Accounts Receivable

Revenue that has not been paid for with cash yet

What is Accounts Receivable (AR)?

Accounts Receivable (AR) represents the credit sales of a business, which have not yet been collected from its customers. Companies allow their clients to pay for goods and services over a reasonable extended period of time, provided that the terms have been agreed upon. For certain transactions, a customer may receive a small discount for paying the amount due to the company early.

The average AR days measure is an important part of forecasting changes in non-cash working capital in financial modeling.

Why Do Companies Have Accounts Receivable?

Some businesses allow selling on credit to make the payment process easier. Take, for example, a phone provider. The provider may find it hard to collect payment every time someone makes a call. Instead, it will bill periodically at the end of the month for the total amount of service used by the customer. Until the monthly invoice has been paid, the amount will be recorded in accounts receivable.

Allowing purchases on credit also encourages more sales. Customers are more likely to buy items if they can pay for them at a later date.

For someone working in FP&A, equity research, or investment banking, it’s important to understand the cash conversion cycle – the amount of time it takes a company to convert its inventory into sales and then cash – as it provides important information on the company’s cash flow.

Example of Accounts Receivable

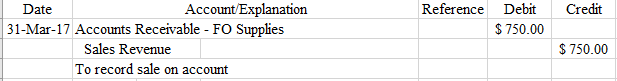

In this example, Corporate Finance Institute sells $750 worth of inventory to FO Supplies. The terms are still the same, at 2/10, n/30.

This is the first entry that an accountant would record to identify a sale on account. Afterward, if the receivables are paid back within the discount period, we need to record the discount.

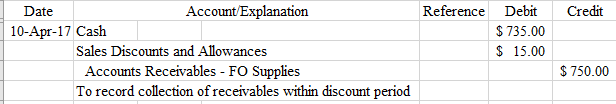

Notice that we have an account called sales discounts and allowances. This account is a contra account that goes against sales revenue on the income statement. Another example of a contra account is allowance for doubtful accounts, which you can learn about in our bad debt expense article.

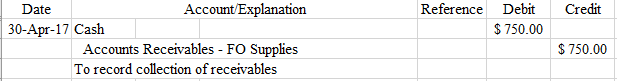

Lastly, if the receivables are paid back after the discount period, we record it as a regular collection of receivables.

Risks of Outstanding Accounts Receivable Balances

There are several risks associated with carrying a large AR balance, including:

- Uncollected debt – High A/R that goes uncollected for a long time is written off as bad debt. This situation occurs when customers who purchase on credit go bankrupt or otherwise do not pay the invoice.

- Cash flow deficiencies – A business needs cash flow for its operations. Selling on credit may boost revenue and income, but it offers no actual cash inflow. In the short term, it is acceptable, but in the long term, it can cause the company to run short on cash and have to take on other liabilities to fund operations.

- Credit risk management – Poor credit policies can lead to accumulating AR from unreliable clients. Without robust credit controls, companies may unknowingly expose themselves to credit risk, ultimately leading to bad debt write-offs, strained cash flow, or even insolvency in extreme cases.

Companies often create an Allowance for Doubtful Accounts to estimate potential losses and manage this risk on their financial statements. Importantly, according to FASB guidelines, companies must report accounts receivable net of any allowances for doubtful accounts.

AR’s Impact on Cash Flow and Financial Modeling

When a company has an accounts receivable balance, it means that a portion of revenue has not been received as a cash payment yet. If payment takes a long time, it can have a meaningful impact on cash flow. For this reason, in financial modeling and valuation, it’s very important to adjust free cash flow for changes in working capital, which includes AR, accounts payable, and inventory.

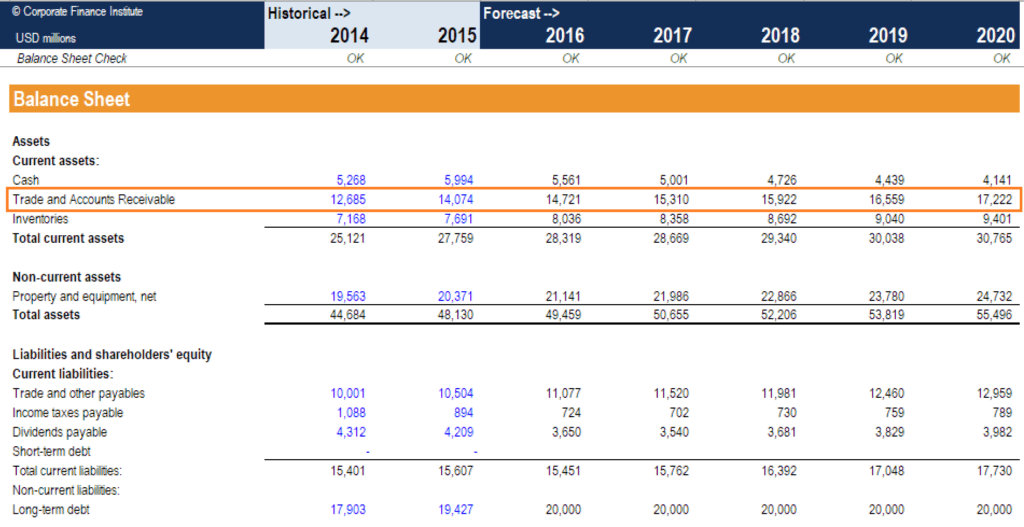

In the example below, you can see how AR is portrayed on the balance sheet in one of CFI’s financial models.

Source: CFI Financial Modeling Course

What are the Differences Between Accounts Receivable and Accounts Payable?

While Accounts Receivable (AR) and Accounts Payable (AP) are both critical components of a company’s working capital, they represent opposite sides of business transactions and are recorded on different parts of the balance sheet.

Accounts Receivable vs. Accounts Payable: Key Differences at a Glance

| Definition | Money a company is owed by customers | Money a company owes to suppliers |

| Balance Sheet Location | Current assets | Current liabilities |

| Impact on Cash Flow | Generates cash inflow | Delays cash outflow |

| Recorded When | Goods/services are delivered, but not paid for | Goods/services are received, but not paid |

| Business Role | Represents credit extended by the company | Represents credit extended to the company |

| Typical Documents | Customer invoices, sales orders | Vendor invoices, purchase orders |

Why This Distinction Matters

Understanding the difference between AR and AP is essential for maintaining accurate financial records and ensuring healthy cash flow. Businesses need to track both to:

-

Ensure timely collections (AR) to fund operations

-

Manage outgoing payments (AP) to avoid late fees or strained vendor relationships

-

Assess liquidity and calculate key ratios like the current ratio or cash conversion cycle

Neglecting either side can lead to cash shortages, credit issues, or inaccurate financial reporting.

Summary

Accounts Receivable (AR) refers to the outstanding payments a business is owed by customers for goods or services delivered on credit. AR is recorded as a current asset on the balance sheet and plays a key role in managing cash flow.

Understanding Accounts Receivable in relation to Accounts Payable, which represents money a business owes, is essential for financial health, liquidity analysis, and operational planning in any organization.

Additional Resources

Thank you for reading this guide to Accounts Receivable (AR) and how it impacts a company’s cash flow. CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)® certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and advancing your career as a financial analyst, check out the following additional CFI resources: