Interest Coverage Ratio

Used to determine how well a company can pay interest on its outstanding debt

What is Interest Coverage Ratio (ICR)?

The Interest Coverage Ratio (ICR) is a financial ratio that is used to determine how well a company can pay the interest on its outstanding debts. The ICR is commonly used by lenders, creditors, and investors to determine the riskiness of lending capital to a company. The interest coverage ratio is also called the “times interest earned” ratio.

Interest Coverage Ratio Formula

The interest coverage ratio formula is calculated as follows:

Where:

- EBIT is the company’s operating profit (Earnings Before Interest and Taxes)

- Interest expense represents the interest payable on any borrowings such as bonds, loans, lines of credit, etc.

Another variation of the formula is using earnings before interest, taxes, depreciation and amortization (EBITDA) as the numerator:

Interest Coverage Ratio = EBITDA / Interest Expense

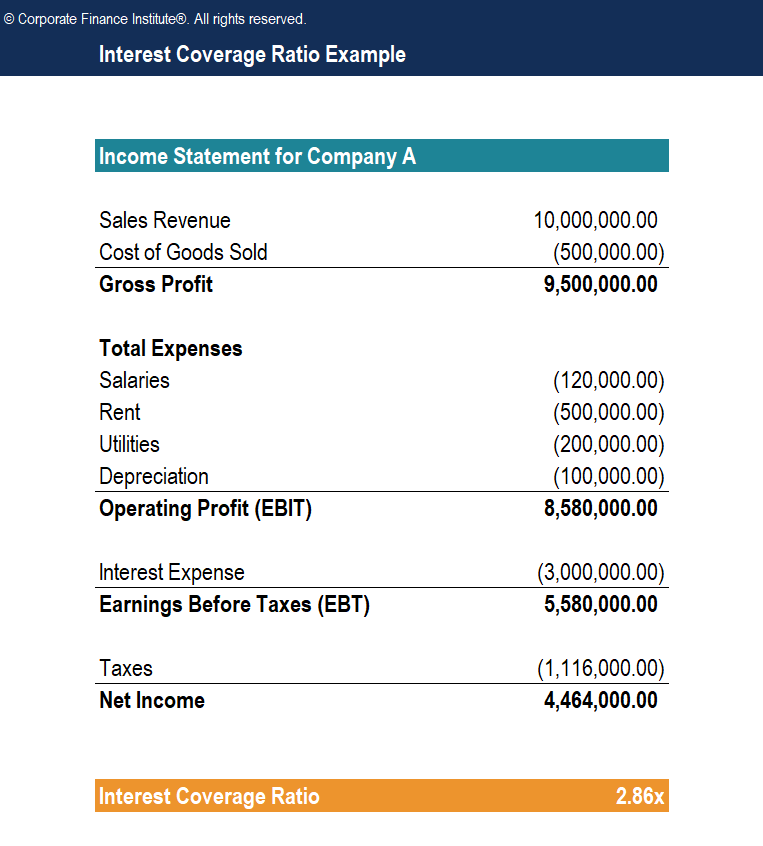

Interest Coverage Ratio Example

For example, Company A reported total revenues of $10,000,000 with COGS (costs of goods sold) of $500,000. In addition, operating expenses in the most recent reporting period were $120,000 in salaries, $500,000 in rent, $200,000 in utilities, and $100,000 in depreciation. The interest expense for the period is $3,000,000. The income statement of Company A is provided below:

To determine the interest coverage ratio:

EBIT = Revenue – COGS – Operating Expenses

EBIT = $10,000,000 – $500,000 – $120,000 – $500,000 – $200,000 – $100,000 = $8,580,000

Therefore:

Interest Coverage Ratio = $8,580,000 / $3,000,000 = 2.86x

Company A can pay its interest payments 2.86 times with its operating profit.

Download the Free Template

Interpretation of Interest Coverage Ratio

The lower the interest coverage ratio, the greater the company’s debt and the possibility of bankruptcy. Intuitively, a lower ratio indicates that less operating profits are available to meet interest payments and that the company is more vulnerable to volatile interest rates. Therefore, a higher interest coverage ratio indicates stronger financial health – the company is more capable of meeting interest obligations.

However, a high ratio may also indicate that a company is overlooking opportunities to magnify their earnings through leverage. As a rule of thumb, an ICR above 2 would be barely acceptable for companies with consistent revenues and cash flows. In some cases, analysts would like to see an ICR above 3. An ICR lower than 1 implies poor financial health, as it shows that the company cannot pay off its short-term interest obligations.

Primary Uses of Interest Coverage Ratio

- ICR is used to determine the ability of a company to pay its interest expense on outstanding debt.

- ICR is used by lenders, creditors, and investors to determine the riskiness of lending money to the company.

- ICR is used to determine company stability – a declining ICR is an indication that a company may be unable to meet its debt obligations in the future.

- ICR is used to determine the short-term financial health of a company.

- Trend analysis of ICR gives a clear picture of the stability of a company in regard to interest payments.

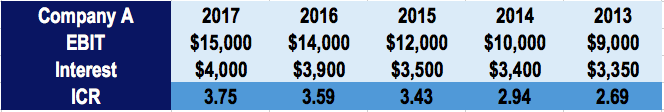

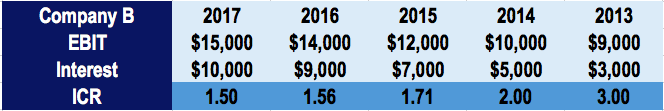

For example, let us use the concept of interest coverage ratio to compare two companies:

When comparing the ICR’s of both Company A and B over a period of five years, we can see that Company A steadily increased its ICR and appears to be more stable, while Company B showed a decreasing ICR and might face liquidity issues in the future.

Additional Resources

Thank you for reading CFI’s guide to Interest Coverage Ratio. To learn more and expand your career, check out the additional relevant CFI resources below.

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?