- What is an Equity Research Report?

- Contents of an Equity Research Report

- Buy Side vs Sell Side Research

- Why Do Banks Publish Equity Research Reports?

- Equity Research Report Recommendations

- Different Types of Equity Research Reports

- Equity Research Report Example

- FAQs: Equity Research Reports

- 1. What is the purpose of an equity research report?

- 2. What information is included in an equity research report?

- 3. Who writes equity research reports?

- 4. What is the difference between a buy-side and sell-side equity research report?

- Additional Resources

Equity Research Report: Definition, Types, and Key Components

What is an Equity Research Report?

An equity research report is a document prepared by an analyst that provides a recommendation on whether investors should buy, hold, or sell shares of a public company. Additionally, it provides an overview of the business, the industry it operates in, the management team, its financial performance, risks, and the target price.

To learn more, check out CFI’s Valuation Modeling courses.

Contents of an Equity Research Report

Let’s take a closer look at what’s included in an equity research report. Below is a list of the main sections you’ll find in one of these reports.

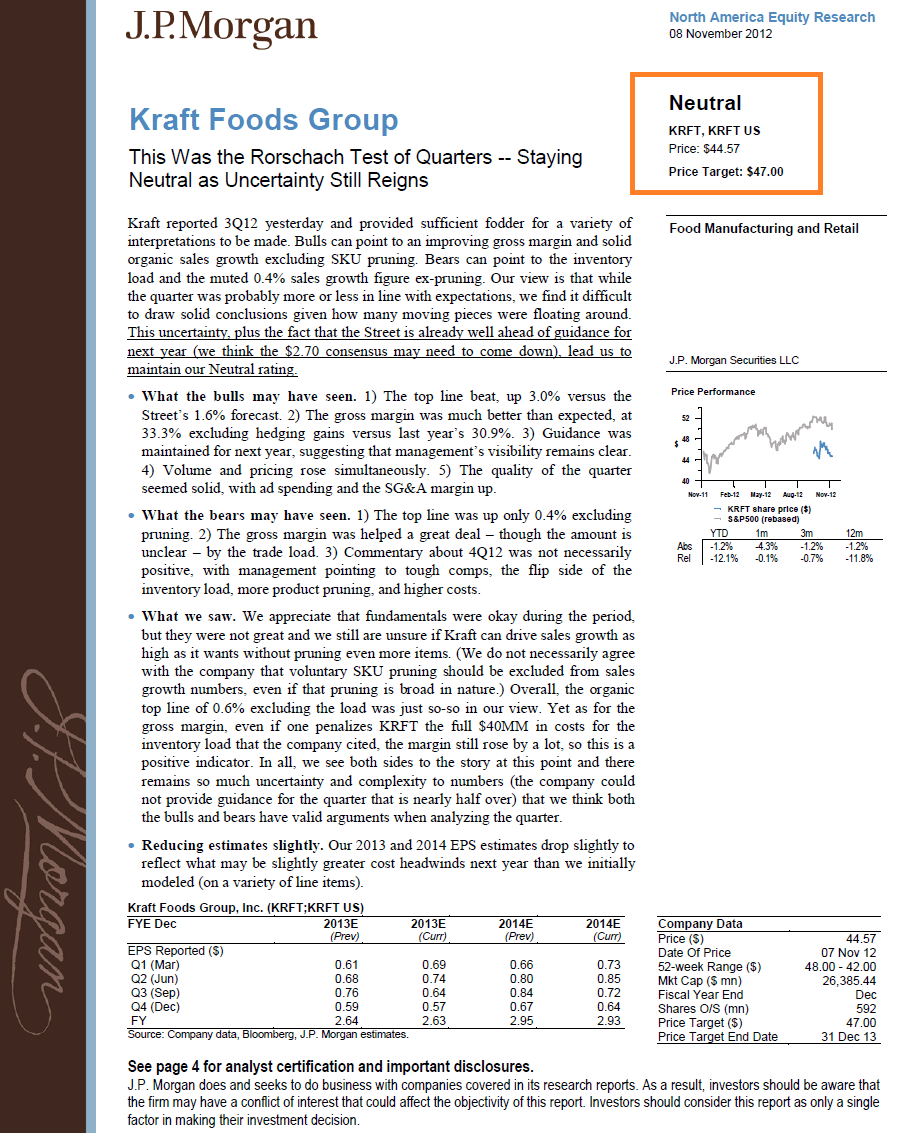

- Recommendation – Typically to either buy, sell, or hold shares in the company. This section also usually includes a target price (i.e., $47.00 in the next 12 months).

- Company Update – Any recent information, new releases, quarterly or annual results, major contracts, management changes, or any other important information about the company.

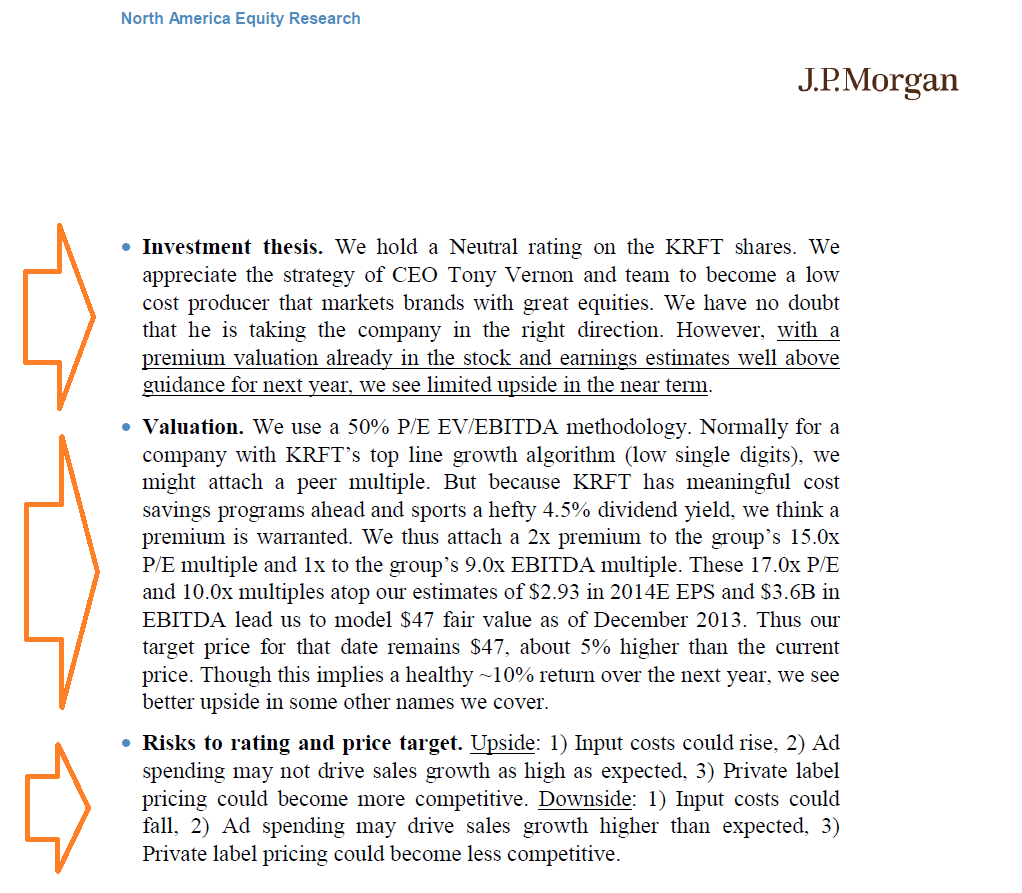

- Investment Thesis – A summary of why the analyst believes the stock will over or underperform and what will cause it to reach the share price target included in the recommendation. This is probably the most interesting part of the report.

- Financial Information & Valuation – A forecast of the company’s income statement, balance sheet, cash flow, and valuation. This section is often an output from a financial model built in Excel.

- Risk & Disclaimers – An overview of the risks associated with investing in the stock. This is usually a laundry list that includes all conceivable risks, thus making it feel like a legal disclaimer. The reports also have extensive disclaimers in addition to the risk section.

Buy Side vs Sell Side Research

It’s important to distinguish between buy side and sell side research reports.

Buy side firms (asset management companies) have their own internal research teams that produce reports and recommendations on which stocks the firm and its portfolio managers should buy and sell. The reports are only used for internal investment decision making and not distributed publicly.

Sell side firms such as investment banks produce equity research reports to be disseminated to their sales and trading clients and wealth management clients. These reports are distributed for free for a variety of reasons (explained below) and have a specific recommendation to buy, sell, or hold as well as an expected target price.

Learn more about buy side vs sell side jobs.

The sell side publishes reports to generate fees, both directly and indirectly.

Why Do Banks Publish Equity Research Reports?

Direct Fees: Trading Commissions

When an investment bank publishes valuable equity research for an institutional client, that client is then likely to use the bank to execute their trades for that stock. While there is no actual agreement to do so, it’s an unspoken rule. The bank might also use the report to persuade a client to buy more shares in a holding they already have, which also increases commissions.

Indirect Fees: Investment Banking Relationships

All banks have a Chinese Wall between their investment banking teams and research departments, but there still remains an indirect incentive for research to be supportive of stocks the bank may provide investment banking services to.

The fees that investment bankers earn on underwriting and mergers and acquisitions (M&A) are huge, and a bank would never want to miss out on an opportunity to work with a CEO of a public company because the bank had a “Sell” rating on their stock.

Because of relationships among investment banks, their research teams, and clients, sell side research reports typically include a disclaimer that discloses these relationships. Disclaimers include statements such as, “Bank X seeks and does business with companies that are covered in its research reports.

Because of this, investors should be aware that the firm may have a conflict of interest (due to these investment banking relationships) that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.”

Equity Research Report Recommendations

Each bank has their own set of recommendations (terms) they use to rate a stock. Below is a list of the most common recommendations or ratings analysts issue.

Ratings include:

- Buy, Outperform, Overweight

- Hold, Neutral, Marketweight

- Sell, Underperform, Underweight

To learn more, check out CFI’s Valuation Modeling courses.

Different Types of Equity Research Reports

This guide has focused on a “typical” equity research report, but there are various other types that can take slightly different forms. Below is a list of other types.

Equity research report types: :

- Initiating Coverage – A long report (often 50-100+ pages long) that is released when a firm starts covering a stock for the first time.

- Industry Reports – General industry updates about a few companies in a sector.

- Top Picks – A list and summary of a firm’s top stock picks and their targeted returns.

- Quarterly Results – A report that focuses on the company’s quarterly earnings release and any updated guidance.

- Flash Reports – Quick 1-2 page report that comments on a news release from the company or other quick information.

Equity Research Report Example

Below is an example of an equity research report on Kraft Foods. As you can see in the images below, the analyst clearly lays out the recommendation, target price, recent updates, investment thesis, valuation, and risks.

To learn more, check out CFI’s Valuation Modeling courses.

FAQs: Equity Research Reports

1. What is the purpose of an equity research report?

The purpose of an equity research report is to help investors make informed decisions about buying, selling, or holding a stock. Analysts evaluate a company’s financial performance, competitive position, and growth prospects to provide investment recommendations and price targets based on detailed analysis.

2. What information is included in an equity research report?

An equity research report includes a buy/sell/hold recommendation with price target, company updates on recent developments, an investment thesis explaining the analyst’s rationale, financial forecasts and valuation models, and a risk section outlining potential investment risks. The investment thesis typically provides the most valuable analytical insights.

3. Who writes equity research reports?

Equity research reports are written by equity research analysts who work at investment banks, brokerage firms, or asset management companies. These analysts typically have finance degrees, industry expertise, and strong financial modeling and valuation skills. Sell-side analysts work for banks, while buy-side analysts work for investment firms.

4. What is the difference between a buy-side and sell-side equity research report?

Sell-side equity research reports are created by investment banks for external clients and are often publicly available. Buy-side equity research reports are produced by asset managers for internal use only and remain confidential. Buy-side reports focus on portfolio decisions, while sell-side reports aim to generate trading commissions.

Additional Resources

Thank you for reading CFI’s guide on Equity Research Report. To learn more, these additional resources will be helpful: