Financial Modeling: Essential Skills, Software, and Uses

The process of combining historical and projected financial information to make business decisions

What is Financial Modeling?

Financial modeling is one of the most highly valued, but thinly understood, skills in financial analysis. The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company’s future results.

A financial model is simply a spreadsheet, usually built in Microsoft Excel, that forecasts a business’s financial performance into the future. The forecast is typically based on the company’s historical performance and assumptions about the future and requires preparing an income statement, balance sheet, cash flow statement, and supporting schedules (known as a three-statement model, one of many types of approaches to financial statement modeling).

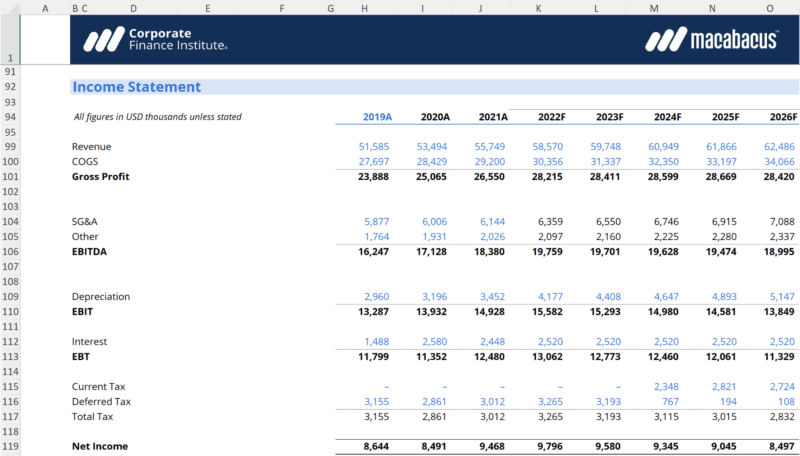

From there, more advanced types of models can be built such as discounted cash flow analysis (DCF model), leveraged buyout (LBO), mergers and acquisitions (M&A), and sensitivity analysis. Below is an example of financial modeling in Excel:

Image: CFI’s Financial Modeling Courses.

Key Highlights

- Financial modeling combines accounting, finance, and business metrics to create a forecast of a company’s future results.

- The main goal of financial modeling is to accurately project a company’s future financial performance.

- Modeling can be useful for valuing companies, determining whether a company should raise capital or grow the business organically or through acquisitions.

What is a Financial Model Used For?

There are many types of financial models with a wide range of uses. The output of a financial model is used for decision-making and performing financial analysis, whether inside or outside of the company. Financial models are used to make decisions about:

- Raising capital (debt and/or equity)

- Making acquisitions (businesses and/or assets)

- Growing the business organically (e.g., opening new stores, entering new markets, etc.)

- Selling or divesting assets and business units

- Budgeting and forecasting (planning for the years ahead)

- Capital allocation (priority of which projects to invest in)

- Valuing a business

- Financial statement analysis/ratio analysis

- Management accounting

Choosing the Right for Financial Modeling?

Forecasting a company’s operations into the future can be very complex. Each business is unique and requires a very specific set of assumptions and calculations. Excel is used because it is the most flexible and customizable spreadsheet tool available. Other software programs may be too rigid and specialized, whereas Excel knowledge is generally more universal.

Who Builds Financial Models?

There are many different types of professionals who build financial models. The most common types of career tracks are investment banking, equity research, corporate development, FP&A, and accounting (due diligence, transaction advisory, valuations, etc).

How Can You Learn Financial Modeling?

The best way to learn financial modeling is to practice. It takes years of experience to become an expert at building financial models, and you really have to learn by doing. Reading equity research reports can be helpful, as they give you something to compare your results to. One of the best ways to practice is to take a mature company’s historical financials, build a model into the future, calculate the net present value per share, and compare your projections to current share prices or the target prices in equity research reports.

Taking a professional financial modeling training course also offers a solid base understanding of the relevant concepts and skills. In the meantime, you may be interested in exploring CFI’s free Financial Modeling Guidelines or having a go at building your own financial models.

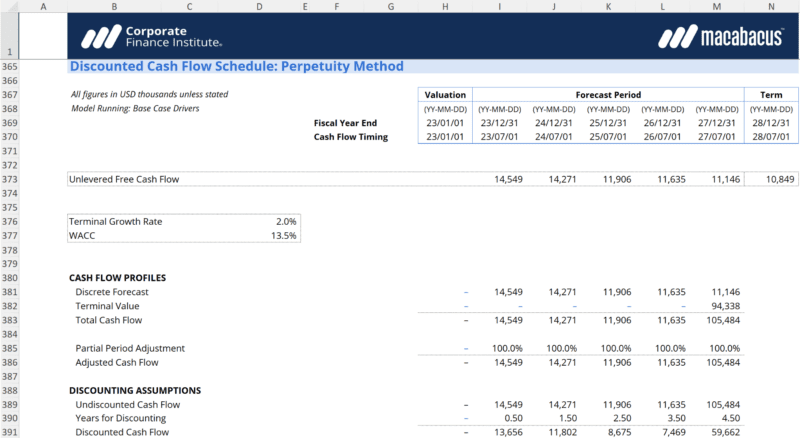

Image: CFI’s Financial Modeling Courses.

How Much Accounting Knowledge is Needed for Financial Modeling?

In order to build a financial model, you need a solid understanding of accounting fundamentals. You have to know what all the various accounts mean, how to calculate them, and how they’re connected. We recommend having at least a few accounting courses under your belt.