Product Costs

Costs incurred in manufacturing a product

What are Product Costs?

Product costs are costs that are incurred to create a product that is intended for sale to customers. Product costs include direct material (DM), direct labor (DL), and manufacturing overhead (MOH).

Understanding the Costs in Product Costs

Product costs are the costs directly incurred from the manufacturing process. The three basic categories of product costs are detailed below:

1. Direct material

Direct material costs are the costs of raw materials or parts that go directly into producing products. For example, if Company A is a toy manufacturer, an example of a direct material cost would be the plastic used to make the toys.

2. Direct labor

Direct labor costs are the wages, benefits, and insurance that are paid to employees who are directly involved in manufacturing and producing the goods – for example, workers on the assembly line or those who use the machinery to make the products.

3. Manufacturing overhead

Manufacturing overhead costs include direct factory-related costs that are incurred when producing a product, such as the cost of machinery and the cost to operate the machinery. Manufacturing overhead costs also include some indirect costs, such as the following:

- Indirect materials: Indirect materials are materials that are used in the production process but that are not directly traceable to the product. For example, glue, oil, tape, cleaning supplies, etc. are classified as indirect materials.

- Indirect labor: Indirect labor is the labor of those who are not directly involved in the production of the products. An example would be security guards, supervisors, and quality assurance workers in the factory. Their wages and benefits would be classified as indirect labor costs.

Example of Product Costs

Company A is a manufacturer of tables. Its product costs may include:

- Direct material: The cost of wood used to create the tables.

- Direct labor: The cost of wages and benefits for the carpenters to create the tables.

- Manufacturing overhead (indirect material): The cost of nails used to hold the tables together.

- Manufacturing overhead (indirect labor): The cost of wages and benefits for the security guards to overlook the manufacturing facility

- Manufacturing overhead (other): The cost of factory utilities.

Company A produced 1,000 tables. To produce 1,000 tables, the company incurred costs of:

- $12,000 on wood

- $2,000 on wages for carpenters and $500 on wages for security guards to overlook the manufacturing facility

- $100 for a bag of nails to hold the tables together

- $500 for factory rent and utilities

Total product costs: $12,000 (direct material) + $2,000 (direct labor) + $100 (indirect material) + $500 (indirect labor) + $500 (other costs) = $15,100. As this is the cost to produce 1,000 tables, the company has a per unit cost of $15.10 ($15,100 / 1,000 = $15.10).

Period Costs

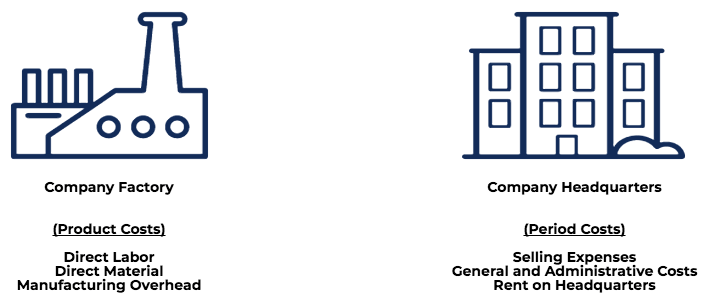

Product costs are costs necessary to manufacture a product, while period costs are non-manufacturing costs that are expensed within an accounting period.

| Product Costs | Period Costs | |

|---|---|---|

| Definition | Costs incurred to manufacture a product | Costs that are not incurred to manufacture a product and, therefore, cannot be assigned to the product |

| Comprises of: | Manufacturing and production costs | Non-manufacturing costs |

| Examples | Raw material, wages on labor, production overheads, rent on the factory, etc. | Marketing costs, sales costs, audit fees, rent on the office building, etc. |

Consider the diagram below:

Costs on Financial Statements

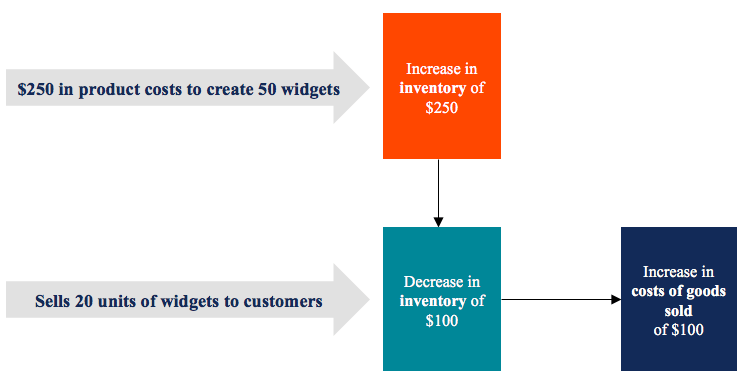

Product costs are treated as inventory (an asset) on the balance sheet and do not appear on the income statement as costs of goods sold until the product is sold.

For example, a company manufactures 50 units of widgets at a unit product cost of $5. On the balance sheet, there would be a $5 x 50 = $250 increase in inventory. If the company sells 20 units of widgets, $5 x 20 = $100 in inventory would be transferred to the cost of goods sold on the income statement while the remaining $150 would remain in inventory on the balance sheet.

Download CFI’s Free Product Costs Template

Click the button below to download our free Product Costs template!

More Resources

Thank you for reading CFI’s guide on Product Costs. To keep learning and advancing your career, the following resources will be helpful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?