Mortgage

A type of loan that is secured by a specific, underlying real estate asset

What is a Mortgage?

A mortgage is a type of loan secured by real property. Most people think of a mortgage as being drawn to purchase a property, but mortgage loans are also used to refinance properties that are already owned by the borrower.

A mortgage drawn to support the acquisition or the refinancing of a home is typically called a residential mortgage. A mortgage drawn to support the acquisition or the refinancing of a commercially zoned property (like a warehouse, mall, or office facility) is usually called a commercial mortgage.

A mortgage lender (creditor) is compensated for extending the credit by charging the borrower (debtor) interest.

Key Highlights

- A mortgage is a type of loan secured by real property.

- There are both residential and commercial mortgages, with risk characteristics that are unique to each.

- Mortgages tend to have more favorable terms (longer amortization, higher LTV, and lower interest rates) than other types of borrowing.

- Mortgage loans are made by traditional banks, as well as other financial services firms like insurance companies, asset managers, and other investment funds.

How Does a Mortgage Work?

Let’s use a residential mortgage example for a personal borrower who approaches their bank to purchase a home. Say the home costs $200,000, and they’re required to put in a 5% down payment. This means:

- $10,000 down payment [200,000 * 0.05].

- $190,000 mortgage [200,000 * 0.95]. This represents a 95% loan-to-value (LTV).

- The bank will register a lien (sometimes called a “security charge”) over the property for the full amount of credit outstanding – in this case, $190,000. This security registration makes the property collateral for the mortgage loan.

But the buyer never actually receives cash from their bank; as noted in the diagram below, they send the down payment to the financial institution, which, in turn, facilitates the home purchase.

They do so by advancing funds on the borrower’s behalf and working with the various legal representatives to ensure that: [A] title of the property is correctly transferred from the vendor to the buyer, [B] the lien is correctly registered on behalf of the buyer’s bank, and [C] the seller receives their funds, by way of their own financial institution.

Over the course of the mortgage’s amortization period, the borrower will then pay the $190,000 back (plus interest).

Mortgages – Residential vs. Commercial

Both residential and commercial mortgages share some common characteristics, including that lenders take property as collateral, they generally require an appraisal, and both typically have a more favorable loan structure than other types of credit.

But there are also some important differences that make them unique.

Residential Mortgages

Some key characteristics include:

- The property is often occupied by the borrower, meaning it’s their primary residence.

- The borrower is typically an individual (or a married couple).

- The borrower(s) is usually servicing the mortgage with their personal earnings and must therefore be able to prove they have a stable income, provide evidence of any other valuable outside assets, and demonstrate a good credit history.

- Residential properties tend to have very active secondary markets and, therefore, generally support higher LTVs (loan-to-values) – often up to 95%.

Commercial Mortgages

Some key characteristics include:

- The borrower is generally a company, such as a corporation or a partnership (although individuals can still own commercial properties).

- The borrower isn’t servicing the mortgage with personal earnings; cash to service the mortgage obligation comes from either business operations (if they run a company on site) or rental income (if it’s an investment property).

- Understanding the cash flows for a business operation requires a much more extensive analysis of the underlying business, including its financial health, management capabilities, and competitive advantage(s).

- Understanding default risk for a rental property is even more difficult, as the lender will not have access to the tenant’s financial information – commercial mortgage deals for investment properties are analyzed based on the geographic location, the quality of the property, and the strength of the lease agreement (among others).

- Commercial properties tend to have many restrictions on uses and, therefore, fewer prospective occupants. This generally means much lower LTVs (loan-to-values) – more like 50%-75%.

Mortgage Payments

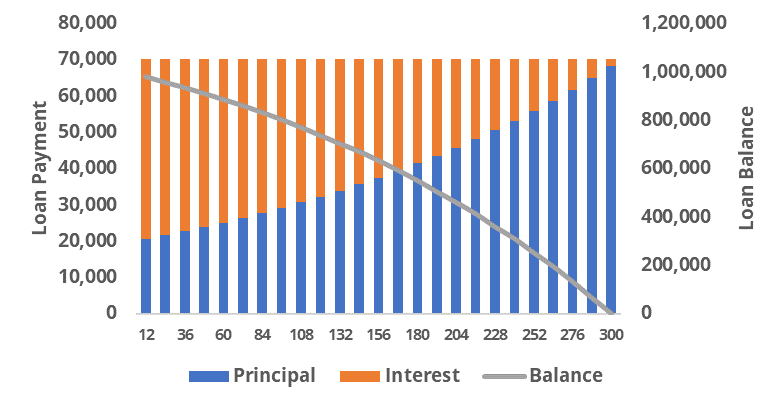

A mortgage payment is made up of two components – interest and principal.

Interest rates vary by jurisdiction and other market conditions; the risk of the borrower and the borrowing request also influence interest rates. Interest rates are generally either fixed or variable (often called floating).

The principal portion of the payment amount goes toward paying down the original mortgage amount outstanding. The original amount outstanding is usually scheduled to be repaid to zero on the last payment of the amortization period – which may be 25-30 years.

Because the amortization periods of mortgage loans are so long, it tends to be that a high proportion of the payment amount early in the amortization period is interest, with the inverse being true as time progresses.

The below chart illustrates this using a $1,000,000 loan on a 300-month (25-year) amortization, with a 5% interest rate:

Who Provides Mortgage Loans?

Mortgage loans are often made by banks and other traditional financial institutions (like credit unions), but not always.

Life insurance companies, pension funds, and other large asset management firms also have mortgage lending arms. In fact, mortgage loans (from the lender’s perspective) tend to represent very stable and consistent sources of future cash flows by way of the borrower’s monthly payments.

Mortgages are also issued by other private investors (both individual and institutional); these parties pool funds into various forms of mortgage trusts to create private lending entities. These funds are often deployed to homebuyers and real estate investors by way of mortgage brokerage companies.

A mortgage broker is not themselves a direct lender. A borrower will generally enlist the services of a mortgage broker to help them “shop around” to all the previously noted mortgage lenders in order to secure the best rate and terms for their borrower. The broker is typically paid by the lender that closes the deal.

Related Resources

CFI offers the CBCA™ certification program for those looking to take their careers in credit and lending to the next level. To keep learning and advancing your career, the following resources will be helpful:

Fundamentals of Credit

Learn what credit is, compare important loan characteristics, and cover the qualitative and quantitative techniques used in the analysis and underwriting process.