Loan Structure

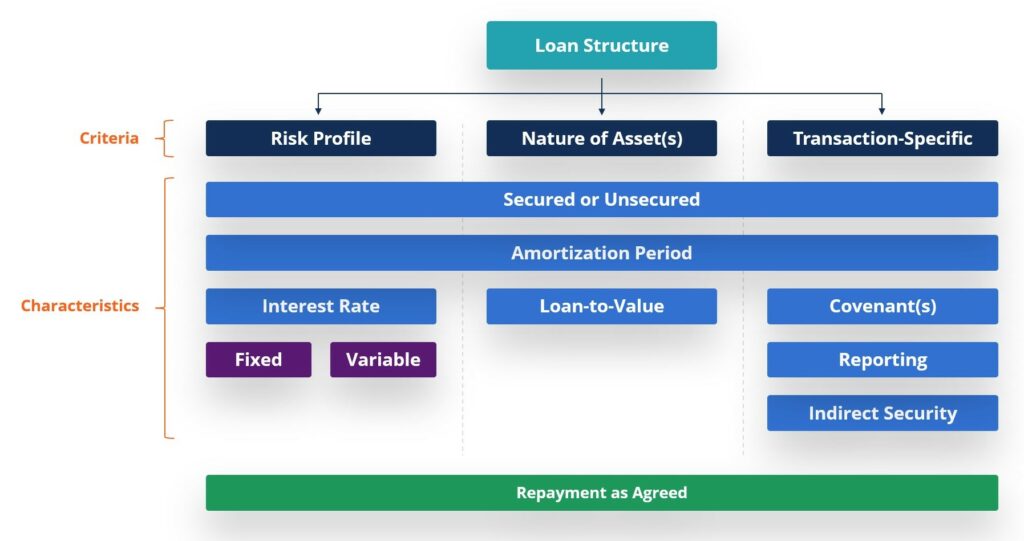

How loans are customized based on the risk of the borrower and the nature of the credit request

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is Loan Structure?

Loan structure refers to the different characteristics that a lender can choose from when extending credit to a borrower. Loan structure is also often referred to as credit structure.

Lenders always want to offer their borrower credit that is appropriate based upon the nature of the credit request as well as the perceived risk of the borrower.

As a result, every loan has a variety of characteristics that make it unique from other loans. Examples include, but are not limited to:

- Will the loan payments be interest-only, or will the principal outstanding reduce by way of regular, periodic, or recurring payments?

- Over how many months (or years) will the loan be repaid?

- What is the interest rate of the loan?

- Will the loan have any specific physical assets that can serve as collateral security, or will the loan be “unsecured”?

- What types of reporting (or other behaviors) will be required of the borrower in order to maintain good standing with the financial institution that extended credit?

Key Highlights

- Loan structure may be influenced by a variety of factors, including the nature of the borrowing request and the client’s risk profile.

- Elements of loan structure include loan-to-value (LTV), interest rate, amortization period, and collateral security requirements.

- Financial services firms generally have credit policies that support their relationship teams in structuring loans for prospective borrowers.

Understanding Loan Structure

Anyone that’s ever borrowed from a bank knows that credit always comes with some guidelines and parameters.

For example, if a borrower wanted to purchase a home, it would be strange for the lender to offer a 5-year amortization. It would also be strange if they offered a 50-year amortization.

A loan to purchase a home is what’s called a mortgage loan; market terms on a mortgage loan are much more like 25 or 30 years (not 5 or 50). Conversely, car loans are generally not 25 or 30 years, they’re much more like 5 or 8 years.

Why is this? Because of loan structure!

Criteria that Influence Loan Structure

Loan structure is informed, at least in part, by any underlying assets that are being financed – as in our mortgage loan example above. But there are other factors and criteria, too. These include:

The borrower’s level of default risk

Lenders have complex risk rating models that help them understand the borrower’s likelihood of triggering an event of default. The higher the likelihood of default, the greater the credit risk.

Higher risk scores generally translate to higher interest rates and loan pricing, which compensate the lender for taking on this greater level of risk. Higher risk scores also tend to translate to more restrictive loan structures (such as shorter amortization periods, higher levels of collateral security, or more frequent and more robust financial reporting).

The desirability of any underlying collateral

Credit is generally extended to support the financing (or the refinancing) of an asset. The quality of that asset as collateral will also help to inform loan structure, including loan-to-value (LTV).

As a general rule, the more “desirable” an asset, the more flexible the loan structure is likely to be. Higher quality collateral is generally characterized by how active the secondary market is, how ascertainable its price is, and how stable the asset’s value is likely to remain.

For example, real estate is generally considered more desirable as collateral than intellectual property. As a result, it will tend to have higher LTVs, lower interest rates, and longer amortizations.

Aligning cash inflows and outflows

This is particularly true of corporate borrowers – think about a piece of manufacturing equipment. If equipment is being purchased and it’s intended to produce cash flow for 10 years, it’s not unreasonable to consider a 10-year repayment period.

The upper limit on amortization may be governed by the condition of the asset, but, intuitively, it would be odd to force a company to pay in full upfront for an asset that will generate cash flow for many years into the future.

Mitigating transaction or asset-specific risks

This, too, is mostly true of corporate borrowers. Consider a management team that strips a lot of cash out of the company by way of dividends. A lender may wish to put a covenant in place that would restrict dividends to ensure that a sufficient cash buffer is retained in the corporation to support liquidity (and timely loan payments).

Another example is if a borrower was taking on operating credit to finance inventory. A prudent lender may structure the credit such that the borrower must provide periodic inventory listings so that the lender can keep a pulse on the quality and the quantity of inventory on the company’s balance sheet.

Loan Structure Characteristics

While this is not an exhaustive list, important considerations around loan structure include the following:

- The loan amount, which is generally a function of the loan-to-value (LTV).

- The interest rate, as well as whether it should be a fixed rate or a variable (floating) rate.

- Is it operating (revolving) credit, or will the loan be structured as term financing?

- Will the loan be reducing (amortizing), or will it be interest-only? If reducing, will the payments be periodic, or will it be structured as a “bullet” repayment?

- Is the loan secured or unsecured?

- Will security charges be first ranking (senior), or will the loan be “subordinated” (i.e., first vs. second mortgage) behind another loan or lender?

- How frequently will the borrower be expected to provide financial reporting to the lender, and what quality should that reporting be (i.e., review engagement, audit engagement, etc.)?

- Will there be any specific financial or non-financial loan covenants that the borrower must comply with?

- Will there be any type of secondary (indirect) security taken (ie. government guarantee programs, personal guarantees by owners, etc.)?

Loan Structure – Bottom Line

World-class credit professionals understand how important it is to structure credit effectively, within the context of both managing risk and the competitive landscape in which they operate.

Many financial institutions and non-bank, private lenders have credit policies in place to help provide guardrails for their relationship management teams to work within when negotiating loan terms with prospective borrowers.

Loan structure is a way to both mitigate risk and also to differentiate oneself in the market – assuming that a lender is willing to be creative in how they structure credit for their borrowers.

Additional Resources

Thank you for reading CFI’s guide to Loan Structure. To keep learning and developing your knowledge base, please explore the additional relevant resources below:

Fundamentals of Credit

Learn what credit is, compare important loan characteristics, and cover the qualitative and quantitative techniques used in the analysis and underwriting process.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in