Residual Income

Learn about the different meanings of residual income

What is Residual Income?

Residual income (RI) can mean different things depending on the context. When looking at corporate finance, residual income is any excess that an investment earns relative to the opportunity cost of capital that was used.

However, in the context of equity valuation, residual income refers to the net income after accounting for all the stockholders’ opportunity cost in generating that income.

Residual Income in Corporate Finance

Calculating the residual income enables companies to allocate resources among investments in a more efficient manner. When there’s a positive RI, it means the company exceeded its minimal rate of return. On the contrary, a negative RI means it failed to meet the projected rate of return.

RI Formula

RI = Controllable Margin – Average of Operating Assets * Required Rate of Return

Where:

- Controllable margin, which is also known as segment margin, refers to the project’s revenue less expenses. Required rate of return is the minimum amount of return that a company is willing to accept from a given investment.

- Average operating assets are the kind of resources required to sustain the company’s operations. They include items like cash, accounts receivable, inventory, and fixed assets, among others.

Residual Income in Equity Valuation

When it comes to equity, residual income is used to approximate the intrinsic value of a company’s shares.

In such a case, the company is assessed based on the sum of its book value, as well as the present value of anticipated residual incomes. The RI helps company owners measure economic profit, which is the net profit after subtracting opportunity costs incurred in all sources of capital.

RI Formula

RI = Net Income – Equity Charge

Simply put, the residual income is the net profit that’s been altered depending on the cost of equity. The equity charge is computed by multiplying the cost of equity and the company’s equity capital.

Residual Income in Personal Finance

In the context of personal finance, residual income is another term for discretionary income. It refers to any excess income that an individual holds after paying all outstanding debts, such as mortgages and car loans.

For example, assume that worker A earns a salary of $4,000 but faces monthly mortgage payments and car loans that add up to $800 and $700, respectively. His RI is $2,500 ($4,000 – ($800 + $700)). Essentially, it is the amount of money that is left over after making the necessary payments.

Residual income is an important metric because it is one of the figures that banks and lenders look at before approving loans. It helps the institutions determine whether an individual is making enough money to cater for his expenses and secure an additional loan. If one demonstrates a high RI, his loan is more likely to be approved than for an individual with a low RI.

Additional Resources

Thank you for reading CFI’s guide to Residual Income. To keep advancing your career, the additional resources below will be useful:

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Analyst Certification FMVA® Program

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

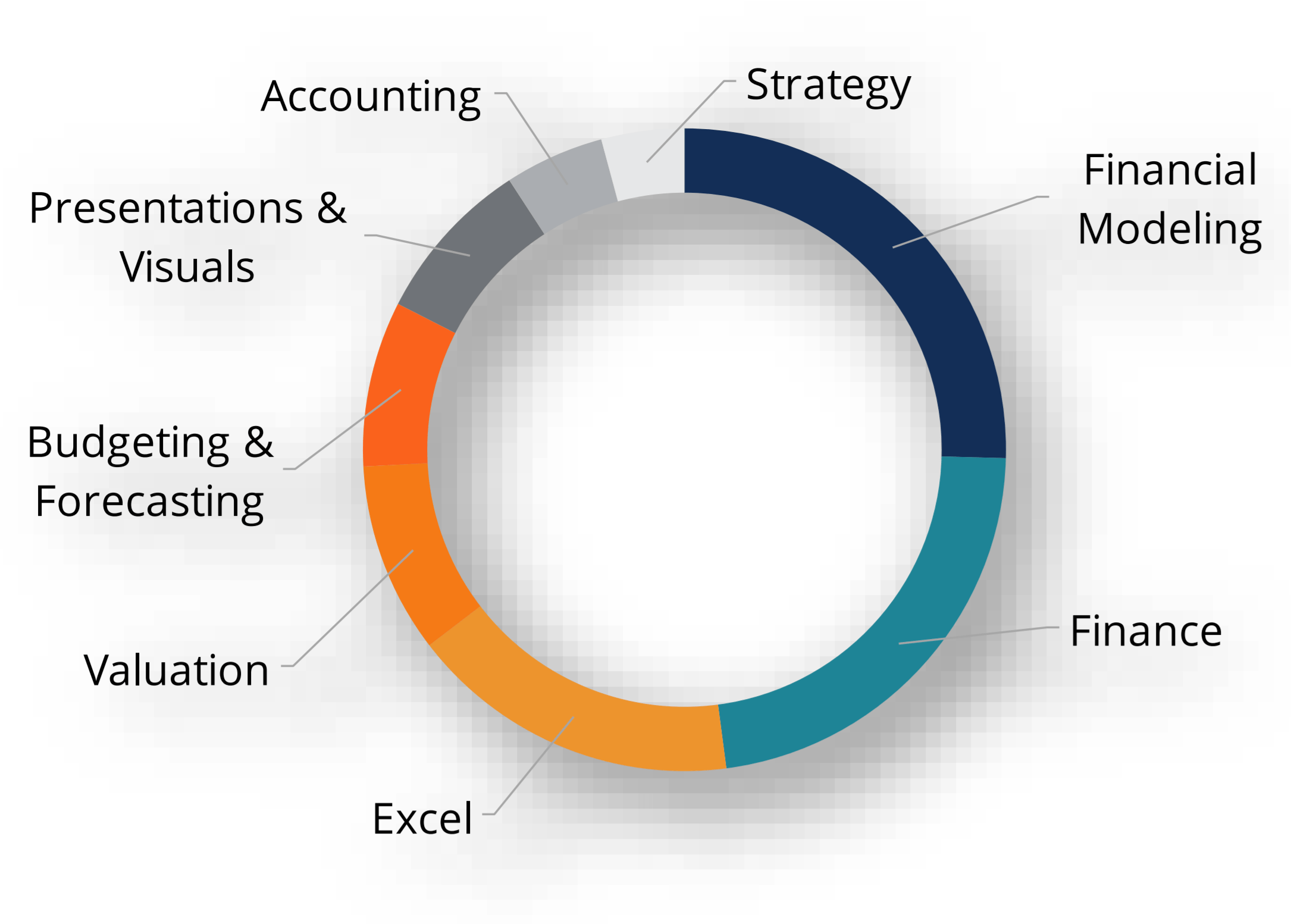

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.