Overview

Commercial Mortgages Course Overview

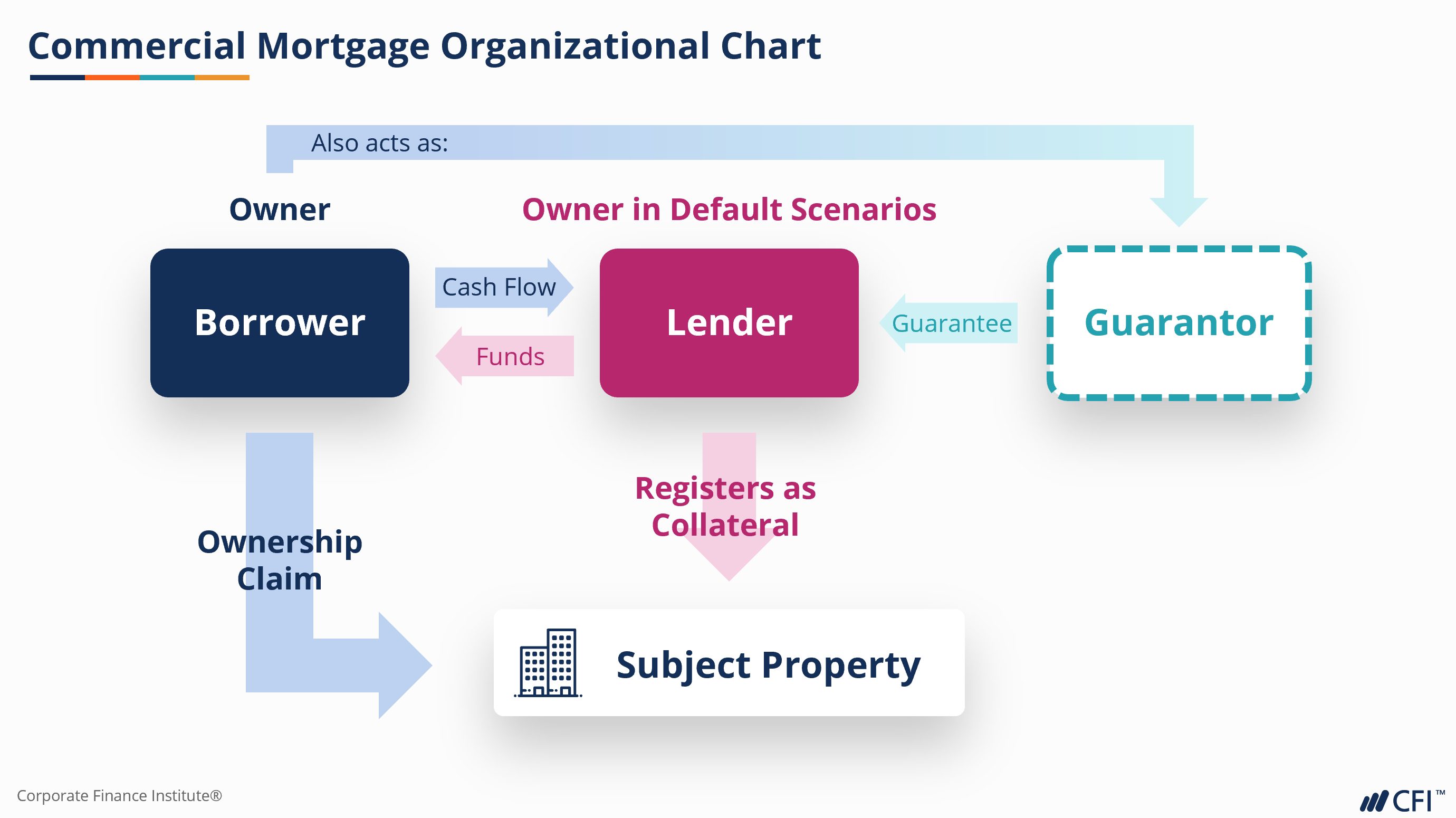

This Commercial Mortgages course explores the elements determining loan details for income-producing investment properties. Commercial mortgages are used to fund real estate investment ventures. They are important for any credit analyst who wishes to understand issues relevant to real estate financing or would like to specialize in the real estate sector. In this course, we examine key metrics of the real estate lending process and dive into the key underwriting parameters for commercial mortgages. We also work through a realistic client example to understand the inner workings of a commercial mortgage deal. In this case study, we examine a rent roll analysis, risk rating, and the pricing of the loan.

Commercial Mortgages Learning Objectives

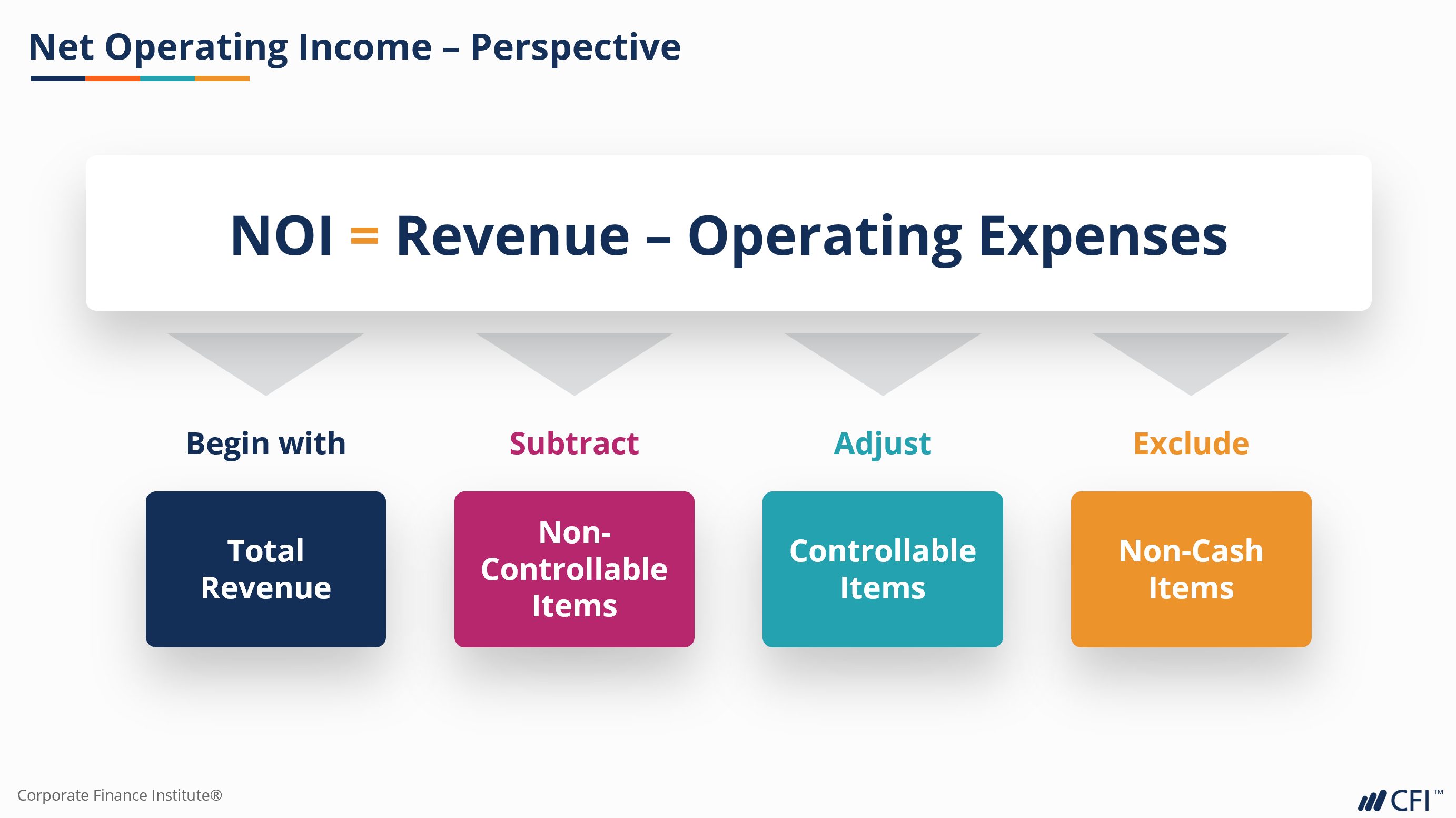

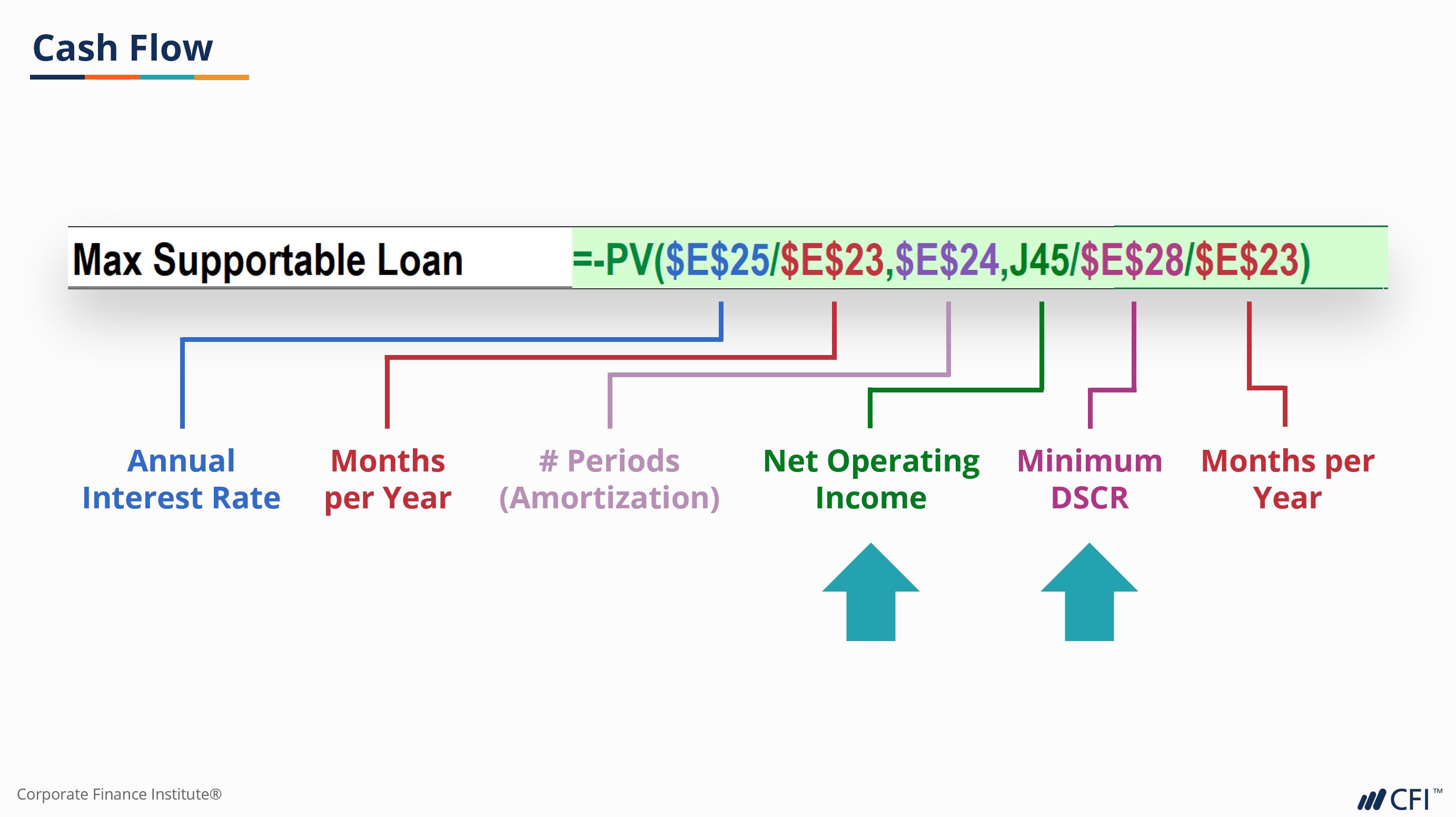

Upon completing this course, you will be able to:- Examine key property valuation metrics like net operating income (NOI) and capitalization rates, and understand how they relate to the credit analysis process

- Review key property parameters and how they inform the underwriting process

- Work through an example property to see the end-to-end underwriting process

- Understand how key variables drive loan amount, risk rating, credit terms, and mortgage pricing

Who should take this course?

This Commercial Mortgages course is designed for current and aspiring commercial banking professionals in the real estate industry. This course is also a great resource for real estate analysts and commercial mortgage brokers who wish to better understand the real estate underwriting process. This course provides a valuable perspective on a real estate lender’s considerations when structuring a commercial mortgage deal which is vital for lenders, brokers, and advisors.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Critical thinking

Commercial Mortgages

Level 4

2h 4min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Key Underwriting Parameters

Pricing & Profitability

Example Client Case Study

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side

Commercial Real Estate Finance Specialization

- Skills Learned Real Estate Lending, Real Estate Financial Modeling, Construction Finance, Environmental Analysis and Due Diligence, Lease and Rent Roll Analysis

- Career Prep Credit Analysts, Risk Manager & Credit Adjudicator, Private Real Estate Lenders, Real Estate Investors and Advisors, Commercial Mortgage Brokers, Commercial Relationship Managers