Free Cash Flow (FCF)

The cash left after making investments in capital assets

What is a Free Cash Flow?

Free cash flow (FCF) measures a company’s financial performance. It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow. In other words, FCF measures a company’s ability to produce what investors care most about: cash that’s available to be distributed in a discretionary way.

Types of Free Cash Flow

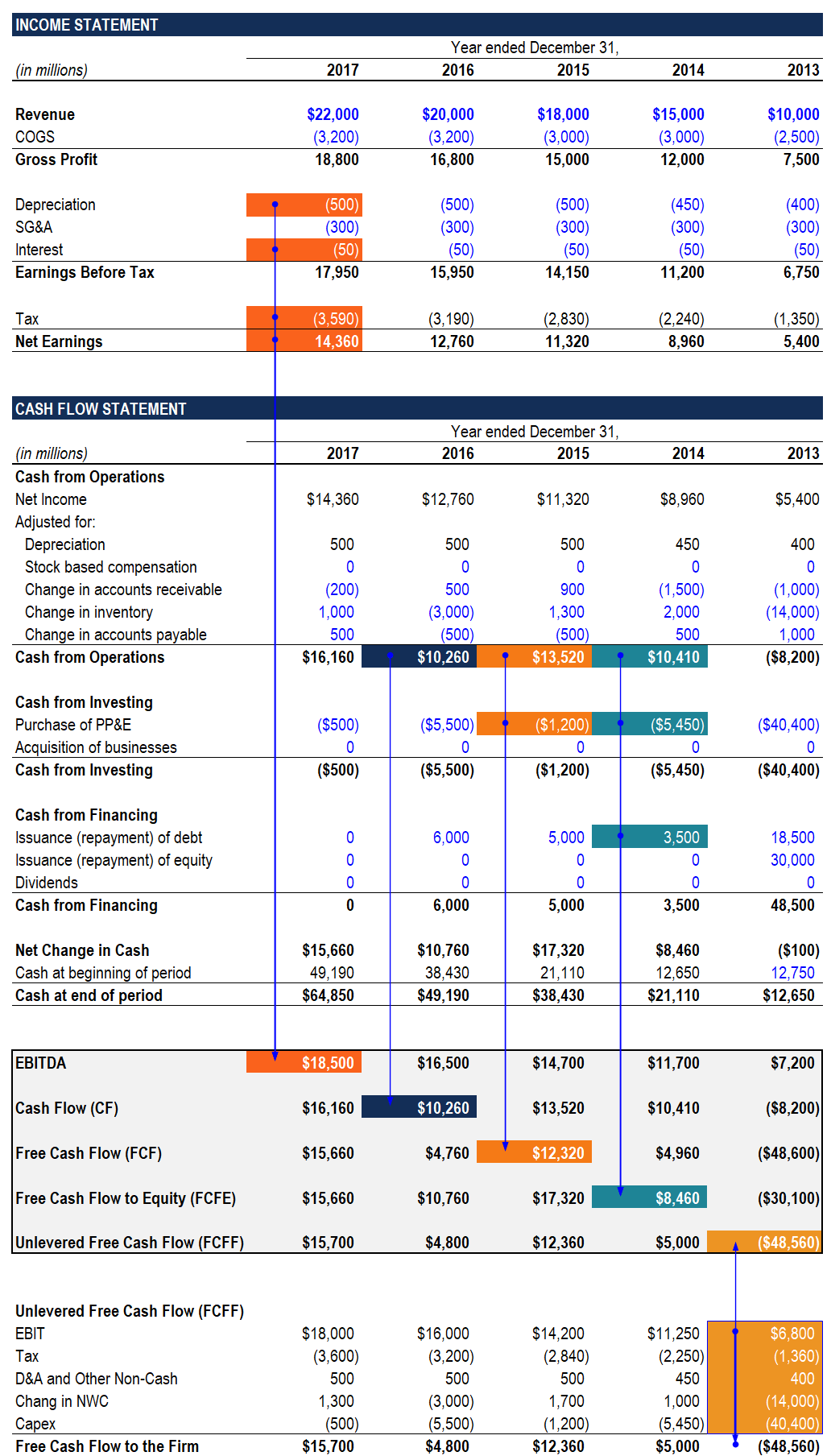

When someone refers to FCF, it is not always clear what they mean. There are several different metrics that people could be referring to.

The most common types include:

- Free Cash Flow to the Firm (FCFF), also referred to as “unlevered”

- Free Cash Flow to Equity, also knows as “levered”

To learn more about the various types, see our ultimate cash flow guide.

Importance of Free Cash Flow

Knowing the company’s free cash flow enables management to decide on future ventures that would improve the shareholder value. Additionally, having an abundant FCF indicates that a company is capable of paying its monthly dues. Companies can also use their FCF to expand business operations or pursue other short-term investments.

Compared to earnings per se, free cash flow is more transparent in showing the company’s potential to produce cash and profits.

Meanwhile, other entities looking to invest may likely consider companies that have a healthy free cash flow because of a promising future. Couple this with a low-valued share price, investors can generally make good investments with companies that have high FCF. Other investors greatly consider FCF compared to other measures because it also serves as an important basis for stock pricing.

How is FCF Calculated?

There are various ways to compute for FCF, although they should all give the same results. The formula below is a simple and the most commonly used formula for levered free cash flow:

Free Cash Flow = Operating Cash Flow (CFO) – Capital Expenditures

Most information needed to compute a company’s FCF is on the cash flow statement. As an example, let Company A have $22 million dollars of cash from its business operations and $6.5 million dollars used for capital expenditures, net of changes in working capital. Company A’s FCF is then computed as:

FCF = $22 – $6.5 = $15.5m

Download the Free Template

FCF Template

Download the free Excel template now to advance your finance knowledge!

Limitations Associated with Free Cash Flow

The company’s net income greatly affects a company’s free cash flow because it also influences a company’s ability to generate cash from operations. As such, other activities (i.e., those not within the core business operations of a company) from which the company generates income must be scrutinized deeply in order to reflect a more appropriate FCF value.

On the investors’ side, they must be wary of a company’s policies that affect their declaration of FCF. For example, some companies lengthen the time to settle their debts to maintain cash or, the opposite, shortening the time they collect debts due to them. Companies also have different guidelines on which assets they declare as capital expenditures, thus affecting the computation of FCF.

Applications in Financial Modeling

For professionals working in investment banking, equity research, corporate development, financial planning & analysis (FP&A), or other areas of corporate finance, it’s very important to have a solid understanding of how FCF is used in financial modeling.

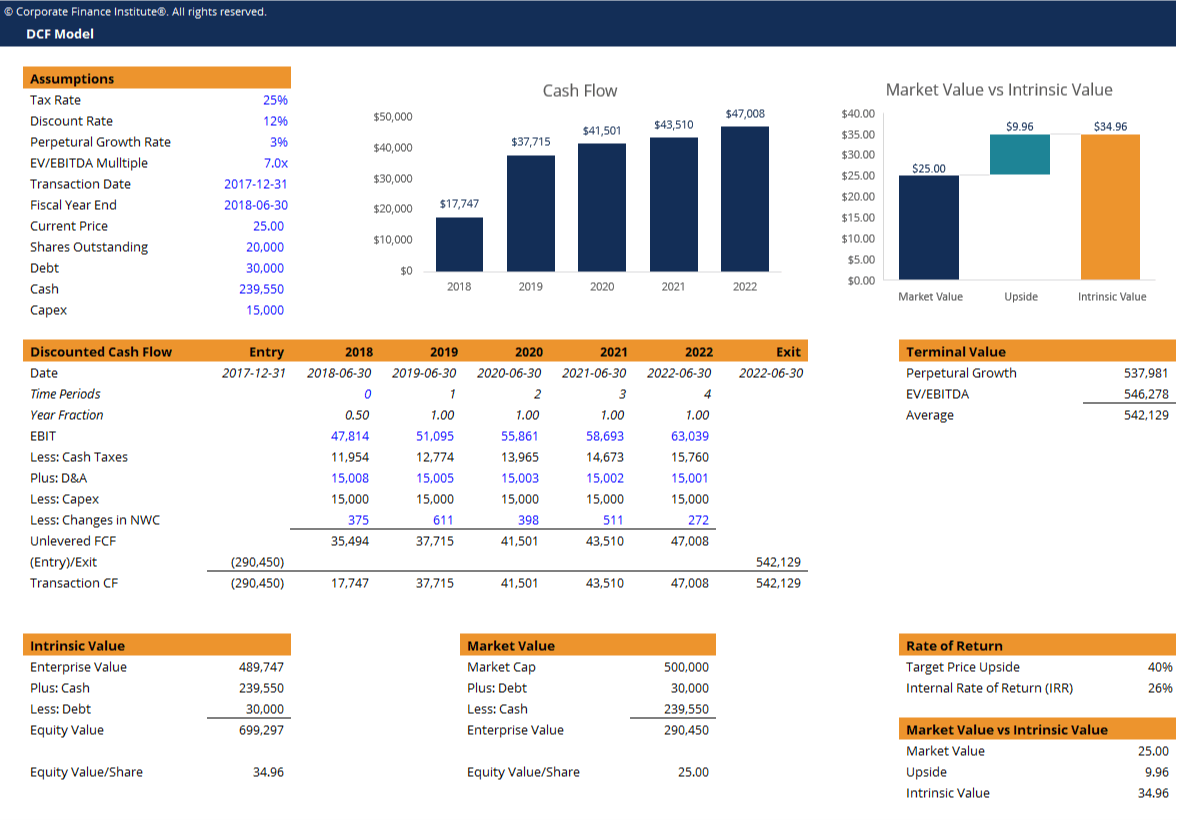

Discounted Cash Flow, or DCF models, are based on the premise that investors are entitled to the free cash flow of a firm, and therefore the model is based solely on the timing and the amount of those cash flows.

To learn more about DCF modeling, check out CFI’s online financial modeling courses.

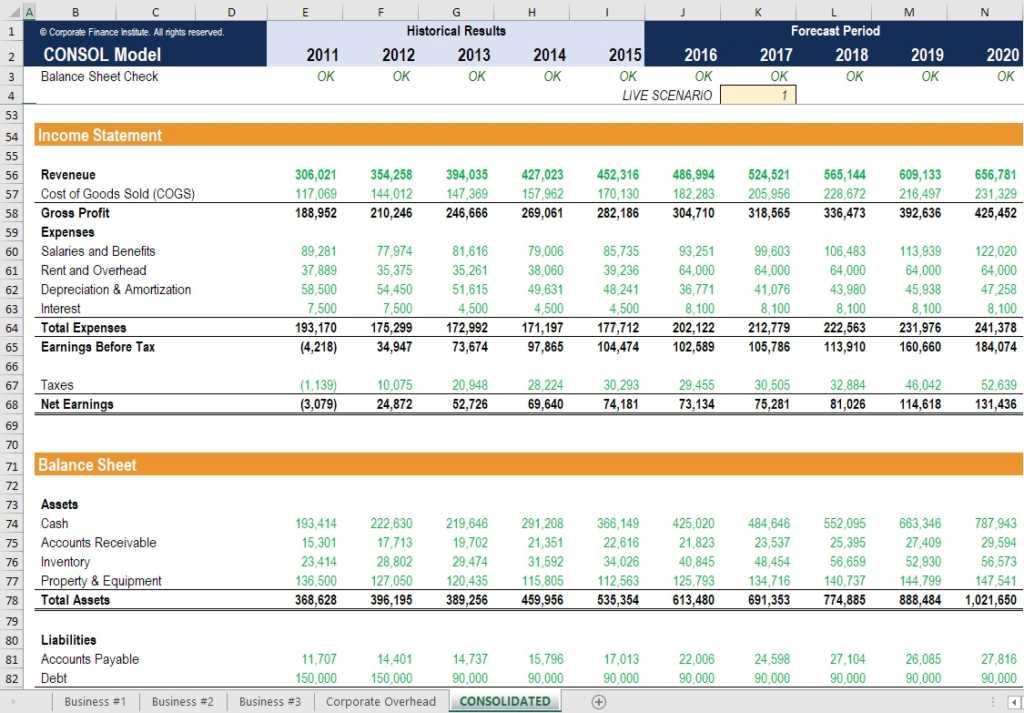

Screenshot from CFI’s financial modeling course.

Additional Resources

Thank you for reading CFI’s guide to Free Cash Flow (FCF). To keep learning and advance your career, the following resources will be helpful:

Analyst Certification FMVA® Program

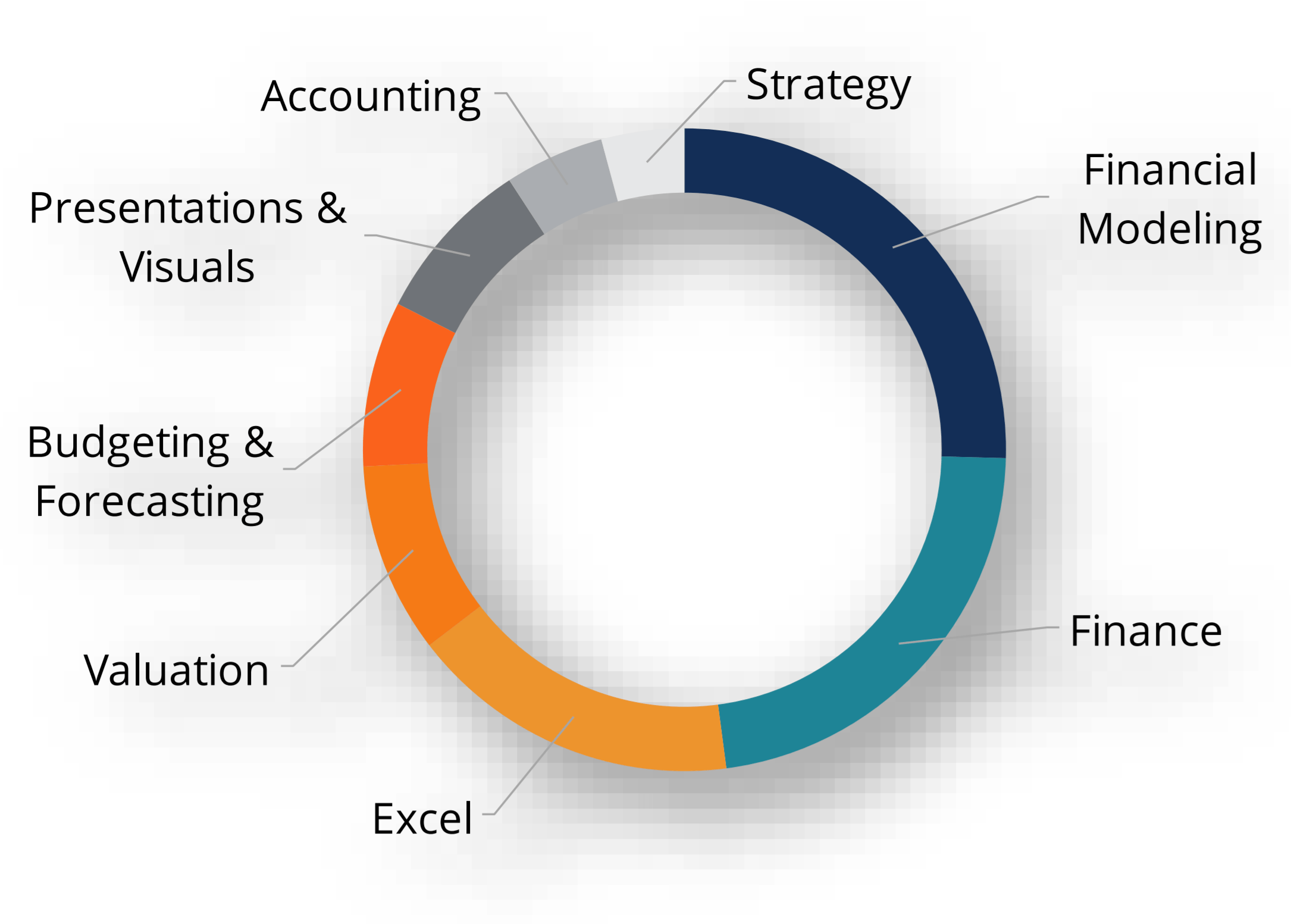

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.