Overview

Syndicated Lending Course Overview

This Syndicated Lending course unpacks the core concepts behind syndicated lending. We will look at what syndicated lending is and why it is important for both clients and banks. By taking this course, you will examine and participate in the syndicated lending process from start to finish. This Syndicated Lending course will lead you through a case as you explore and apply the concepts of syndicated lending to a real example. This course prepares you for real lending situations as a credit analyst.

Syndicated Lending Learning Objectives

Upon completing this course, you will be able to:- Understand what syndicated lending is and why it is important to borrowers

- Understand the importance and attractiveness of syndicated lending to banks

- Appreciate how credit risk can be transferred through syndicated lending

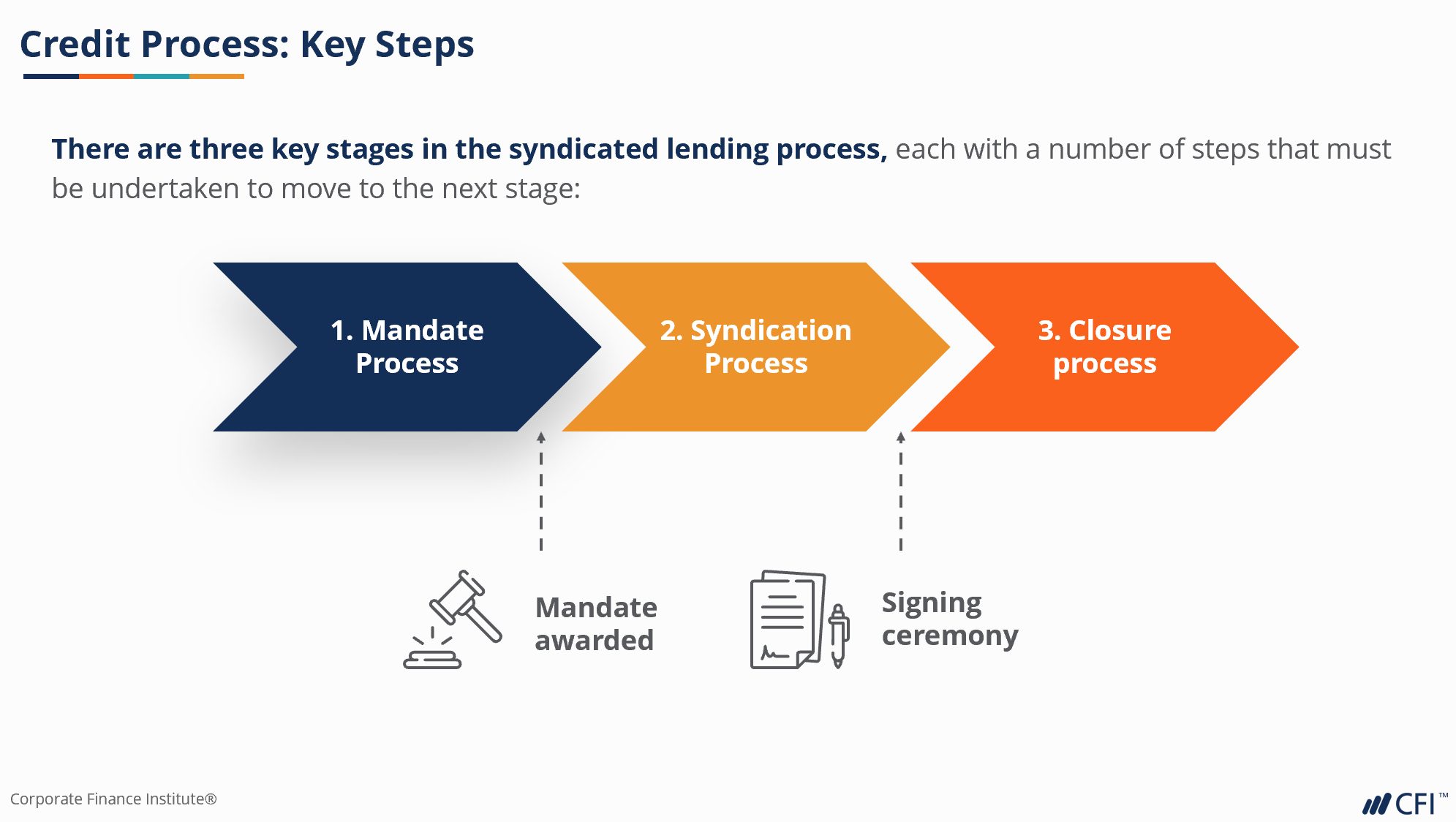

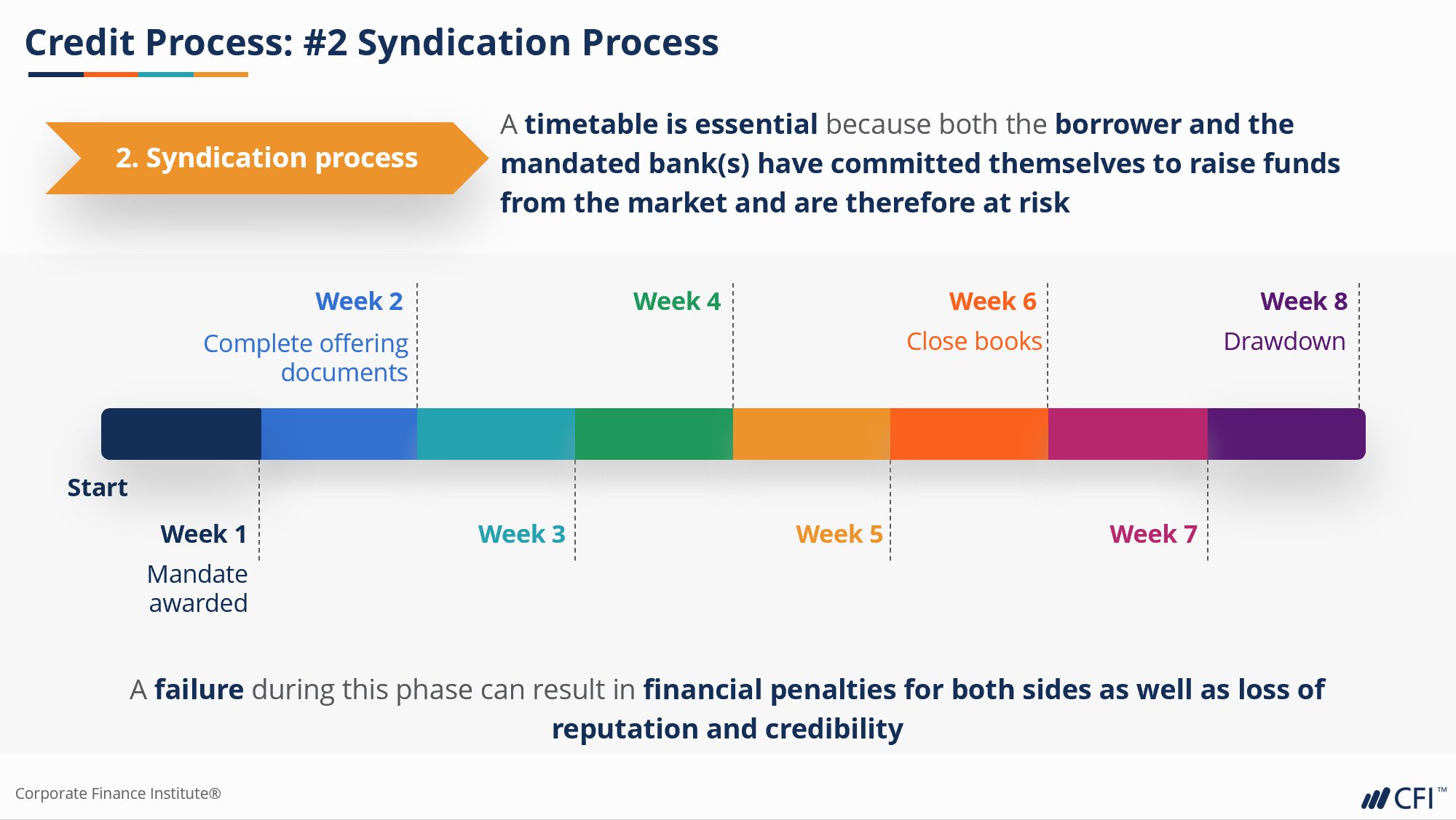

- Map the syndicated lending process from initiation through execution

- Explore how fees are structured and charged

Who Should Take This Course?

This Syndicated Lending course is created for credit analysts that aspire to work at a major financial institution. This course explores concepts that are used every day in lending institutions and provides realistic scenarios that you will encounter as a credit analyst. By covering the entire syndicated lending process, you will gain perspective on what it is like to work on some of the largest deals in the financial world. The exercises and tools explored in this course will be useful for any financial analyst that wishes to work in credit analysis, business banking, commercial banking, corporate banking, and other areas of lending and credit evaluation.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

Syndicated Lending

Level 3

1h 16min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

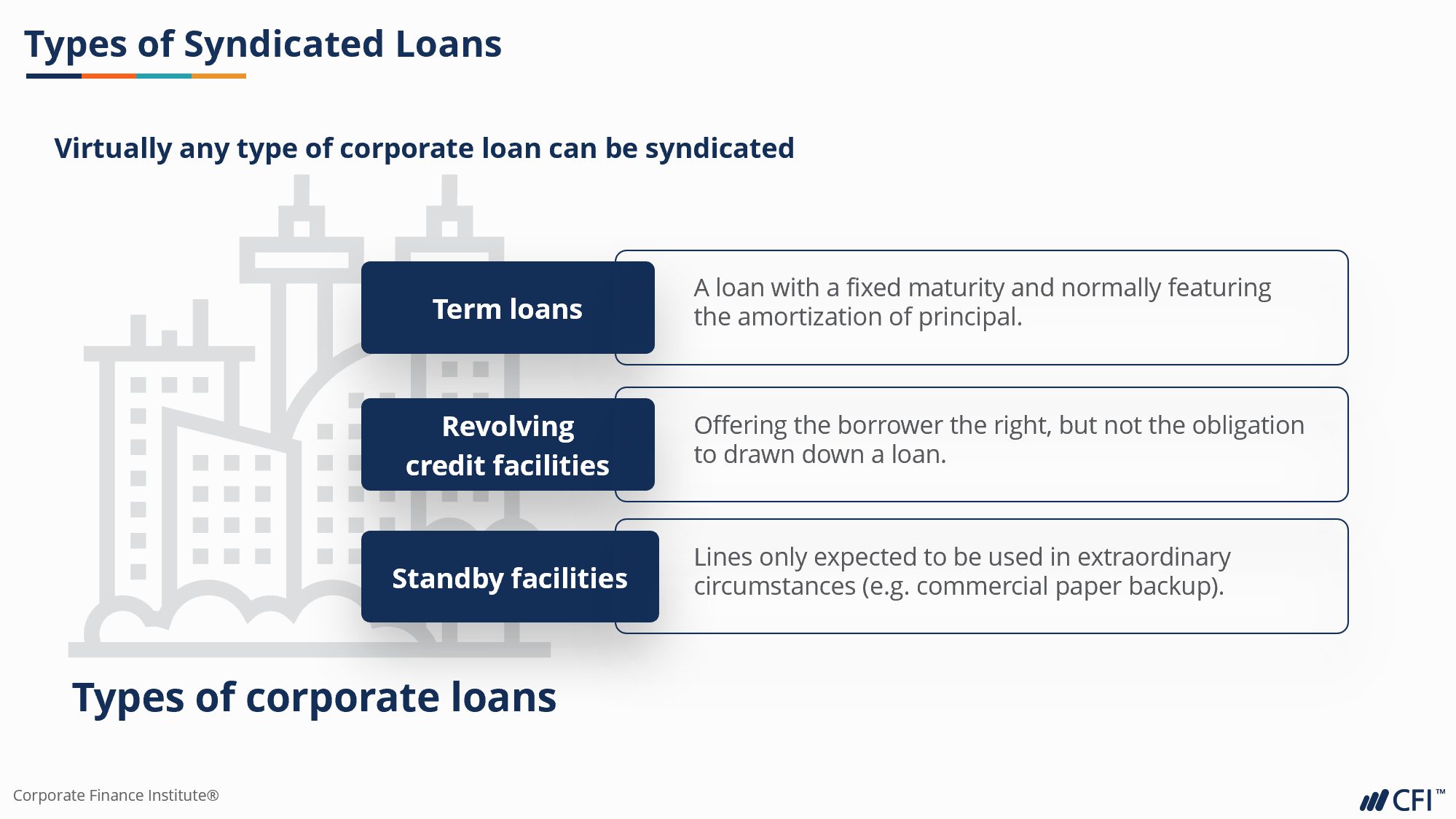

Syndicated Lending

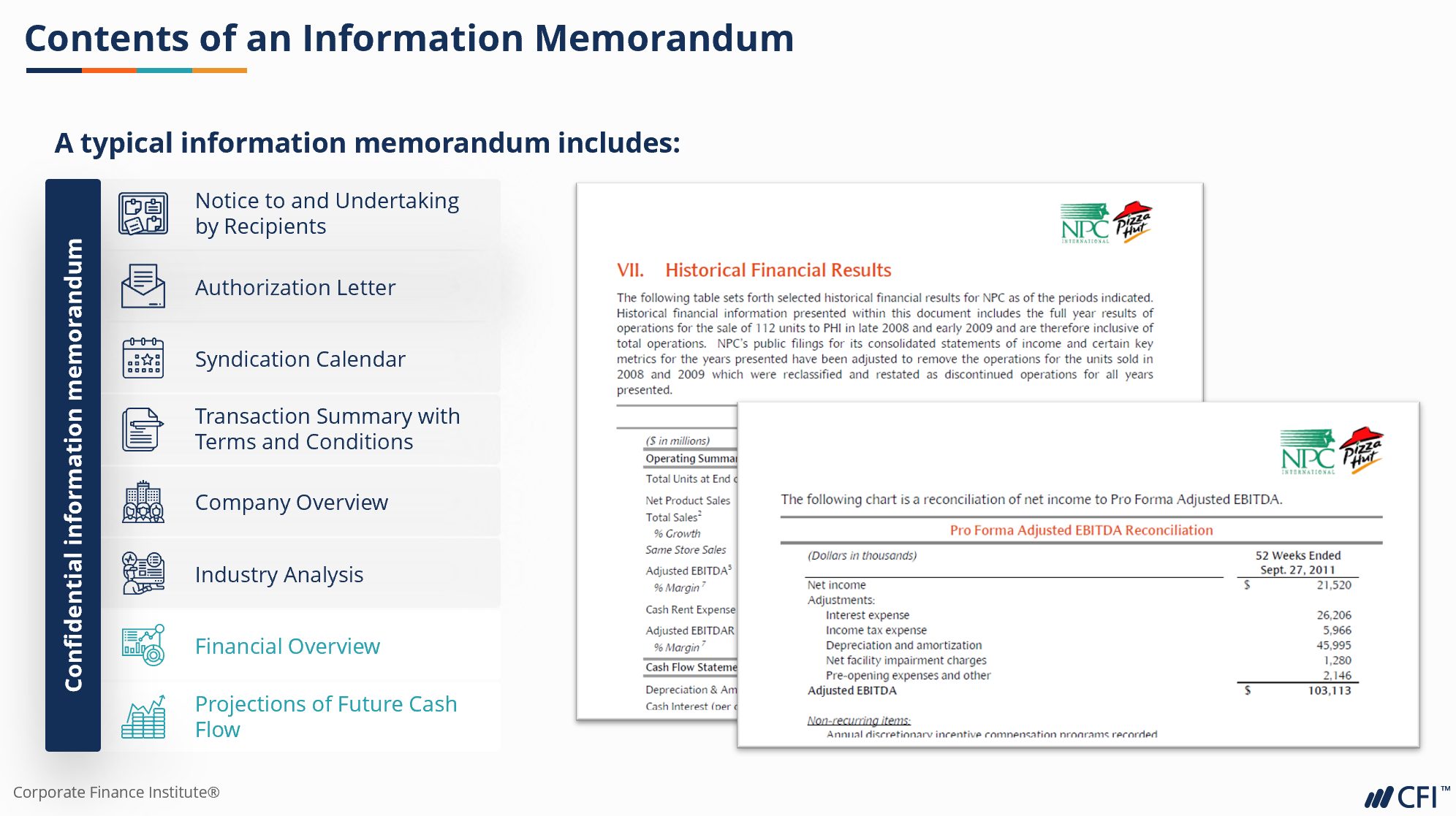

Syndicated Lending Credit Process

Syndicated Lending Fee Structure

Course Summary and Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side