- What Is Finance?

- What Are the Types of Finance?

- Video: What is Finance?

- Examples of Finance Activities

- Finance Topics

- Finance Careers

- Excel Modeling Skills

- Frequently Asked Questions: Finance Definition

- What is finance in simple words?

- What is the best definition of finance?

- What are the three types of finance?

- What does finance mean as a job?

- How can I learn corporate finance?

- Additional Resources

Finance Definition

What Is Finance?

Finance is defined as the management of money and includes activities such as investing, borrowing, lending, budgeting, saving, and forecasting.

The financial system includes the circulation of money, the management of investments, and money lending. In businesses, the finance team is responsible for ensuring the company’s capital is adequate, that appropriate investments are made, and that the company’s revenues and expenses are well-managed.

What Are the Types of Finance?

The three main types of finance are personal finance, corporate finance, and public finance. Personal finance refers to individual money management, while corporate finance includes business capital and investment decisions. Public finance involves government fiscal policy and public spending.

1. Personal Finance

Personal finance is the management of an individual’s or household’s income, expenses, investments, and obligations, such as income tax. Individuals often work with a personal banker, investment advisor, accountant, mortgage broker, and other professionals to manage their financial situation.

Examples of Personal Finance

Bank accounts

- Credit cards

- Mortgages

- Lines of credit

- Employment income

- Personal spending and expenses

- Taxes

- Savings

Investments (stocks, bonds, real estate, etc.)

2. Corporate Finance (Business)

From a business perspective, corporate finance is the management of a company’s funding and its revenue sources, capital structure, and profit and loss (P&L) statement. Financial professionals employed by companies are responsible for managing the companies’ capital and financial performance. These roles include accountants, financial analysts, finance managers, and executives, such as the Chief Financial Officer (CFO).

Examples of Corporate Finance

- Debt

- Equity

- Cost of Capital

- Capital Structure

- Return on Investment (ROI)

- Assets

- Liabilities

- Balance Sheet

- Revenues

- Expenses

- Profit

- Income Statement

- Cash Flow

- Dividends

- Cash Flow Statement

3. Public Finance (Government)

Public finance includes managing a country’s national budget, treasury department, central bank, and other government agencies. It focuses on collecting tax revenue and spending that money on national services and programs such as roads, hospitals, and social security.

Examples of Public Finance

- Income tax

- Sales tax

- Property tax

- Inflation

- Infrastructure spending (roads, hospitals, etc.)

- Social security and insurance

- Supply of money

- International trade

- Employment

- Gross national product (GNP)

- National debt

- National budget

Video: What is Finance?

Watch this short video for a quick breakdown of the definition of finance with examples and common financial topics.

Examples of Finance Activities

The easiest way to define finance is by providing examples of financial activities. Below is a list of the most common examples:

- Investing personal or client money in stocks, bonds, or guaranteed investment certificates (GICs).

- Borrowing money from institutional investors by issuing bonds on behalf of a public company.

- Lending money to people by providing them with a mortgage to buy a house.

- Using Excel spreadsheets to build a budget and financial model for a corporation.

- Saving personal money in a high-interest savings account.

- Developing a forecast for government spending and revenue collection.

Finance Topics

There is a wide range of topics that concern people in the financial industry. Below is a list of some of the most common topics you should expect to encounter in the industry.

- Interest rates and spreads

- Yield (coupon payments, dividends)

- Financial statements (balance sheet, income statement, cash flow statement)

- Cash flow (free cash flow, other types of cash flow)

- Profit (net income)

- Cost of capital (WACC)

- Rates of return (IRR, ROI, ROA)

- Dividends and return of capital

- Shareholders

- Creating value

- Risk and return

- Behavioral finance

Finance Careers

A definition of finance would not be complete without exploring the career options associated with the industry. Below are some of the most popular career paths:

- Commercial banking

- Personal banking (or private banking)

- Investment banking

- Wealth management

- Corporate finance

- Mortgages/lending

- Accounting

- Financial planning

- Treasury

- Audit

- Equity research

- Insurance

Excel Modeling Skills

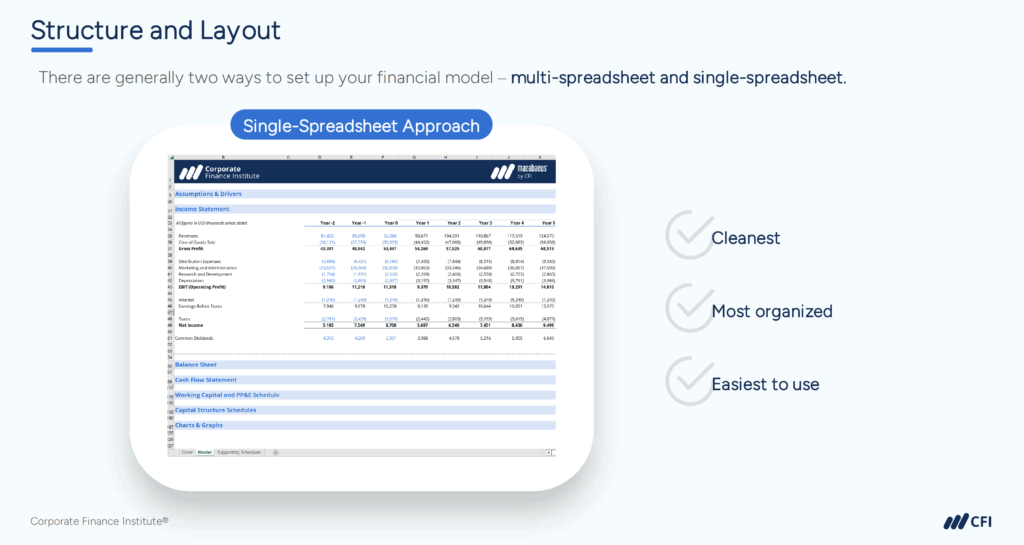

Across the entire industry, one of the most important and highly sought-after skill sets is financial modeling and the ability to create an Excel model that evaluates a particular situation. The screenshot below shows an example from one of CFI’s Excel modeling courses.

Frequently Asked Questions: Finance Definition

What is finance in simple words?

Finance is the management of money. It includes how individuals, businesses, and governments earn, spend, save, invest, and borrow money to achieve their financial goals.

What is the best definition of finance?

Finance is the management of money and includes activities such as investing, borrowing, lending, budgeting, saving, and forecasting. Finance encompasses how people and organizations make decisions about acquiring and using financial resources.

What are the three types of finance?

The three main types of finance are personal finance (managing individuals’ money), corporate finance (managing business capital and investments), and public finance (managing government budgets and fiscal policy). Each type focuses on different financial decisions and stakeholders.

What does finance mean as a job?

Finance jobs involve managing money and financial decisions for individuals, businesses, or governments. Common finance careers include financial analyst, investment banker, accountant, financial planner, wealth manager, and corporate finance professional. These roles focus on analyzing financial data, making investment recommendations, managing budgets, and helping organizations optimize their financial performance.

How can I learn corporate finance?

You can learn corporate finance through formal higher education, but many people build applied finance skills outside of degree programs. Online courses and certification programs are designed to bridge the gap between theory and real-world application. Starting with foundations in accounting, capital structure, and using Excel, these programs will help you gain a strong knowledge base to build upon.

CFI’s Financial Modeling & Valuation Analyst (FMVA®) certification provides this foundation through applied, hands-on learning recognized across finance and business.

Additional Resources

To continue developing and preparing for a career in finance, these additional CFI materials will be helpful:

How to Choose the Right Career Path in Finance for Your Skills