Mezzanine Fund

Capital used for acquisitions, growth, recaps, or MBOs/LBOs

What is a Mezzanine Fund?

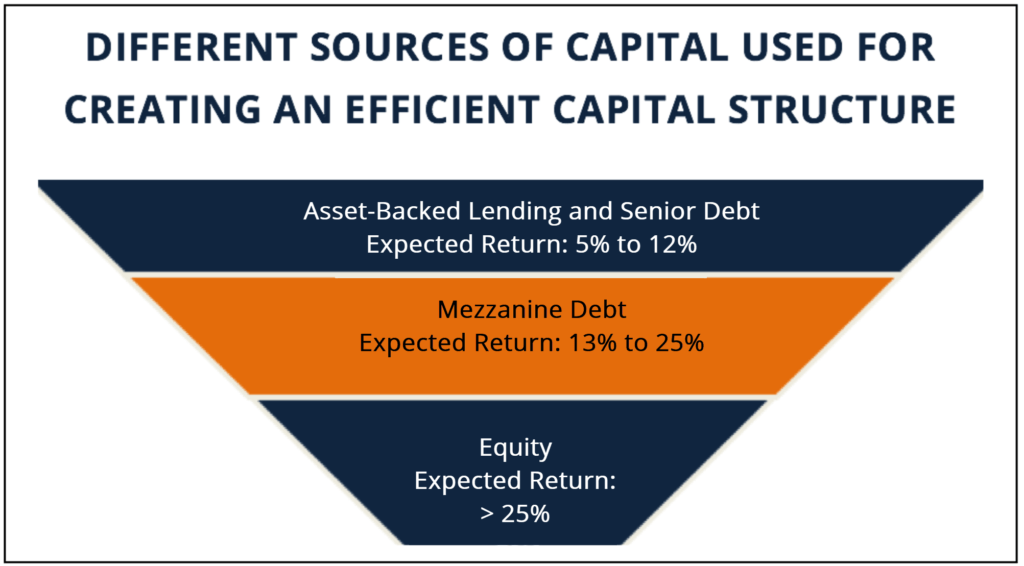

A mezzanine fund is a pool of capital that invests in mezzanine finance for acquisitions, growth, recapitalization, or management/leveraged buyouts. In the capital structure of a company, mezzanine finance is a hybrid between equity and debt. Mezzanine financing most commonly takes the form of preferred stock or subordinated and unsecured debt. It is treated as equity on the balance sheet.

To learn more about Mezzanine Funds, launch our free corporate finance course!

Why is Mezzanine Finance Needed?

Mezzanine capital fills the gap between equity and senior debt in the capital structure of a company, which may arise due to:

- Discounting inventories, fixed assets, and accounts receivable at a higher rate than before, for fear of them not realizing their value;

- a high proportion of intangible assets on a balance sheet; and/or

- ceilings on the amount of debt that can be raised from a bank.

Rate of Return (RoR) of a Mezzanine Fund

Mezzanine investors receive a rate of return (RoR) of 15% to 20%, which is higher than the RoR offered on traditional forms of debt financing (such as high-yield bonds and bank loans). This is because mezzanine capital is not as liquid as traditional debt finance and is subordinate to all other debt held by the company. The return on mezzanine finance becomes available through five sources:

- Cash interest: periodic cash payments that are a function of the percentage of the outstanding balance of mezzanine financing. The interest rate can be a fixed rate or a floating rate linked to base rates (such as LIBOR, CRR, etc.).

- Payable in kind interest (PIK): a periodic payment where the interest is not paid in cash but through an increase in the principal amount in tune with the interest payment – e.g., a $100 million bond having 9% PIK interest rate will pay out $109 million at maturity but without any cash interest.

- Ownership: like a convertible bond, mezzanine finance offers lenders the right to a stake in equity (in the form of a warrant) or a conversion to ownership, in the case of default.

- Participation payout: the lender may take a percentage claim in the company’s performance (as measured by EBITDA, total sales, or profits).

- Arrangement fee: Mezzanine lenders also charge an arrangement fee (to cover administrative costs) that is payable upfront upon closing the transaction.

To learn more about Mezzanine Funds, launch our free corporate finance course!

Eligibility

To raise mezzanine finance, a company must have a credible track record in the industry, consistent profitability, and a feasible plan for expansion through an initial public offering (IPO) or acquisition. Thus, mezzanine finance is used by companies that have a positive cash flow.

Maturity and Redemption

Mezzanine debt usually has a maturity period of 5 years or more. However, if the mezzanine debt is issued at the same time as bank debt, the mezzanine debt matures after the bank debt. Furthermore, given the high RoR offered on mezzanine finance vis-à-vis traditional finance, issuers often prefer shorter maturities. Mandatory redemption/prepayment is required in the event of asset sales or a change in control transactions.

Transferability

Traditionally, mezzanine capital is a buy and hold product. Thus, unlike bonds and stock, mezzanine debt securities are not traded. As a result, they have limited liquidity. Managers of a mezzanine fund need to take the non-transferability of these securities into account when managing their portfolio, it’s liquidity, and the timing of maturities.

To learn more about Mezzanine Funds, launch our free corporate finance course!

Advantages to the Borrower (the issuer)

Mezzanine debt is cheaper than equity and also does not result in the dilution of existing stakeholders. When used, it reduces the need for equity. Furthermore, interest on mezzanine debt is tax-deductible. Additionally, banks are more likely to lend to a company with mezzanine funding, as the mezzanine lender is usually an institutional investor whose presence reduces the risk of lending to the company.

Thus, by using mezzanine funding, as a borrower, you can create a cost-effective capital structure with maximum funding, maximum return on equity, and minimum cost of capital.

Advantages to the Lender

Unlike stock (which does not guarantee the provision of dividend), a mezzanine investor is contractually entitled to interest payments monthly, quarterly, or annually. Thus, returns are more consistent and the downside risk is minimized. Furthermore, the option of converting to equity may increase the investor’s returns if the company starts doing well.

To learn more about Mezzanine Funds, launch our free corporate finance course!

Learn More

We hope this overview of a Mezzanine Fund has been a helpful starting point for you. In order to keep learning about other investment vehicles and corporate finance in general, we highly recommend these related CFI articles: