- What Makes These Financial Modeling Courses So Popular?

- Top Financial Modeling Courses That Take You From Beginner to Advanced

- #1 Introduction to 3-Statement Financial Modeling (Beginner)

- #2 Introduction to Business Valuation (Intermediate)

- #3 DCF Valuation Modeling (Advanced)

- #4 Scenario and Sensitivity Analysis in Excel (Intermediate)

- #5 Real Estate Financial Modeling (Advanced)

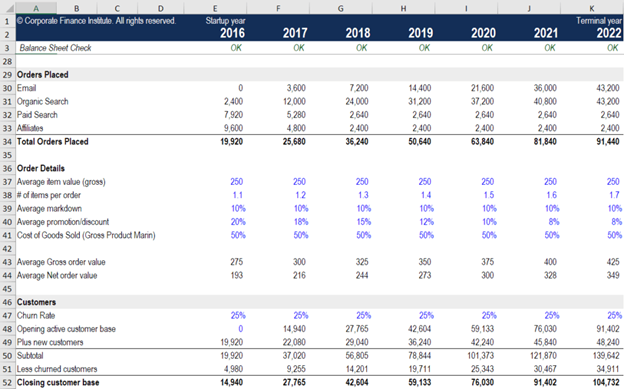

- #6 Startup eCommerce Financial Modeling & Valuation (Intermediate)

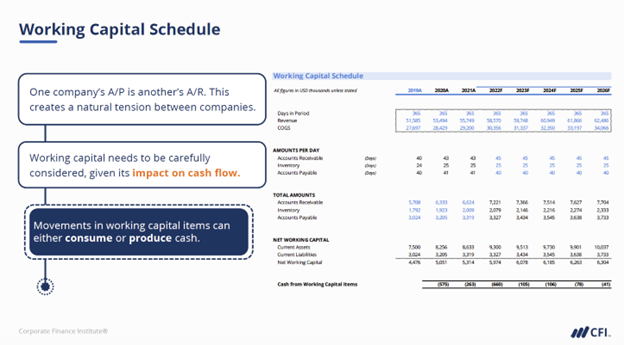

- #7 Operational Modeling (Intermediate)

- Top Financial Modeling Courses for Investment Banking and Private Equity

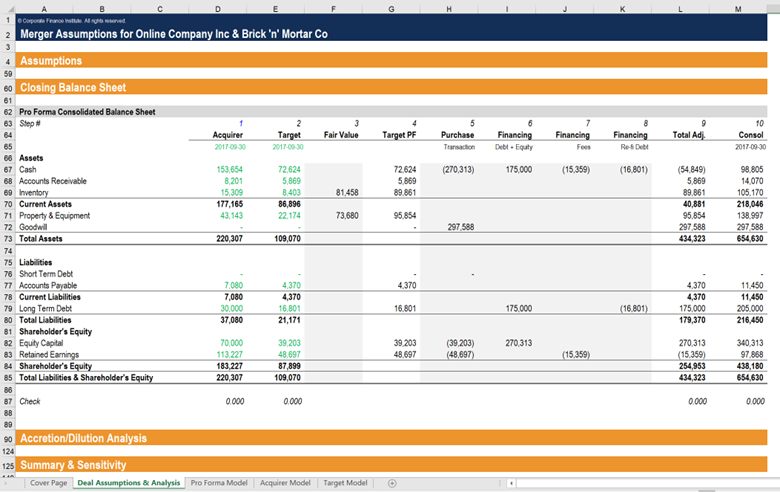

- #8 Mergers and Acquisitions (M&A) Financial Modeling (Advanced)

- #9 Leveraged Buyout (LBO) Modeling (Advanced)

- Financial Modeling Courses in the FMVA® Program

- FAQs: Top Financial Modeling Courses

- What is the top financial modeling course for beginners?

- Can I learn financial modeling online?

- How long does it take to learn financial modeling online?

- Do I need a finance background to take a financial modeling course?

- Are online financial modeling courses worth it for career growth?

- Additional Resources

Top Financial Modeling Courses to Build Real-World Excel Modeling Skills

A curated set of practical courses from CFI’s FMVA® program for aspiring analysts and finance professionals

What Makes These Financial Modeling Courses So Popular?

If you want to learn how to build Excel-based financial models like a financial analyst with the top financial modeling courses, you’re in the right place. The courses below are among the most popular in CFI’s Financial Modeling & Valuation Analyst (FMVA®) Certification — designed to teach you the real-world skills employers look for, from building 3-statement models to forecast the future performance to estimating the value of businesses.

Looking for a complete skill-building path? Explore the FMVA® program.

Top Financial Modeling Courses That Take You From Beginner to Advanced

Below are detailed descriptions of the top nine financial modeling courses, ranked from beginner to advanced. CFI offers over 24 courses designed to help transform anyone into a world-class financial analyst.

Not sure which course format fits your goals? Read our guide on how to choose the best financial modeling course.

#1 Introduction to 3-Statement Financial Modeling (Beginner)

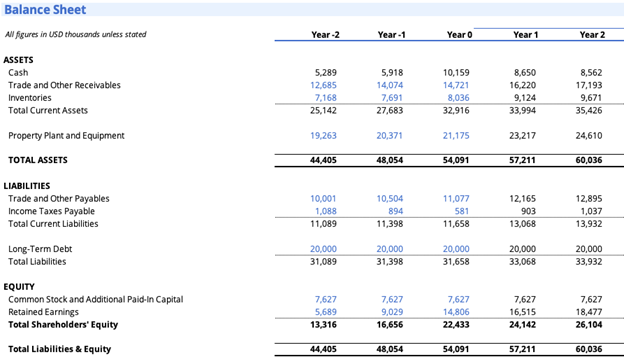

Master the fundamentals of financial modeling by learning how to build and link the income statement, balance sheet, and cash flow statement in Excel from scratch. This course is ideal for new analysts or anyone looking to build a solid modeling foundation.

- Skill Level: Beginner

- Estimated Time to Complete: 3 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Link all three financial statements using Excel formulas

- Build a financial model using best practices

- Develop a model with historical data and various assumptions about future performance

This introductory modeling course prepares learners to progress to the intermediate 3-Statement Modeling course.

Explore the beginner Introduction to 3-Statement Modeling course and intermediate 3-Statement Modeling course.

#2 Introduction to Business Valuation (Intermediate)

Valuation is one of the most fundamental concepts in finance. This Introduction to Business Valuation course teaches the three core methodologies used by professionals to estimate a company’s worth:

- Comparable company analysis,

- Precedent transactions, and

- Discounted cash flow (DCF).

Building on the 3-statement modeling foundation, this course is ideal for newcomers to valuation and those pursuing roles in investment banking, equity research, private equity, and financial planning & analysis (FP&A).

- Skill Level: Intermediate

- Estimated Time to Complete: 3–4 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Learn the three primary valuation techniques — comparable company analysis, precedent transactions, and discounted cash flow (DCF) — and when to apply each method.

- Calculate and distinguish between enterprise value and equity value.

- Build a comprehensive valuation model for a target company using multiple methodologies.

- Evaluate which valuation approach is most appropriate based on company type, industry, and transaction context.

Explore this Introduction to Business Valuation course

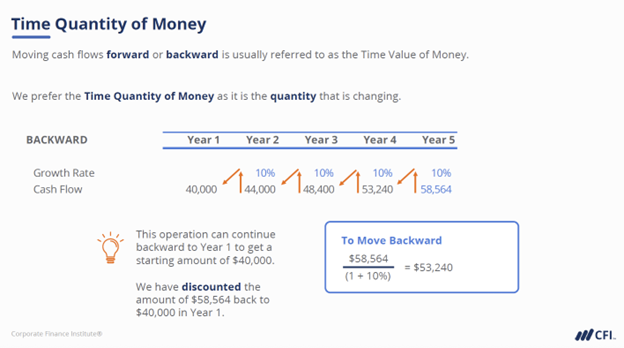

#3 DCF Valuation Modeling (Advanced)

The discounted cash flow (DCF) model is one of the most widely used valuation techniques in finance. This advanced course teaches how to build a best-in-class DCF model while avoiding common errors related to cash flows, discount rates, timing, and tax calculations.

- Skill Level: Advanced

- Estimated Time to Complete: 5 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Design and construct a best-in-class DCF valuation model optimized for presentation and printing.

- Build separate levered and unlevered income tax schedules to avoid common tax calculation errors.

- Calculate unlevered free cash flow (UFCF) and pair it correctly with the weighted average cost of capital (WACC).

- Apply both the perpetuity method and the exit multiple method to calculate the terminal value accurately.

- Address common timing errors related to cash flows, discounting periods, and valuation dates.

- Create a comprehensive dashboard with one- and two-dimensional sensitivity tables to illustrate model outputs.

Explore this DCF Valuation Modeling course

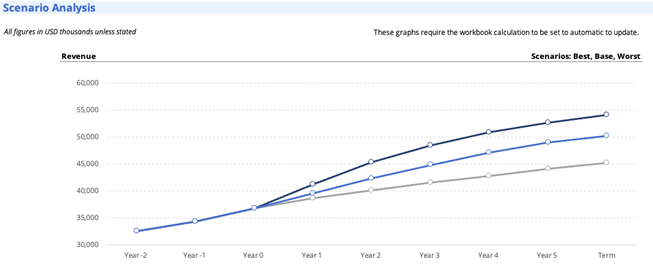

#4 Scenario and Sensitivity Analysis in Excel (Intermediate)

Scenario and sensitivity analysis are critical financial modeling tools for evaluating uncertainty and risk in financial decisions. This course teaches how to build dynamic Excel models that test key assumptions, adapt to multiple business cases, and identify variables with the greatest impact on outcomes.

- Skill Level: Intermediate

- Estimated Time to Complete: 50 minutes

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Build a dynamic scenario manager to model base case, upside, and downside business scenarios.

- Create data tables and sensitivity outputs that clearly identify which variables drive the greatest impact.

- Apply Excel best practices to integrate sensitivity analysis into valuation and forecasting models.

- Use visual tools like charts and graphs to communicate financial implications and support decision-making.

Explore this Scenario and Sensitivity Analysis in Excel course

#5 Real Estate Financial Modeling (Advanced)

In this financial modeling course, you learn how to build a dynamic real estate financial model for development projects, from land acquisition through construction and sales. Develop the skills to evaluate investment returns, model cash flow waterfalls, and perform sensitivity analysis on key development drivers.

- Skill Level: Advanced

- Estimated Time to Complete: 2–3 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Build a complete real estate development financial model in Excel from scratch.

- Calculate the Cap Rate and Net Operating Income (NOI) to value properties at different development stages.

- Model debt and equity financing flows throughout the development lifecycle, from acquisition to sales.

- Create cash flow waterfall charts that show distribution priorities for joint venture (JV) structures.

- Calculate Internal Rate of Return (IRR), Return on Sales, and Return on Cost by investor type.

- Build sensitivity analysis and triggers to understand project exposure to development costs, sales prices, and other key drivers.

Explore this Real Estate Financial Modeling in Excel course

#6 Startup eCommerce Financial Modeling & Valuation (Intermediate)

This financial modeling course teaches how to build a complete model for an eCommerce startup from scratch, using industry best practices and key assumptions to forecast cash flows and determine valuation. Learn to model customer acquisition, revenue buildup, and funding requirements for early-stage businesses.

- Skill Level: Intermediate

- Estimated Time to Complete: 2–3 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Build a comprehensive eCommerce startup financial model using one unified set of assumptions to drive all outputs.

- Calculate customer base growth and order buildup schedules to forecast revenue accurately.

- Model the three financial statements — income statement, balance sheet, and cash flow statement — based on the startup business plan.

- Determine funding requirements by modeling annual cash flows and capital needs.

- Perform a discounted cash flow (DCF) valuation to assess the startup’s investment potential.

- Create output charts and graphs to visualize key metrics, cash flows, and the overall investment opportunity.

Explore this eCommerce Startup Financial Modeling & Valuation course

#7 Operational Modeling (Intermediate)

This financial modeling course teaches how to build an operational financial model using a proven framework and fundamental schedules that serve as the foundation for more complex analysis. Learners develop structured schedules for a company’s operations.

- Skill Level: Intermediate

- Estimated Time to Complete: 4 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Apply a proven framework and guidelines for building effective operational financial models.

- Organize a company’s operations into structured schedules, including revenue, costs, working capital, depreciation, assets, and income tax.

- Follow a consistent workflow to approach each schedule systematically and calculate key outputs.

- Build and maintain a reusable library of schedules that can be applied across different modeling projects.

- Finalize and review models using best practices, automation, and integrity checks to ensure accuracy.

- Develop foundational modeling skills that support more advanced financial analysis throughout your career.

Explore this Operational Modeling course

Top Financial Modeling Courses for Investment Banking and Private Equity

Investment banking and private equity roles require strong transaction-based modeling skills for M&A deals, leveraged buyouts, and other complex transactions. The two online financial modeling courses below are part of CFI’s Investment Banking & Private Equity Modeling Specialization, designed specifically for professionals working in these sectors.

#8 Mergers and Acquisitions (M&A) Financial Modeling (Advanced)

This advanced financial modeling course teaches how to build a complete M&A financial model in Excel, from structuring assumptions to performing accretion/dilution analysis.

Ideal for professionals in investment banking, corporate development, and private equity, analyzing merger and acquisition transactions.

- Skill Level: Advanced

- Estimated Time to Complete: 3 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Build an M&A model from scratch, including all required assumptions, drivers, and adjusting entries.

- Structure sources and uses of cash and perform purchase price allocation to determine goodwill.

- Create a pro forma model that integrates the acquirer and target into one consolidated entity.

- Model multiple scenarios for synergies, takeover premiums, and other key transaction assumptions.

- Calculation accretion/dilution of key per share metrics such as Earnings Per Share (EPS) and assess impact on share price.

- Perform sensitivity analysis to understand how changes in assumptions affect transaction outcomes.

Explore this Mergers and Acquisitions (M&A) Modeling course

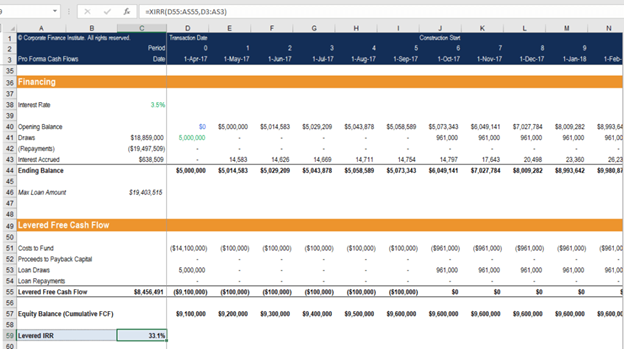

#9 Leveraged Buyout (LBO) Modeling (Advanced)

This LBO Modeling course demonstrates how to build a complete Leveraged Buyout (LBO) model step by step, covering complex capital structures, multiple scenarios, and investor returns. LBO models are essential tools in investment banking and private equity for evaluating buyout transactions and calculating returns.

- Skill Level: Advanced

- Estimated Time to Complete: 4.5–5 hours

- Format: Self-paced, Excel-based, video lessons + hands-on exercises

What You’ll Learn:

- Build a detailed LBO model from scratch using modeling best practices and step-by-step guidance.

- Structure a complex capital structure with multiple debt tranches and equity layers in the capital stack.

- Model the income statement and cash flow statement to reflect high leverage and debt repayment schedules.

- Create multiple scenarios for key assumptions, including entry multiples, exit strategies, and growth rates.

- Calculate Internal Rate of Return (IRR) and cash-on-cash returns by investor type, plus credit metrics and debt covenants.

- Build a comprehensive dashboard with charts, sensitivity analysis, and error checks.

Explore this Leveraged Buyout (LBO) Modeling course

Financial Modeling Courses in the FMVA® Program

These courses take learners from beginner to advanced step-by-step in the order laid out above. If you are considering enrolling in the full Financial Modeling and Valuation Analyst Program (FMVA®), you will also be required to complete other classes that cover critical skills for becoming a world-class financial analyst.

Additional topics include:

- Accounting

- Financial subjects (financial theory, financial math)

- Presentations and pitchbooks

- Data visualization, charts, and graphs

- Corporate strategy

A world-class financial analyst requires more than just technical Excel skills. It takes performing a comprehensive analysis that considers a company’s overall business strategy and industry, presented in a clear and visually compelling way.

FAQs: Top Financial Modeling Courses

What is the top financial modeling course for beginners?

The top financial modeling course for beginners is Introduction to 3-Statement Modeling, which teaches how to link the income statement, balance sheet, and cash flow statement in Excel. This foundational course covers essential formulas, dynamic forecasting, and the core skills needed before progressing to advanced financial modeling courses.

Can I learn financial modeling online?

Yes, you can learn financial modeling online through self-paced courses that combine video lessons with hands-on Excel exercises. Online financial modeling courses teach the same skills used in investment banking, private equity, and corporate finance, allowing you to build models from scratch and practice with real-world scenarios at your own pace.

How long does it take to learn financial modeling online?

Learning basic financial modeling online takes 4-6 hours for a foundational course like the 3-statement model. Complete proficiency across multiple modeling techniques—including valuation, M&A, and LBO models — typically requires 20-30 hours of coursework. Advanced specializations like real estate or eCommerce modeling add 2-5 hours each, depending on complexity and prior experience.

Do I need a finance background to take a financial modeling course?

No, you don’t need a finance background to start learning financial modeling. Beginner courses are designed for newcomers and teach fundamental concepts from scratch. However, accounting, Excel, and basic financial analysis skills are recommended before starting any financial modeling coursework.

Are online financial modeling courses worth it for career growth?

Yes, online financial modeling courses are worth it for career growth in investment banking, private equity, corporate finance, and FP&A roles. Employers value hands-on modeling skills. Completing courses like the FMVA certification demonstrates technical proficiency that can lead to promotions, career transitions, and higher earning potential in finance careers.

Want to learn more? Visit our FMVA® Certification Page

Additional Resources

To continue advancing your career as a world-class financial analyst, the additional CFI resources below will be helpful: