EV/EBITDA

Enterprise Value over Earnings Before Interest Taxes Depreciation & Amortization

What is EV/EBITDA?

EV/EBITDA is a ratio that compares a company’s Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA). The EV/EBITDA ratio is commonly used as a valuation metric to compare the relative value of different businesses.

In this guide, we will break down the EV/EBTIDA multiple into its various components and walk you through how to calculate it step by step. Learn more in CFI’s Business Valuation Techniques course.

What is the EV/EBITDA Multiple Used For?

The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. This ratio tells investors how many times EBITDA they have to pay, were they to acquire the entire business.

The most common uses of EV/EBITDA are:

- To determine what multiple a company is currently trading at (I.e 8x)

- To compare the valuation of multiple companies (i.e. 6x, 7.5x, 8, and 5.5x across a group)

- To calculate the terminal value in a Discounted Cash Flow DCF model

- In negotiations for the acquisition of a private business (i.e. the acquirer offers 4x EBITDA)

- In calculating a target price for a company in an equity research report

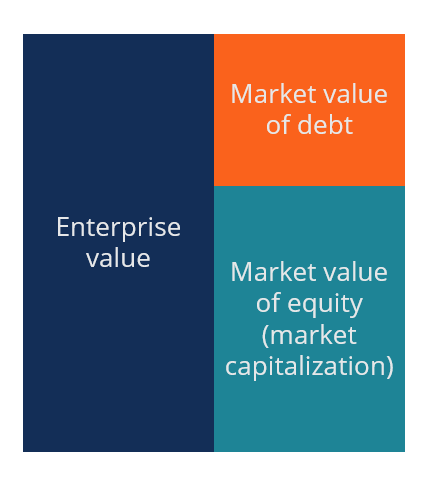

What is EV?

EV stands for Enterprise Value and is the numerator in the EV/EBITDA ratio. A firm’s EV is equal to its equity value (or market capitalization) plus its debt (or financial commitments) less any cash (debt less cash is referred to as net debt).

To learn more, see our guide to Enterprise Value vs Equity Value.

What is EBITDA?

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. It often used in valuation as a proxy for cash flow, although for many industries it is not a useful metric.

To learn more, read our Ultimate Cash Flow Guide.

EV/EBITDA in a Comps Table

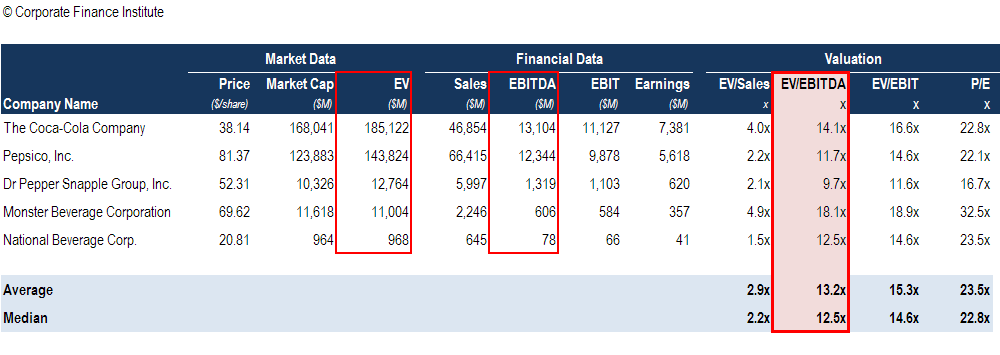

The most common way to see the EV/EBITDA multiple displayed is in a comparable company analysis (referred to as Comps for short).

Below is an example of the EV/EBITDA ratios for each of the 5 companies in the beverage industry. As you will see by the red lines highlighting the relevant information, by taking the EV column and dividing it by the EBITDA column, one arrives at the EV/EBITDA column.

An analyst looking at this table may make several conclusions, depending on other information they have about the company. For example, Monster Beverage has the highest EV/EBITDA multiple which could be because it has the highest growth rate, is considered the lowest risk, has the best management team, and so on.

Pros and Cons of EV/EBITDA

There are many pros and cons to using this ratio. As with most things, whether or not it is considered a “good” metric depends on the specific situation.

Pros include:

- Easy to calculate with publicly available information

- Widely used and referenced in the financial community

- Works well for valuing stable, mature businesses with low capital expenditures

- Good for comparing relative values of different businesses

Cons include:

- May not be a good proxy for cash flow

- Does not take into account capital expenditures

- Hard to adjust for different growth rates

- Hard to justify observed “premiums” and “discounts” (mostly subjective)

To learn more about valuation multiples, check out our business valuation fundamentals course.

How to Learn to Calculate EV/EBITDA

The best way to learn is by doing. If you want to calculate Enterprise Value to EBITDA ratios for a group of companies, follow these steps and try on your own.

10 steps to calculate EV/EBITDA and value a company:

- Pick an industry (i.e. the beverage industry, as in our example)

- Find 5-10 companies that you believe are similar enough to compare

- Research each company and narrow your list by eliminating any companies that are too different to be comparable (i.e. too big/small, different product mix, different geographic focus, etc.)

- Gather 3 years of historical financial information for each company (i.e. revenue, gross profit, EBITDA, and EPS)

- Gather current market data for each company (i.e. share price, number of shares outstanding, and net debt)

- Calculate the current EV for each company (i.e. market capitalization plus net debt)

- Divide EV by EBITDA for each of the historical years of financial data you gathered

- Compare the EV/EBITDA multiples for each of the companies

- Determine why companies have a premium or discounted EV/EBITDA ratio

- Make a conclusion about what EV/EBITDA multiple is appropriate for the company you’re trying to value

EV/EBITDA Calculator

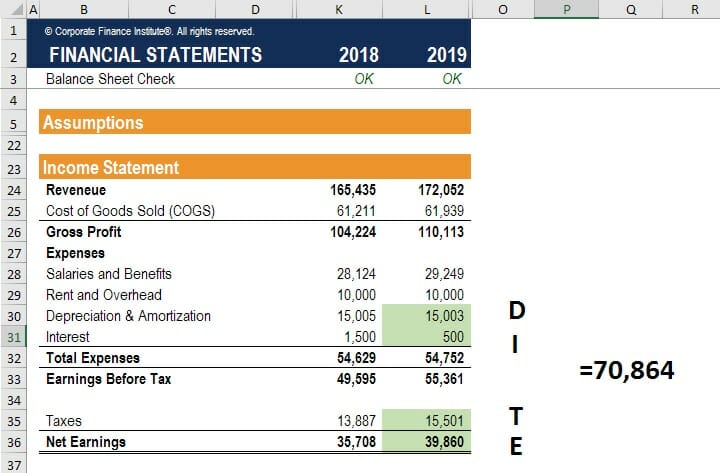

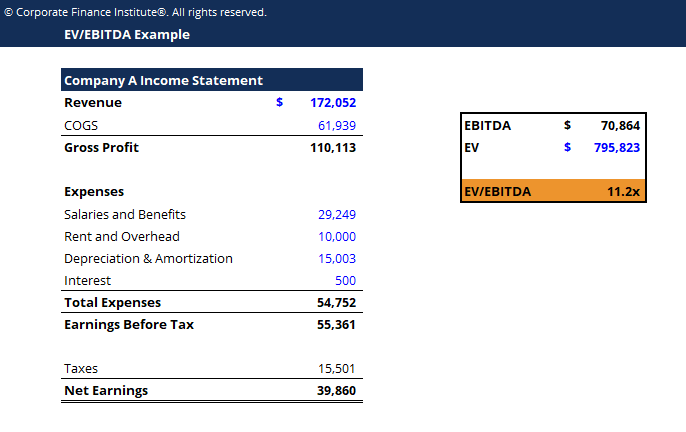

Download CFI’s free EV to EBITDA Excel Template to calculate the ratio and play with some examples on your own.

The above template is designed to give you a simple example of how the math on the ratio works and to calculate some examples yourself!

More Valuation Resources

We hope this has been a useful guide to calculating Enterprise Value to EBITDA and better understanding the various pros and cons of using this valuation multiple. At CFI, we’re on a mission to help you advance your career, and with that in mind, we’ve created these additional resources to help you on your path to becoming a world-class financial analyst.

Relevant resources include: