend per Share

- The Rationale for Paying a Dividend to Shareholders

- The Rationale for Not Paying a Dividend

- Additional Resources

Dividend Per Share (DPS)

Total amount of dividend attributed to each share outstanding

What is Dividend Per Share (DPS)?

Dividend Per Share (DPS) is the total amount of dividends attributed to each individual share outstanding of a company. Calculating the dividend per share allows an investor to determine how much income from the company he or she will receive on a per-share basis. Dividends are usually a cash payment paid to the investors in a company, although there are other types of payment that can be received (discussed below).

Dividend Per Share Formula

The formula for calculating dividend per share has two variations:

Dividend Per Share = Total Dividends Paid / Shares Outstanding

or

Dividend Per Share = Earnings Per Share x Dividend Payout Ratio

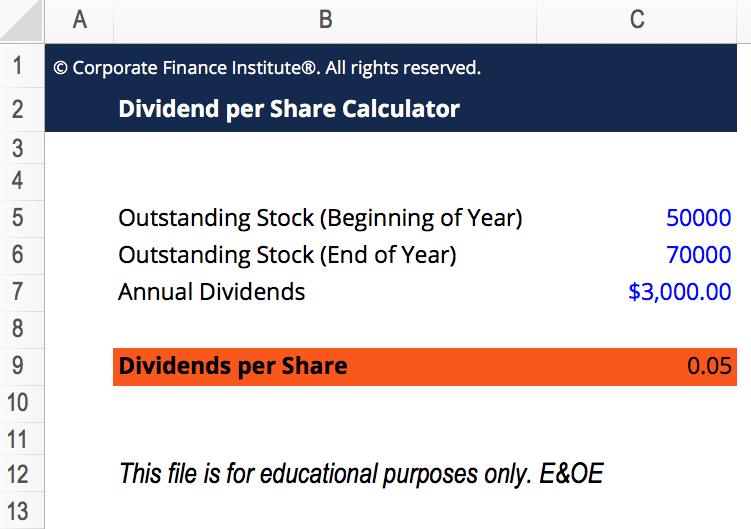

Download CFI’s Free Dividend Per Share Calculator

Complete the form below to download our Dividend Per Share Calculator!

Types of Dividends

Although dividends are usually a cash payment paid to investors, that is not always the case. There are several types of dividends, such as:

1. Cash dividends

This is the most common form of dividend per share an investor will receive. It is simply a cash payment and the value can be calculated by either of the above two formulas.

2. Property dividends

The company issues a dividend in the form of an asset such as property, plant, and equipment (PP&E), a vehicle, inventory, etc.

3. Stock dividends

The company gives each shareholder a certain number of extra shares based on the current amount of shares that each shareholder owns (on a pro-rata basis).

4. Scrip dividends

The company promises payment to shareholders at a later date. Scrip dividends are essentially a promissory note to pay shareholders at a future date.

5. Liquidating dividends

The company liquidates all its assets and pays the sum to shareholders as a dividend. Liquidating dividends are usually issued when the company is about to shut down.

Dividend Per Share Example

Company A announced a total dividend of $500,000 paid to shareholders in the upcoming quarter. Currently, there are 1 million shares outstanding.

The dividend per share would simply be the total dividend divided by the shares outstanding. In this case, it is $500,000 / 1,000,000 = $0.50 dividend per share.

Calculating DPS from the Income Statement

If a company follows a consistent dividend payout ratio (i.e., the company is known to pay a consistent percentage of its earnings as dividends), a rough estimate of the dividend per share can be calculated through the income statement. To calculate the DPS from the income statement:

1. Figure out the net income of the company

Net income is generally the last item on the income statement.

2. Determine the number of shares outstanding

The number of shares outstanding can typically be found on the company’s balance sheet. If there are treasury shares, it is important to subtract those from the number of issued shares to get the number of outstanding shares.

3. Divide net income by the number of shares outstanding

Dividing net income by the number of shares outstanding would give you the earnings per share (EPS).

Alternatively:

4. Determine the company’s typical payout ratio

Estimate the typical payout ratio by looking at past historical dividend payouts. For example, if the company historically paid out between 50% and 55% of its net income as dividends, use the midpoint (53%) as the typical payout ratio.

5. Multiply the payout ratio by the net income per share to get the dividend per share

Sample Dividend Per Share Calculation

Company A reported a net income of $10 million. Currently, there are 10 million shares issued with 3 million shares in the treasury. Company A has historically paid out 45% of its earnings as dividends.

To estimate the dividend per share:

- The net income of this company is $10,000,000.

- The number of shares outstanding is 10,000,000 issued – 3,000,000 in the treasury = 7,000,000 shares outstanding.

- $10,000,000 / 7,000,000 = $1.4286 net income per share.

- The company historically paid out 45% of its earnings as dividends.

- 0.45 x $1.4286 = $0.6429 dividend per share.

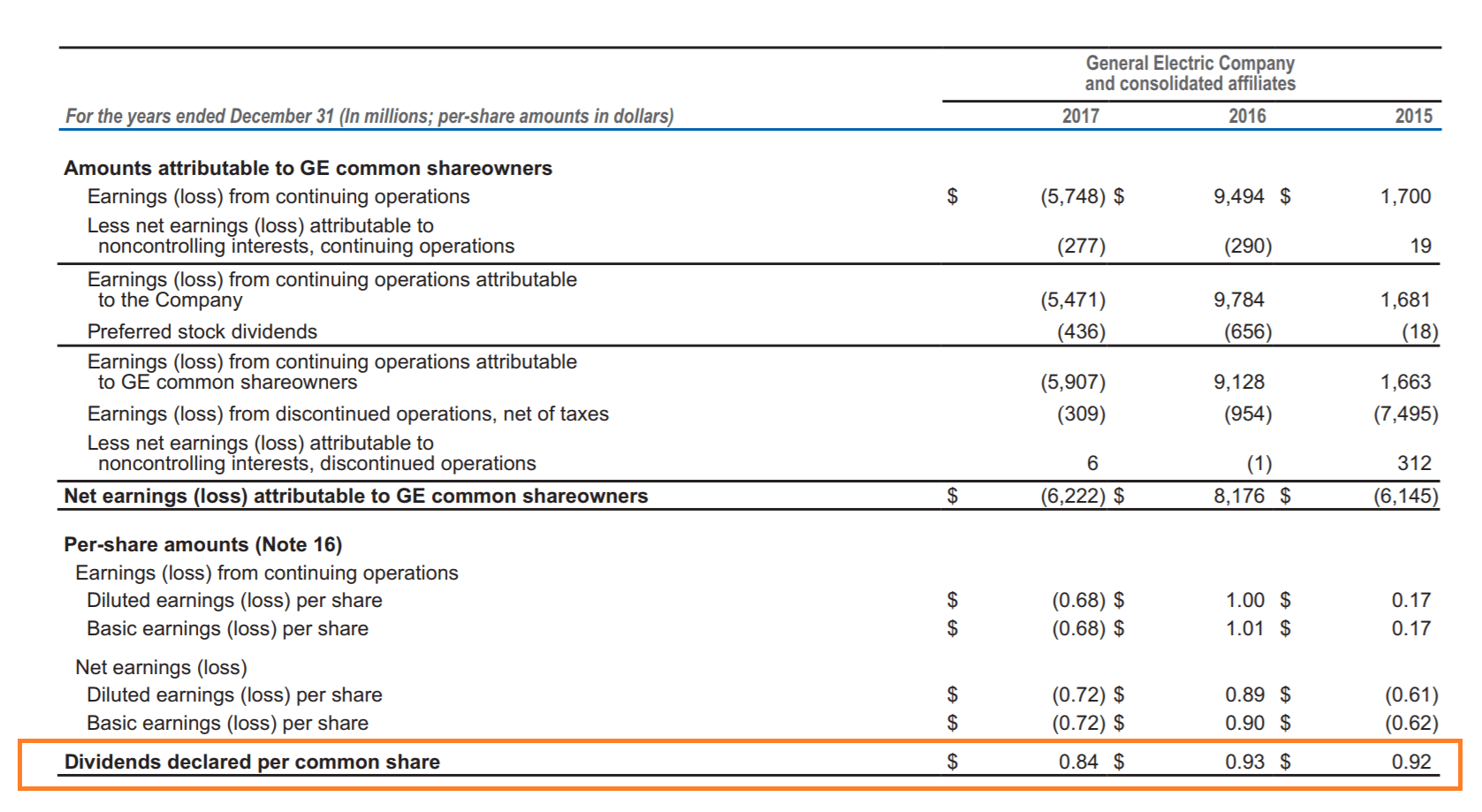

Example of Dividend per Share

Below is an example from GE’s 2017 annual report. In their financial statements is a section that outlines the dividends declared per common share. For easy reference, you can compare the dividends to the net earnings per share (EPS) in the same period.

The Rationale for Paying a Dividend to Shareholders

Let us consider two key reasons as to why companies choose to issue dividends:

1. To attract investors

Many investors enjoy receiving dividends and view them as a steady income source. Therefore, these investors are more attracted to dividend-paying companies.

2. To signal the company’s strength

Paying a dividend to shareholders may be a signaling method by the company. Dividend payments are typically associated with a strong company with positive expectations about its future earnings. This makes the stock more attractive and may increase the market value of the company’s stock.

The Rationale for Not Paying a Dividend

Although dividends can be used to signal a company’s strength and attract investors, there are also several important reasons as to why companies do not issue dividends:

1. Rapid growth

A company that is growing rapidly most likely won’t pay dividends. The earnings of the company are instead reinvested to help fund further growth.

2. Internal investment opportunities

A mature company may hold onto its earnings and reinvest them. The money may be used to fund a new project, acquire new assets, or pursue mergers and acquisitions (M&A).

3. Wrong signaling

If a company originally issues dividends but decides to pull back on its dividend payout, it can create unfavorable signaling for the company. When companies eliminate or reduce their existing dividend policy, this is typically viewed negatively by investors. Therefore, companies may avoid paying dividends at all to avoid this problem.

Additional Resources

Thank you for reading CFI’s guide to dividend per share. To help you in your journey of becoming a world-class financial analyst, these additional CFI resources will be helpful: