Operating Profit Margin

Operating profit divided by total revenue, expressed as a percentage

What is Operating Profit Margin?

Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and interest charges. It is calculated by dividing the operating profit by total revenue and expressing it as a percentage. The margin is also known as EBIT (Earnings Before Interest and Tax) Margin.

Image: CFI’s Financial Analysis Courses.

Operating Profit Margin differs across industries and is often used as a metric for benchmarking one company against similar companies within the same industry. It can reveal the top performers within an industry and indicate the need for further research regarding why a particular company is outperforming or falling behind its peers.

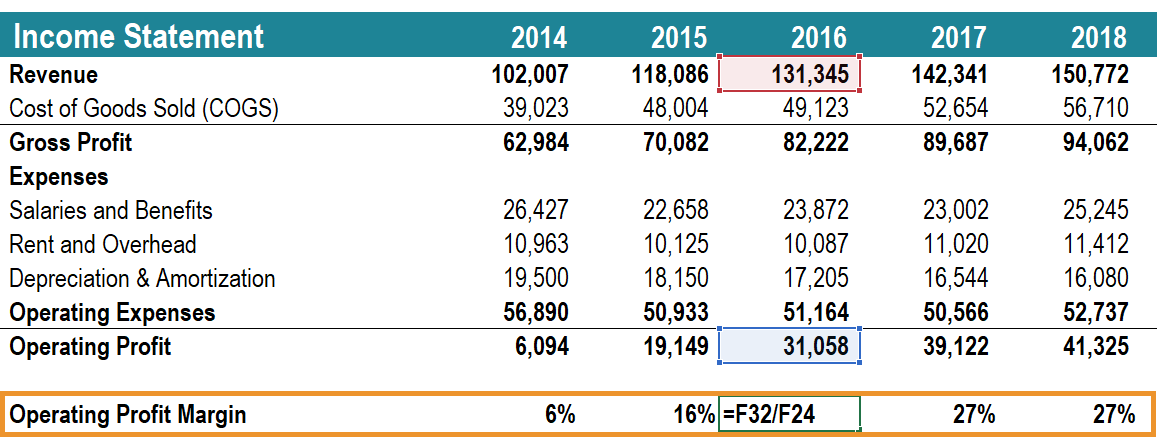

How to Calculate Operating Profit Margin?

Operating profit is calculated by subtracting all COGS, depreciation and amortization, and all relevant operating expenses from total revenues. Operating expenses include a company’s expenses beyond direct production costs, such things as salaries and benefits, rent and related overhead expenses, research and development costs, etc. The operating profit margin calculation is the percentage of operating profit derived from total revenue. For example, a 15% operating profit margin is equal to $0.15 operating profit for every $1 of revenue.

![]()

How to Use Operating Profit Margin?

Operating Profit Margin differs from Net Profit Margin as a measure of a company’s ability to be profitable. The difference is that the former is based solely on its operations by excluding the financing cost of interest payments and taxes.

An example of how this profit metric can be used is the situation of an acquirer considering a leveraged buyout. When the acquirer is analyzing the target company, they would be looking at potential improvements that they can bring into the operations.

The operating profit margin provides an insight into how well the target company performs in comparison to its peers, in particular, how efficiently a company manages its expenses so as to maximize profitability. The omission of interest and taxes is helpful because a leveraged buyout would inject a company with completely new debt, which would then make historical interest expense irrelevant.

A company’s operating profit margin is indicative of how well it is managed because operating expenses such as salaries, rent, and equipment leases are variable costs rather than fixed expenses. A company may have little control over direct production costs, such as the cost of raw materials required to produce the company’s products.

However, the company’s management has a great deal of discretion in areas such as how much they choose to spend on office rent, equipment, and staffing. Therefore, a company’s operating profit margin is usually seen as a superior indicator of the strength of a company’s management team, as compared to gross or net profit margin.

Video Explanation of Operating Profit Margin

Below is a short video that explains how to calculate the ratio and why it’s important when performing financial analysis.

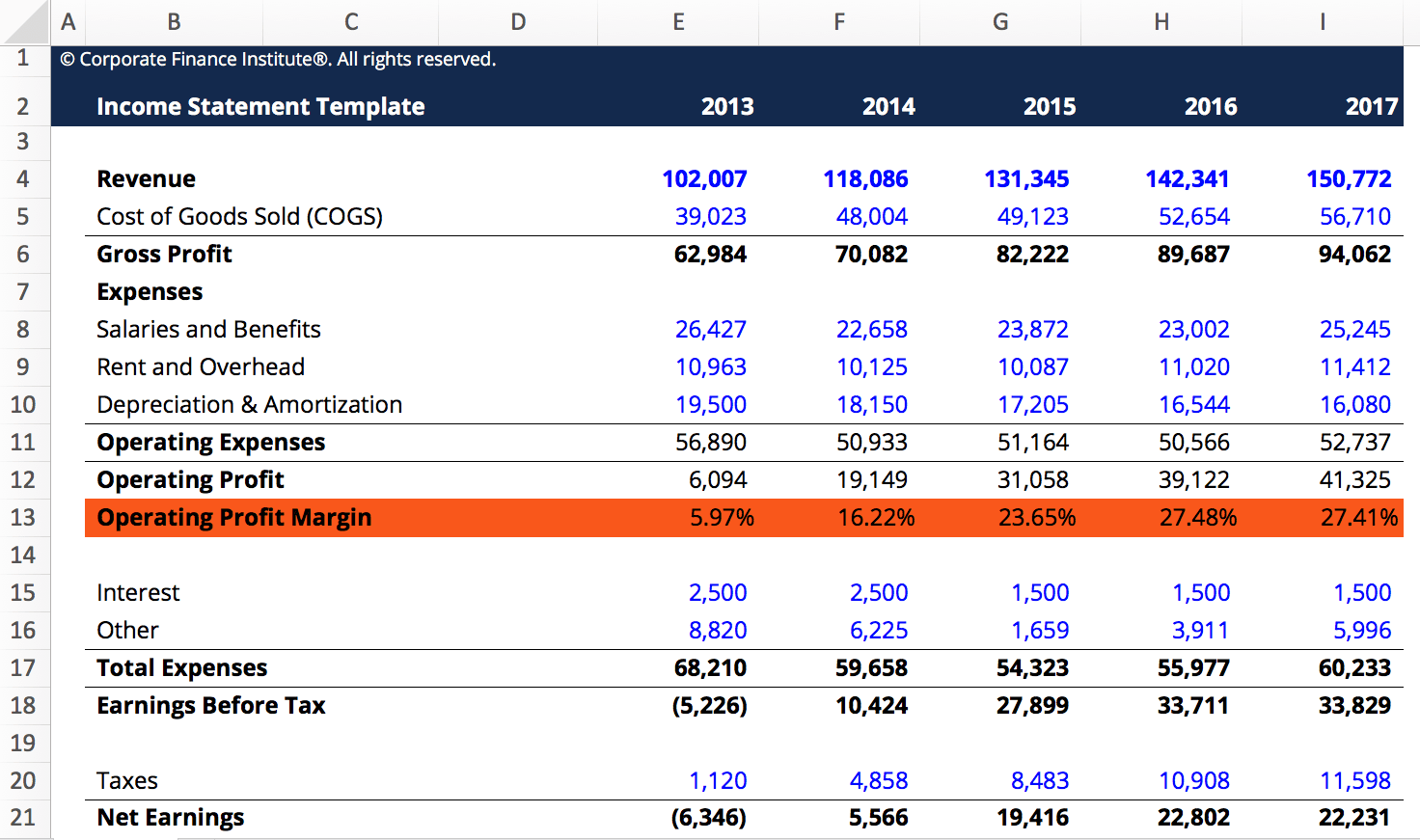

Operating Profit Margin Template

Download CFI’s Excel template to advance your finance knowledge and perform better financial analysis.

Image: CFI’s Financial Analysis Courses.

Limitations of Using the Operating Profit Margin Ratio

As in any part of financial analysis, any number of interest requires additional research to understand the reasons behind the number. Discrepancies in operating profit margin between peers can be attributed to a variety of factors. For instance, a company pursuing an outsourcing strategy may report a different profit margin than a company that produces in-house.

In comparing companies, the method of depreciation may yield changes in operating profit margin. A company using a double-declining balance depreciation method may report lower profit margins that increase over time, even if no change in efficiency occurs. A company using a straight-line depreciation method would see a constant margin unless some other factor changes as well.

A general rule is to hold factors such as geography, company size, industry, and business model constant when using operating profit margin as a comparison analytic between peers. It is also useful to consider other profitability metrics alongside it, such as Gross Profit Margin or Net Profit Margin, as well as other financial metrics, such as leverage, efficiency, and market value ratios.

You can advance your expertise in financial analysis of companies’ money management and profitability by learning about the other aspects of corporate finance that are detailed in the articles listed below.

More Resources

Thank you for reading CFI’s guide to Operating Profit Margin. To continue advancing your career, these CFI resources will be useful:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?