Investment Banking Pitch Book

A free guide on how to make investment banking pitchbooks.

What is an Investment Banking Pitch Book?

An investment banking pitch book is a PowerPoint presentation designed to win new business. The “pitch” is typically an explanation of why the bank in question is best suited to lead the transaction and why they should be engaged by the client.

There are various types of pitches, and depending on the relationship with the client and the type of traction, they can vary widely.

What’s Included in an Investment Banking Pitch Book?

Here is an example outline for an investment banking pitch book:

- Title page – logos, date, and a title

- Table of Contents – all sections in the pitch book

- Executive Summary / Situation Overview – explain why you’re giving the pitch and the call to action or recommendation on one page

- Team & Bank Introduction – introduce the people at the meeting (short biographies) and discuss the bank’s track record in the client’s space

- Market Overview – charts and graphs, as well as commentary describing the current market environment and trends in the client’s sector

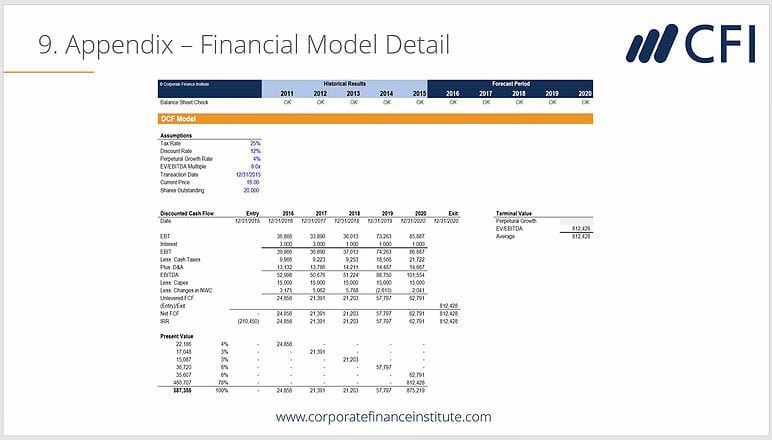

- Valuation – valuation methods include comparable company analysis, precedent transactions, and DCF analysis (if enough information has been provided to perform one), all displayed in a football field graph

- Transaction Strategy – details around the bank’s strategy for the transaction they’re pitching the client to lead – whether an IPO, acquisition, or sale of the business

- Summary – recap why the team and the bank are best suited to lead the transaction, how the market environment is relevant, the valuation you think is achievable, and the band’s strategy if leading the transaction

- Appendix – may contain a wide range of information depending on the pitch, but mostly backup information the bank feels there may be questions on, but doesn’t belong in the main pitch book – like financial modeling assumptions/details)

How is the Pitch Book Actually Made?

The pitch book is a collaboration between junior and senior bankers, with most of the actual work being done by investment banking analysts and associates.

Typically, a managing director (who has a relationship with the client) will sit down with a director or VP to create an outline of the pitch book. Then the VP or director will wireframe the structure of the pitch and have the associate work with the analyst to crunch all the numbers and create all the analysis used to populate the presentation.

The process can take anywhere from a couple of days to a few weeks, depending on the client’s timeline and how busy the team is. The process usually requires a high number of iterations with many drafts or versions of the pitch –often late at night and over the weekend.

How is the Pitch Delivered?

In most cases, the pitch book is delivered in person at the bank’s or corporate client’s office by senior members of the investment banking team. The managing director, who has a relationship with the client, will typically lead the meeting, and other bankers may have smaller roles as well. If junior members of the team – like analysts or associates – attend, they usually don’t say anything and take notes or are prepared to dig up any additional information that’s required.

More Investment Banking Resources

Whether you’re looking to get hired or move up the ladder, we’ve got all the resources you need for a successful career in investment banking.

Helpful resources include: