Restricted Cash

Cash that is not available for immediate business use

What is Restricted Cash?

Restricted cash refers to cash that is held onto by a company for specific reasons and is, therefore, not available for immediate ordinary business use. It can be contrasted with unrestricted cash, which refers to cash that can be used for any purpose.

Quick Summary:

- Restricted cash refers to cash that is held by a company for specific reasons and not available for immediate business use.

- Restricted cash is commonly found on the balance sheet with a description of why the cash is restricted in the accompanying notes to the financial statements.

- Reasons for cash being restricted include bank loan requirements, payment deposits, and collateral pledges.

Restricted Cash on the Balance Sheet

Restricted cash can be commonly found on the balance sheet as a separate line item. For example, the balance sheet may look as follows:

The reason for any restriction is generally revealed in the accompanying notes to the financial statements. Additionally, depending on how long the cash is restricted for, the line item may appear under current assets or non-current assets. Cash that is restricted for one year or less is categorized under current assets, while cash restricted for more than a year is categorized as a non-current asset.

Reasons for Restrictions

There are several reasons why cash can be restricted:

1. Bank loan requirements

When a company receives a bank loan, the bank may require that the company reserves (or maintains) a certain amount of cash that will be unavailable for spending.

2. Payment deposits

A company may receive cash from a customer prior to providing services or shipping goods. The customer may require, through a clause in the agreement, that the company cannot spend the cash until the service or order is fulfilled.

3. Collateral pledge

A company may be required by an insurance company to pledge a certain amount of cash as collateral against risk.

4. Paying off debt

A company may set aside a certain amount of cash each quarter to make a payment on long-term debt.

Financial Ratios

Due to the cash not being readily available for use, cash that is restricted is generally excluded in several liquidity ratios. Failure to exclude the cash in the calculation of liquidity ratios will make the company look more liquid than it is and, thereby, be misleading. Examples of liquidity ratios that exclude restricted cash include the cash ratio and the quick ratio.

Example

John, a junior analyst, has been instructed by the head of equity research to conduct liquidity analysis of a company. More specifically, he has been asked to determine the current ratio of a company to see if it has enough cash to pay off its short-term obligations. Recall that the quick ratio is calculated as (Cash and Cash Equivalents + Marketable Securities) / Current Liabilities.

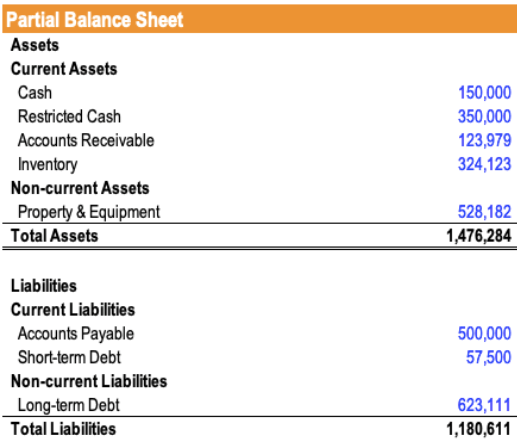

The company’s balance sheet is provided as follows:

Under accompanying notes to the financial statements, John notes that the restricted cash is in relation to a payment deposit where the company agreed with a customer to keep $350,000 in cash until its obligation with the customer is settled. The obligation is expected to settle within a year.

John excludes that cash from his calculations and determines the company’s quick ratio to be $150,000 / ($500,000 + $57,500) = 0.27.

Had John used the restricted cash in his calculation of the quick ratio, he would have gotten a quick ratio of ($150,000 + $350,000) / ($500,000 + $57,000) = 0.90 and mistakenly deemed the company much more liquid than it is.

More Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?