Amortizing Loan

Also known as "Reducing Loan"

What is an Amortizing Loan?

An amortizing loan is a type of credit that is repaid via periodic installment payments over the lifetime of a loan.

Installments are typically monthly payments, but not always. Each periodic payment includes both a principal portion and an interest portion.

Amortization refers to the reduction in loan principal outstanding. Because of this structure, amortizing loans are also sometimes referred to as reducing loans.

Key Highlights

- An amortizing loan has predetermined, periodic payments (often monthly); there is both an interest and a principal portion.

- The interest portion of a blended payment represents the cost of borrowing, while the principal portion is applied directly to reduce the outstanding loan balance.

- Auto loans and home mortgage loans are common examples of amortizing loans.

- Details like interest rates and the breakdown of principal and interest can be found in a loan amortization schedule.

How Does Loan Amortization Work?

When cash credit is extended as an amortizing loan, it’s expected that the loan balance will eventually reduce to zero over its lifetime. Once the loan principal is repaid, it’s said to be a fully amortized loan.

Many amortizing loans feature monthly, blended payments. Loan payments are called blended because they feature a principal portion and an interest portion.

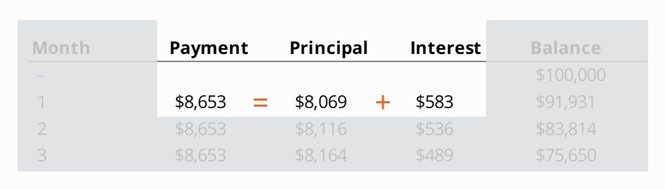

The details of a reducing/amortizing loan, including the amount of each payment that is interest vs. principal, are outlined in a document called a loan amortization schedule.

Interest portion

The interest payment represents the borrower’s cost of accessing the credit. The actual interest rate is a function of the borrower’s level of default risk, as determined by the lender.

For corporate borrowers, the interest payment flows through to the P&L as an expense line item.

Principal portion

The principal portion of the loan payment is subtracted directly from the previous period’s outstanding balance.

This new balance is used to calculate the interest portion of the next period’s blended loan payment, so the proportion of interest to principal reduces every period as each new payment is made and the total amount outstanding gets smaller.

For corporate borrowers, the principal portion of a blended loan payment appears as a reduction to the loan liability account on the borrower’s balance sheet and as a use of cash on its statement of cash flows.

Examples of Amortizing Loans

Most consumer credit is amortizing, as is a good deal of corporate credit. Examples include:

- Mortgage loans. A mortgage loan is credit secured by real estate. Most residential mortgage loans have a 25- to 30-year amortization period; commercial mortgages are typically between 15 and 25 years, depending on the nature and condition of the property.

- Auto loans. Credit extended towards a vehicle purchase is usually amortizing. Vehicle loans typically have a 5- to 8-year amortization period.

- Business and commercial loans. Debt financing to support a commercial borrower with the acquisition of assets comes in many shapes and sizes; many commercial loans are structured to reduce via periodic installments.

Using Amortizing Loans to Maximize Utility

For a borrower, getting an amortizing loan may allow them to make a purchase or an investment for which they currently lack sufficient funds.

In addition, the fact that blended loan payments do not vary from month to month gives the borrower predictability into future cash obligations and/or monthly expenses.

Although there is a cost to borrowing money (the total amount of interest paid over the life of the loan), in many instances, the benefits of using credit may outweigh the costs.

Amortization Period vs. Loan Term

The amortization period is the period over which the entire outstanding loan balance will be repaid to zero, assuming the contract remains in effect through the entire life of that loan. The amortization period is not the same as the loan term.

A loan term is a period of time over which specific loan features have been negotiated (like interest rate, blended payment amount, etc.). The end of that loan term is called the maturity date.

An example is a 5-year fixed-rate mortgage; this loan may amortize over 25-30 years, but the interest rate and the blended payment amount (of principal and interest) would only remain locked in for the 5-year term.

Technically, a loan’s entire balance is “due” at maturity; however, in practice, many people renew their mortgage or refinance it with another lender, thus triggering a new amortization period and loan term/maturity date.

Amortizing vs. Non-Amortizing Credit

It’s important to note that not all credit reduces via scheduled loan payments. While not an exhaustive list, some examples of non-amortizing credit include:

- Trade credit. When companies sell on credit terms, there typically is no installment component to its repayment. In fact, “open” tends to be the most common form of trade credit. This means that a buyer can draw against their limit, pay it down, then draw again.

- Interest-only loans. This includes lines of credit; whether for a company or an individual, interest-only loans are designed to provide flexibility. The loan balance may revolve up and down depending on the person or the company’s cash position at any given time.

- Non-standard repayment profiles. Some corporate credit may be extended using non-standard structures. Two of the more common examples are bullet payments and PIK (pay-in-kind) structures. Both of these structures require the full amount of principal to be paid at maturity. However, with a PIK, the interest expense is accrued (i.e., not paid in cash) and is added to the loan balance, so the loan balance increases over time.

Amortizing Loans & Collateral Security

An asset becomes collateral when it’s pledged as security against credit exposure.

Most assets depreciate in value over time (think a vehicle as it ages or manufacturing equipment as it accumulates hours of usage). A lender is always looking to maintain a collateral surplus, which is when the residual liquidation value of that asset is greater than the amount of credit outstanding against it.

A lender never wants to be in the opposite position, which is having more credit outstanding against an asset than they’re able to recover by taking enforcement action against it; this is called collateral deficit (or shortfall).

Loan amortization plays a big part in ensuring that the principal owed by a borrower is reducing, at least in line with the rate at which the underlying asset is losing its value.

Related Resources

CFI offers the Commercial Banking & Credit Analyst (CBCA)™ certification program for those looking to take their careers in banking to the next level. To keep learning and advancing your career, the following resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?