Corporate Banking

A division within financial services firms that is a hybrid between Commercial and Investment Banking

What is Corporate Banking?

Corporate banking is a very important division within many large commercial and bulge bracket banks; this team serves as a critical link between the commercial banking group and the capital markets/investment banking teams.

Corporate banking teams provide financial services like cash management, payment processing, credit products, and hedging strategies to large corporations. Most of these corporations are publicly traded.

The term “corporate banking” is often used erroneously by non-finance people when talking about the provisioning of banking services to corporations (broadly); however, there is much more nuance when it comes to banking for businesses.

Key Highlights

- “Corporate banking” is not the same as providing banking services to just any corporation; it refers to products and services offered to very large, typically publicly traded companies.

- Corporate bankers tend to have extensive lending and capital markets or investment banking experience.

- One of the most common financial services provided to corporate banking clients is syndicated lending.

- An important rationale behind extending credit to corporate banking clients is to develop strong relationships in order to secure future investment banking opportunities.

The Business Banking Spectrum

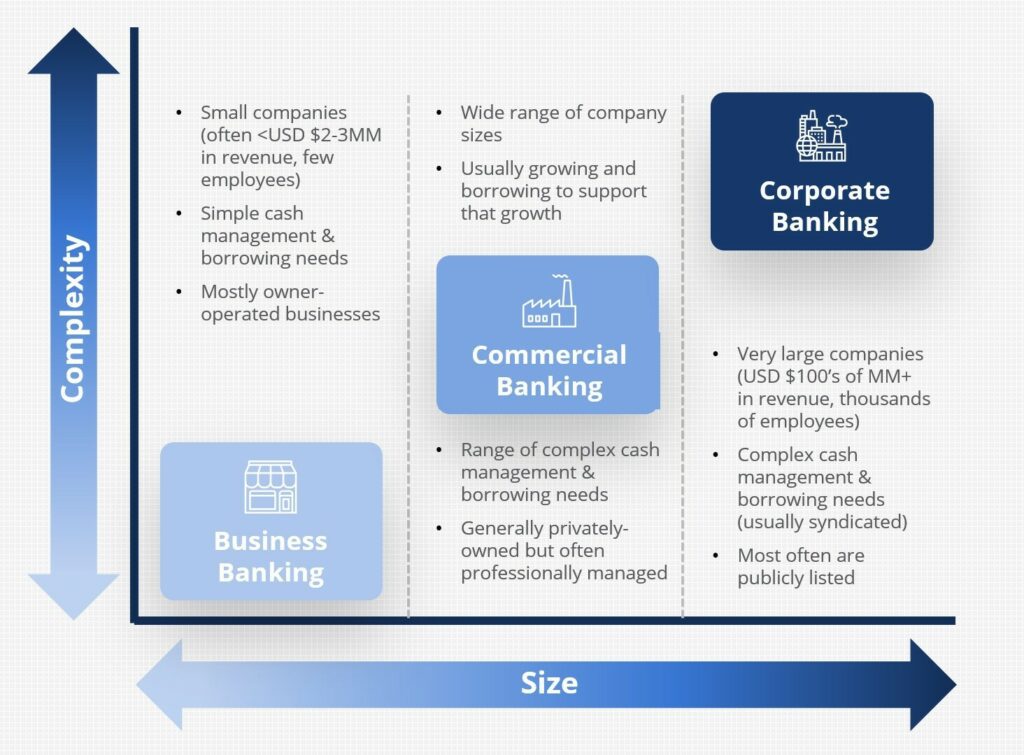

As illustrated in the graphic above, there are generally three groups at a bank that provide financial services to business clients (as opposed to individual, “retail” clients). These are the business banking team (often called small business), commercial banking, and the corporate banking team.

The easiest way to plot a prospective client on this chart is by its size and its level of complexity. “Small businesses” are typically characterized by much lower revenues and very simple operations, whereas corporate banking prospects are generally extremely large and very complex businesses (which require complex banking and credit solutions).

In order to deliver complex banking products and credit solutions, a corporate banker must have extensive industry knowledge as well as experience with their firm’s systems and processes.

One of the most common complex credit solutions provided for corporate banking clients is syndicated lending.

What is Syndicated Lending?

Corporate bankers from different financial institutions join together to offer credit and share in the risk of financing a corporate borrower using a multilateral credit arrangement called a syndicated loan.

Corporate banking clients often borrow dollar amounts that are extraordinarily high, given that these are typically large, publicly traded companies. Some of this credit is issued through the corporate bond market, but some is debt (like revolvers, CAPEX loans, and commercial real estate lending) extended directly by financial institutions or other private lenders (e.g. private equity, pension plans, etc).

For example, an institution’s business or commercial banking division may limit credit to a single name or group of a specific risk to $10MM via a bilateral lending agreement. Beyond that, the same bank’s corporate banking division may get involved in structuring multilateral lending via a syndicate once its corporate hold limit is exceeded.

Concentration risk from any single name or group on the balance sheet of the lending institution guides the hold limit amount and influences a firm’s participation in a syndicate.

Corporate Banking vs. Business & Commercial Banking

As noted earlier, the principal difference between business/commercial banking and corporate banking is the size and complexity of the borrowing client’s operations, as well as the nature of the financial services and products it requires. Other key differences include:

- Portfolio size – A business banker may have several hundred small business clients in their portfolio, whereas a corporate banker is likely to have no more than 8-10 very large, very complex clients.

- Lending structures – Commercial bankers (and small business bankers in particular) have a suite of loan products at their disposal that are much more homogeneous in nature, so underwriting the exposure is easier and less customized than for corporate bankers. This means that individuals with much less financial services experience or capital markets exposure can still effectively structure credit within the firm’s strict policies and guidelines.

- Proportion of secured credit – Small business and commercial bankers generally extend loans that are both senior (first ranking) as well as directly secured (by specific collateral); most small business and commercial lenders will also take alternative recourse, sometimes called indirect security, like a personal guarantee from the business owner(s). As borrowers become larger and more complex, the proportion of unsecured credit tends to increase significantly. For corporate borrowers, security tends to rely upon floating charges and the cash generation ability of the corporation. Priorities and waterfall are specified in the agreement between the corporation and firms in the syndication.

External recourse (guarantees) for public companies that are widely held or for large private companies tend to be from other related corporations rather than individuals. The construct of this collateral is part of “ring-fencing” that determines the overall value of the borrowing entity.

- Lending vs advisory relationships – The core business model of a commercial bank is to lend money and generate net interest income on performing loan assets. For corporate bankers, lending serves as a gateway to becoming lead arrangers on syndicated deals and for the purpose of securing (or retaining) higher margin investment banking business as the relationship and corporation grow. Fees related to advisory services such as underwriting public debt and equity offerings, prospective M&A transactions, etc., are sizable and often exceed the value of the corporate banking relationship.

- Many professionals in corporate banking begin their careers in credit-focused roles or transition into a commercial lending career supporting middle-market clients.

Additional Resources

CFI offers the CBCA™ certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following resources will be helpful:

Fundamentals of Credit

Learn what credit is, compare important loan characteristics, and cover the qualitative and quantitative techniques used in the analysis and underwriting process.