Notes Receivable

Written promissory notes that give the holder the right to receive the amount outlined in an agreement

What are Notes Receivable?

Notes receivable are a balance sheet item that records the value of promissory notes that a business is owed and should receive payment for. A written promissory note gives the holder, or bearer, the right to receive the amount outlined in the legal agreement. Promissory notes are a written promise to pay cash to another party on or before a specified future date.

If the note receivable is due within a year, then it is treated as a current asset on the balance sheet. If it is not due until a date that is more than one year in the future, then it is treated as a non-current asset on the balance sheet.

Often, a business will allow customers to convert their overdue accounts (the business’ accounts receivable) into notes receivable. By doing so, the debtor typically benefits by having more time to pay.

Summary

- A note receivable is also known as a promissory note.

- When the note is due within less than a year, it is considered a current asset on the balance sheet of the company the note is owed to. If its due date is more than a year in the future, it is considered a non-current asset.

- The interest income on notes receivable is recognized on the income statement. Therefore, when payment is made on a note receivable, both the balance sheet and the income statement are affected.

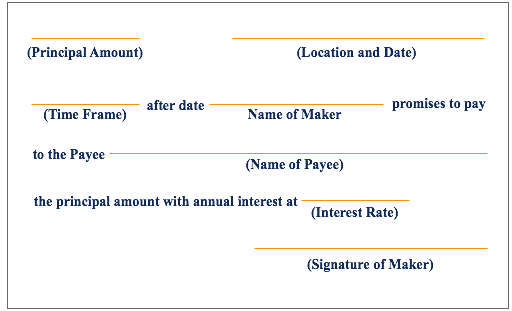

Key Components of Notes Receivable

Here are the key components of notes receivable:

- Principal value: The face value of the note

- Maker: The person who makes the note and therefore promises to pay the note’s holder. To a maker, the note is classified as a note payable.

- Payee: The person who holds the note and therefore is due to receive payment from the maker. To a payee, the note is classified as a note receivable

- Stated interest: A note receivable generally includes a predetermined interest rate; the maker of the note is obligated to pay the interest amount due, in addition to the principal amount, at the same time that they pay the principal amount.

- Timeframe: The length of time during which the note is to be repaid. Notes receivable are not usually subject to prepayment penalties, so the maker of the note is free to pay off the note on or before the note’s stated due, or maturity, date.

Example of Notes Receivable

Company A sells machinery to Company B for $300,000, with payment due within 30 days. After 45 days of nonpayment by Company B, both parties agree that Company B will issue a note payable for the principal amount of $300,000, at an interest rate of 10%, and with a payment of $100,000 plus interest due at the end of each month for the next three months. Alternatively, the note may state that the total amount of interest due is to be paid along with the third and final principal payment of $100,000.

In this example, Company A records a notes receivable entry on its balance sheet, while Company B records a notes payable entry on its balance sheet. The principal value is $300,000, $100,000 of which is to be paid monthly. In addition, the agreed upon interest rate on the note is 10%.

Example of Journal Entries for Notes Receivable

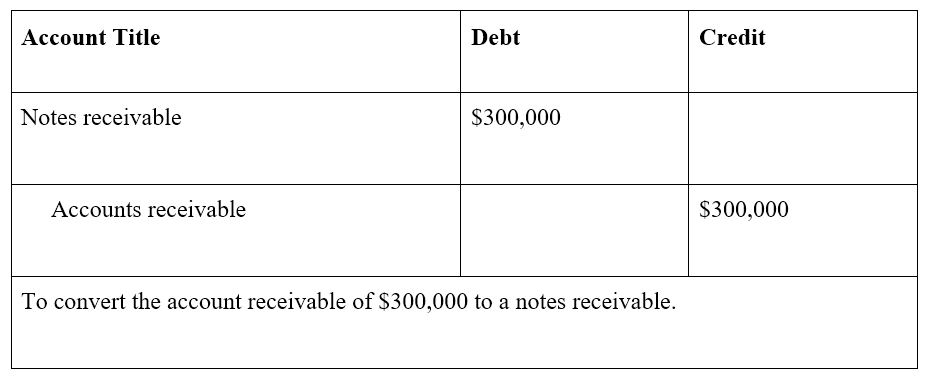

Still using the example delineated above, with companies A and B:

A note receivable of $300,000, due in the next 3 months, with payments of $100,000 at the end of each month, and an interest rate of 10%, is recorded for Company A.

The proper journal entries for Company A are as follows:

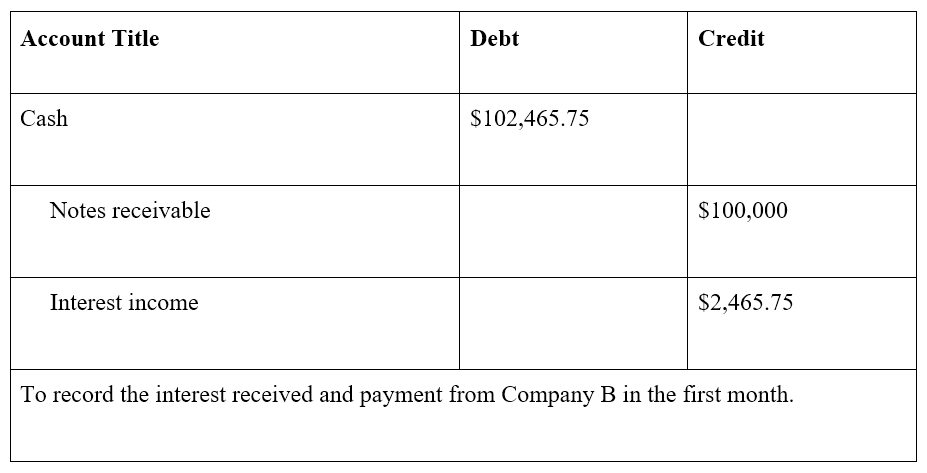

At the end of the first month, Company B pays $100,000 as well as an interest payment = $2,465.75 (calculated as $300,000 x 10% x 30 / 365 days = $2,465.75).

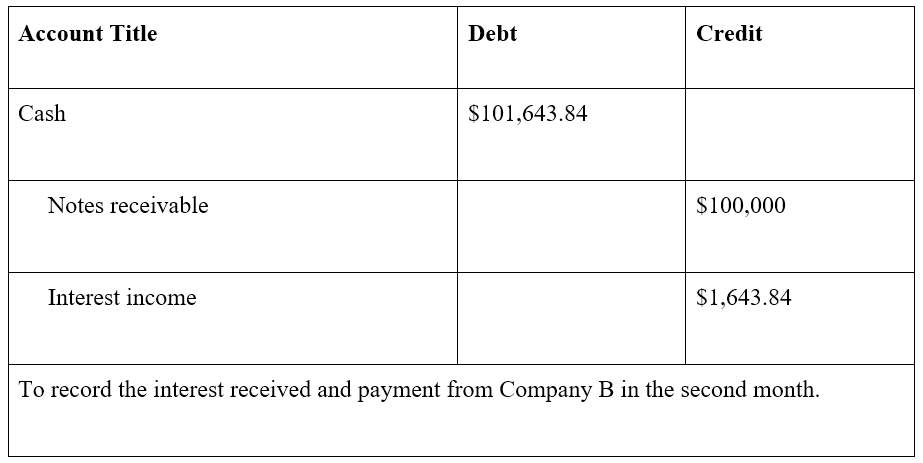

At the end of the second month, Company B pays $100,000, along with interest of $200,000 x 10% x 30 / 365 days = $1,643.84. Note that the amount of interest is lower because the outstanding principal amount is now only $200,000 ($300,000 – $100,000), having been reduced by the previous month’s payment.

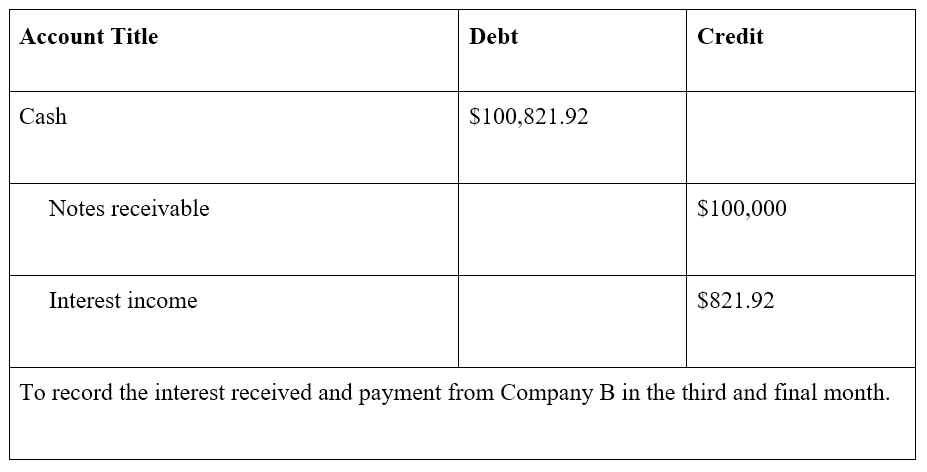

At the end of the third and final month, Company B pays the remaining principal of $100,000, as well as the interest of $100,000 x 10% x 30 / 365 days = $821.92

At the end of the three months, the note, with interest, is completely paid off.

Notes Receivable vs Notes Payable

It is not unusual for a company to have both a Notes Receivable and a Notes Payable account on their statement of financial position. Notes Payable is a liability as it records the value a business owes in promissory notes. Notes Receivable are an asset as they record the value that a business is owed in promissory notes. A closely related topic is that of accounts receivable vs. accounts payable.

Additional Resources

Thank you for reading our guide to Notes Receivable. To continue learning and advancing your career in corporate finance, you may find the additional free CFI resources below helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?