Enterprise Value to Revenue Multiple

A company's enterprise value divided by its total annual revenue

What is the Enterprise Value to Revenue Multiple?

The Enterprise Value to Revenue Multiple is a valuation metric used to value a business by dividing its enterprise value (equity plus debt minus cash) by its annual revenue. The EV to revenue multiple is commonly used for early-stage or high-growth businesses that don’t have positive earnings yet.

Why Use the EV to Revenue Multiple?

If a company doesn’t have positive Earnings Before Interest Taxes Depreciation & Amortization (EBITDA) or positive Net Income, it’s not possible to use EV/EBITDA or P/E ratios to value the business. In this case, a financial analyst will have to move further up the income statement to either gross profit or all the way up to revenue.

If EBITDA is negative, then having a negative EV/EBITDA multiple is not useful. Similarly, a company with a barely positive EBITDA (almost zero) will result in a massive multiple, which isn’t very useful either.

For these reasons, early-stage companies (often operating at a loss) and high growth companies (often operating at breakeven) require an EV/Revenue multiple for valuation.

EV to Revenue Multiple Formula

The formula for calculating the multiple is:

= EV / Revenue

Where:

- EV (Enterprise Value) = Equity Value + All Debt + Preferred Shares – Cash and Equivalents

- Revenue = Total Annual Revenue

Sample Calculation

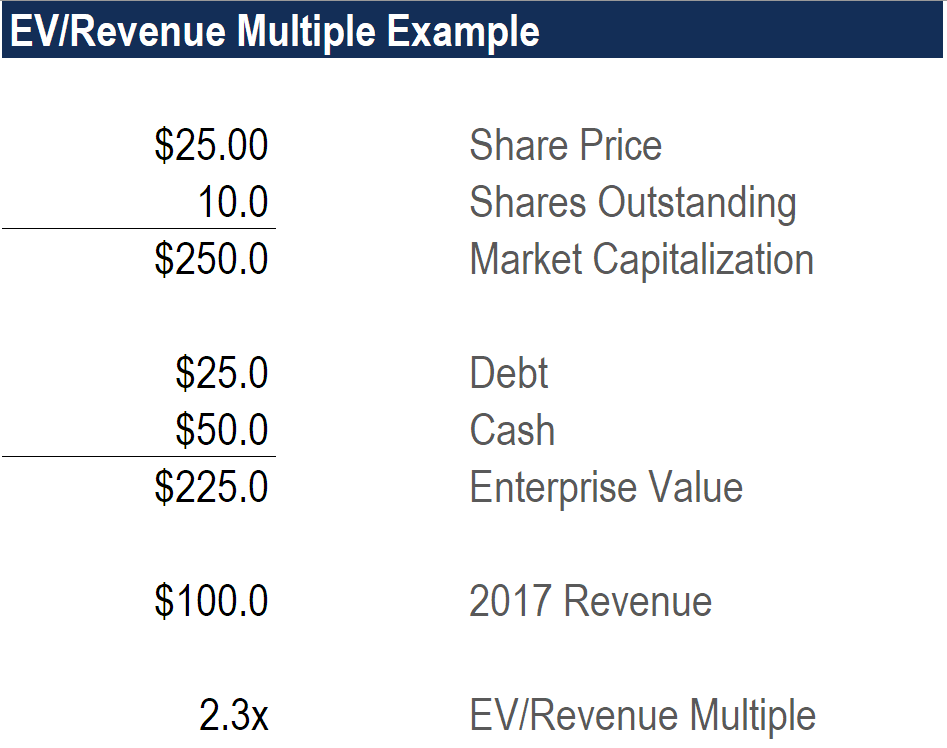

Here is an example of how to calculate the EV to Revenue multiple:

Suppose a company has a current share price of $25.00, shares outstanding of 10 million, a debt of $25 million, cash of $50 million, no preferred shares, no minority interest, and a 2017 revenue of $100 million. What is its EV/Revenue ratio?

Answer:

- $25 times 10 million shares is a market capitalization of $250 million.

- Add $25 million of debt and deduct $50 million of cash to get an Enterprise Value (EV) of $225 million.

- $225 million divided by $100 million of revenue is 2.25x EV/Revenue.

Below is a screenshot of the calculation in Excel:

Download the Free Template

Enter your name and email in the form below and download the free template now!

EV/Revenue Calculator

Download the free Excel template now to advance your finance knowledge!

Why is EV Used in the Numerator Instead of Price (or Market Cap)?

EV is used instead of the price or market cap in the numerator to remove any impact of valuation caused by a company’s capital structure. This will allow the comparison of values between similar-type companies with different capital structures (debt vs. equity mix).

What are the Pros and Cons of the EV to Revenue Multiple?

As with any valuation method, there are advantages and disadvantages, which are outlined below:

Pros:

- Useful for companies with negative earnings

- Useful for businesses with negative or near zero EBITDA

- Easy to find revenue figures for most businesses

- Easy to calculate the ratio

Cons:

- Does not take into account the company’s capital structure

- Ignores profitability and cash flow generation

- Hard to compare across different industries and different growth stages of companies (early vs. mature)

Case Study

As a case study, you can learn how to calculate the EV to revenue multiple in two of CFI’s online courses. The first example is in the Business Valuation course, which leads students through a detailed exercise of creating a “Comps Table” or comparable company analysis.

The second example is in CFI’s e-Commerce Financial Modeling course, where students will build a model from scratch to value a business, which includes determining the company’s EV/Revenue ratios across various years.

Additional Resources

Thank you for reading CFI’s guide to Enterprise Value to Revenue Multiple. To continue learning on your own, these resources will be helpful:

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Analyst Certification FMVA® Program

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?