Current Ratio Formula

Current Assets / Current Liabilities

What is the Current Ratio?

The current ratio, also known as the working capital ratio, measures the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities.

It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. The current ratio formula (below) can be used to easily measure a company’s liquidity.

Current Ratio Formula

The Current Ratio formula is:

Current Ratio = Current Assets / Current Liabilities

Example of the Current Ratio Formula

If a business holds:

- Cash = $15 million

- Marketable securities = $20 million

- Inventory = $25 million

- Short-term debt = $15 million

- Accounts payables = $15 million

Current assets = 15 + 20 + 25 = 60 million

Current liabilities = 15 + 15 = 30 million

Current ratio = 60 million / 30 million = 2.0x

The business currently has a current ratio of 2, meaning it can easily settle each dollar on loan or accounts payable twice. A rate of more than 1 suggests financial well-being for the company. There is no upper end on what is “too much,” as it can be very dependent on the industry, however, a very high current ratio may indicate that a company is leaving excess cash unused rather than investing in growing its business.

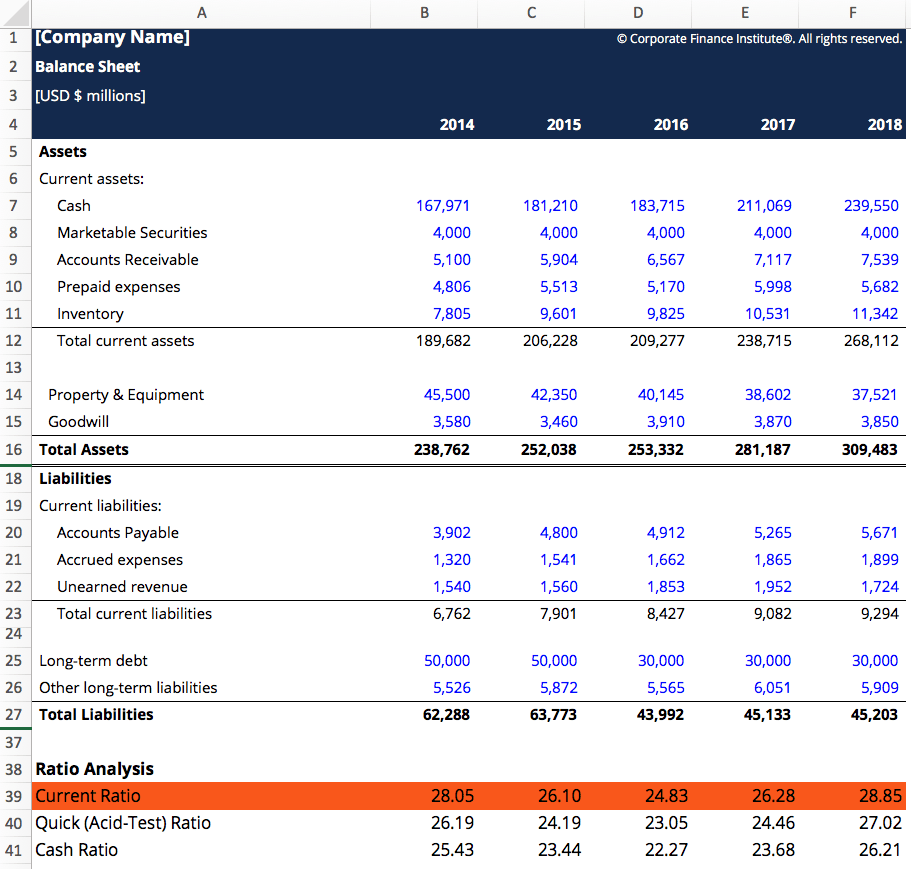

Image: CFI’s Financial Analysis Fundamentals Course

Download CFI’s Free Current Ratio Formula Template

Click the button below to download our free Current Ratio Formula template!

Current Ratio Formula – What are Current Assets?

Current assets are resources that can quickly be converted into cash within a year’s time or less. They include the following:

- Cash – Legal tender bills, coins, undeposited checks from customers, checking and savings accounts, petty cash

- Cash equivalents – Corporate or government securities with 90 days or less maturity

- Marketable securities – Common stock, preferred stock, government and corporate bonds with a maturity date of 1 year or less

- Accounts receivable – Money owed to the company by customers and that is due within a year – This net value should be after deducting an allowance for doubtful accounts (bad credit)

- Notes receivable – Debt that is maturing within a year

- Other receivables – Insurance claims, employee cash advances, income tax refunds

- Inventory – Raw materials, work-in-process, finished goods, manufacturing/packaging supplies

- Office supplies – Office resources such as paper, pens, and equipment expected to be consumed within a year

- Prepaid expenses – Unexpired insurance premiums, advance payments on future purchases

Current Ratio Formula – What are Current Liabilities?

Current liabilities are business obligations owed to suppliers and creditors, and other payments that are due within a year’s time. This includes:

- Notes payable – Interest and the principal portion of loans that will become due within one year

- Accounts payable or Trade payable – Credit resulting from the purchase of merchandise, raw materials, supplies, or usage of services and utilities

- Accrued expenses – Payroll taxes payable, income taxes payable, interest payable, and anything else that has been accrued for but an invoice is not received

- Deferred revenue – Revenue that the company has been paid for that will be earned in the future when the company satisfies revenue recognition requirements

Why Use the Current Ratio Formula?

This current ratio is classed with several other financial metrics known as liquidity ratios. These ratios all assess the operations of a company in terms of how financially solid the company is in relation to its outstanding debt. Knowing the current ratio is vital in decision-making for investors, creditors, and suppliers of a company. The current ratio is an important tool in assessing the viability of their business interest.

Other important liquidity ratios include:

Below is a video explanation of how to calculate the current ratio and why it matters when performing an analysis of financial statements.

Video: CFI’s Financial Analysis Courses

Additional Resources

Thank you for reading this guide to understanding the Current Ratio Formula. To keep educating yourself and advancing your finance career, these CFI resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?