Overview

Recommended Prep Courses

These preparatory courses are optional, but we recommend you complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:Mergers and Acquisitions (M&A) Modeling Course

Welcome to CFI’s advanced financial modeling course on mergers and acquisitions (M&A). This course is designed for professionals working in investment banking, corporate development, private equity, and other areas of corporate finance that deal with analyzing M&A transactions.

Who should take this course?

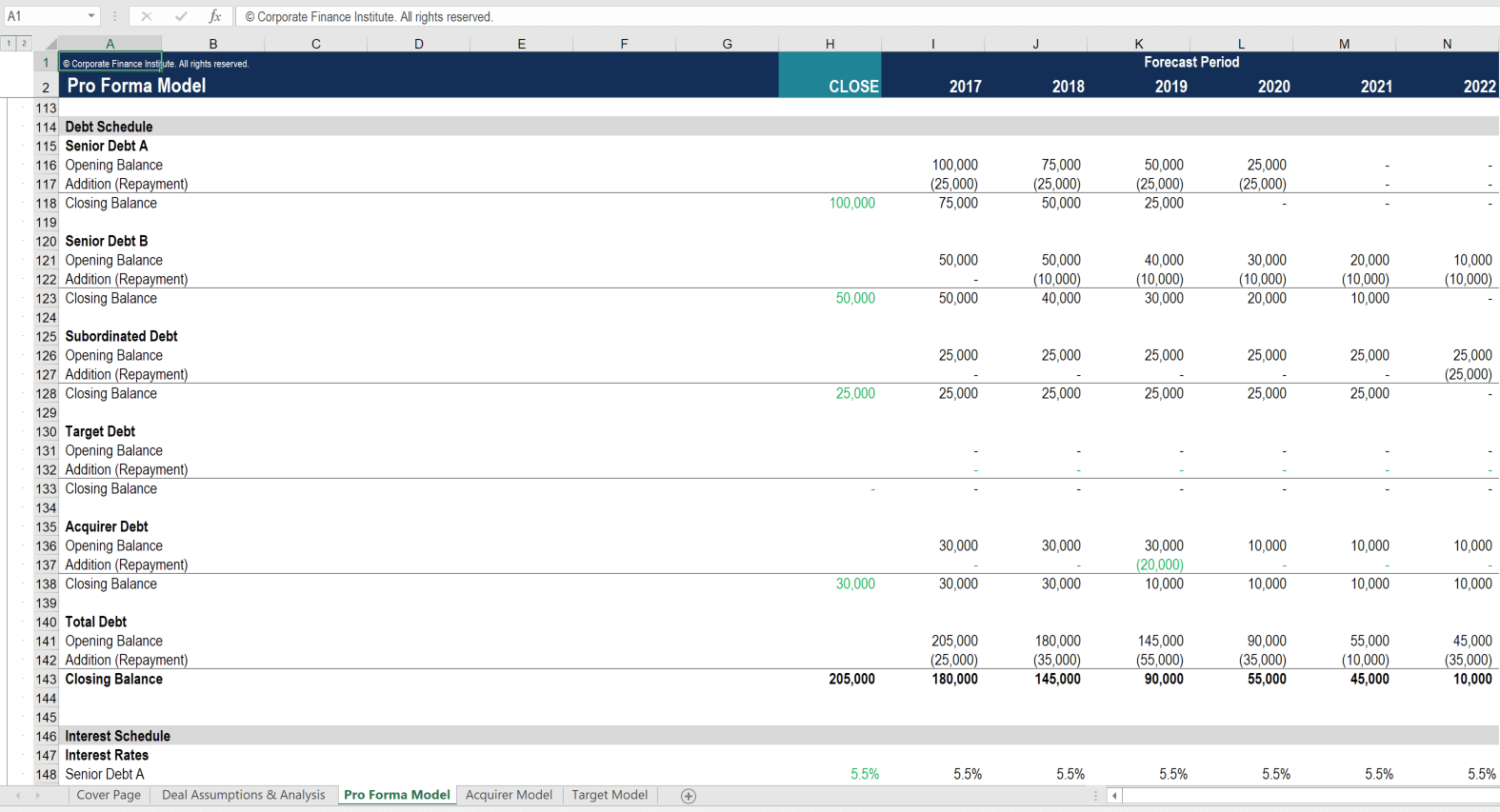

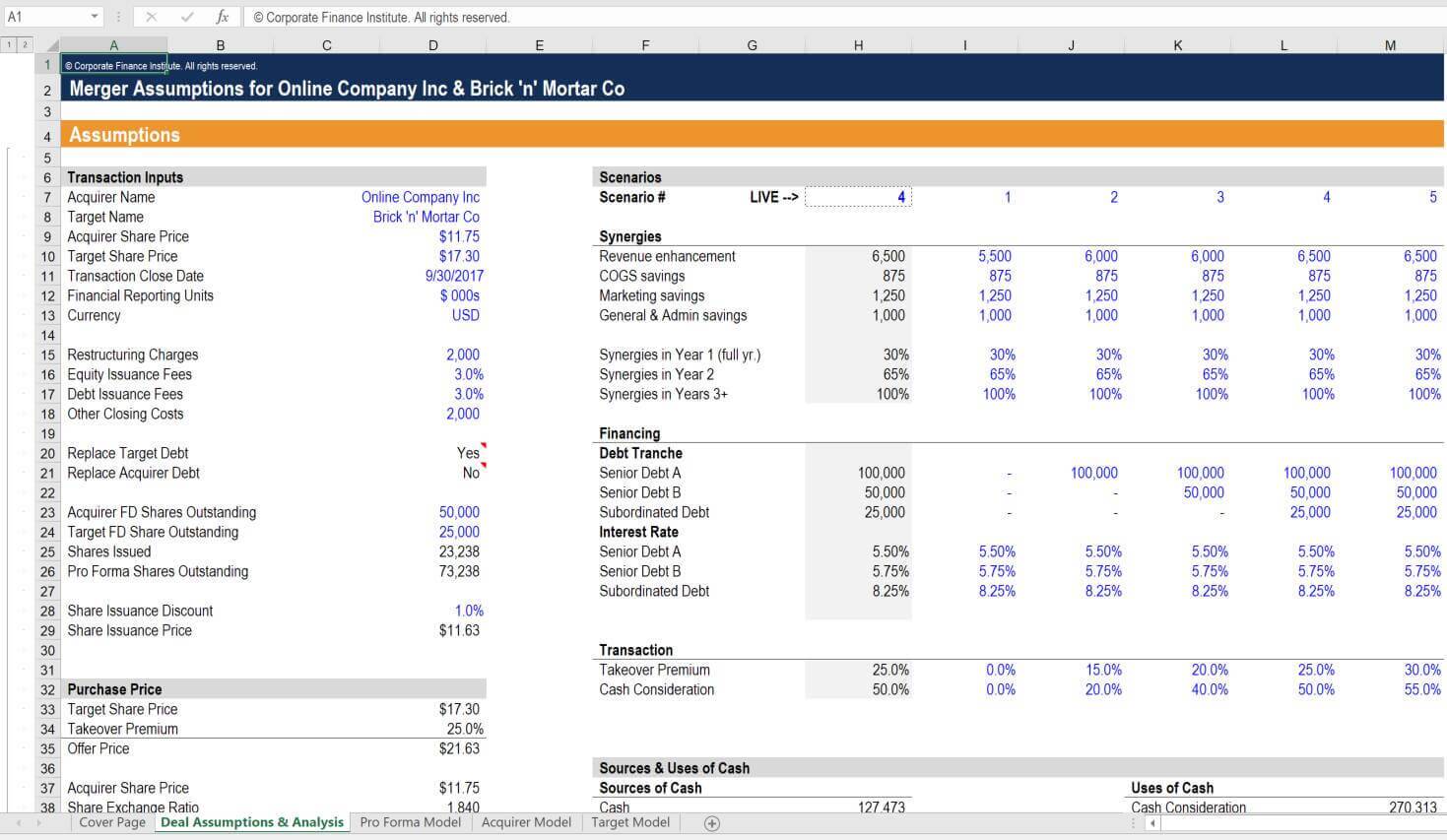

This class is perfect for anyone who wants to learn how to build a financial model for mergers and acquisitions from the bottom up. The video-based lessons will teach you all the formulas and functions to calculate stub periods, outline sources and uses of cash, perform a purchase price allocation and determine goodwill, create multiple scenarios for synergies and other key assumptions, and integrate all of the above into a well laid out pro forma model. In addition to learning the detailed mechanics of how to build the model, students will also learn how to assess the impact of the transaction through accretion/dilution analysis and the impact on the implied share price (intrinsic value per share). By performing sensitivity analysis, users will understand how a change in assumptions impacts future outcomes of the merger or acquisition.

Mergers and Acquisitions Course Case Study

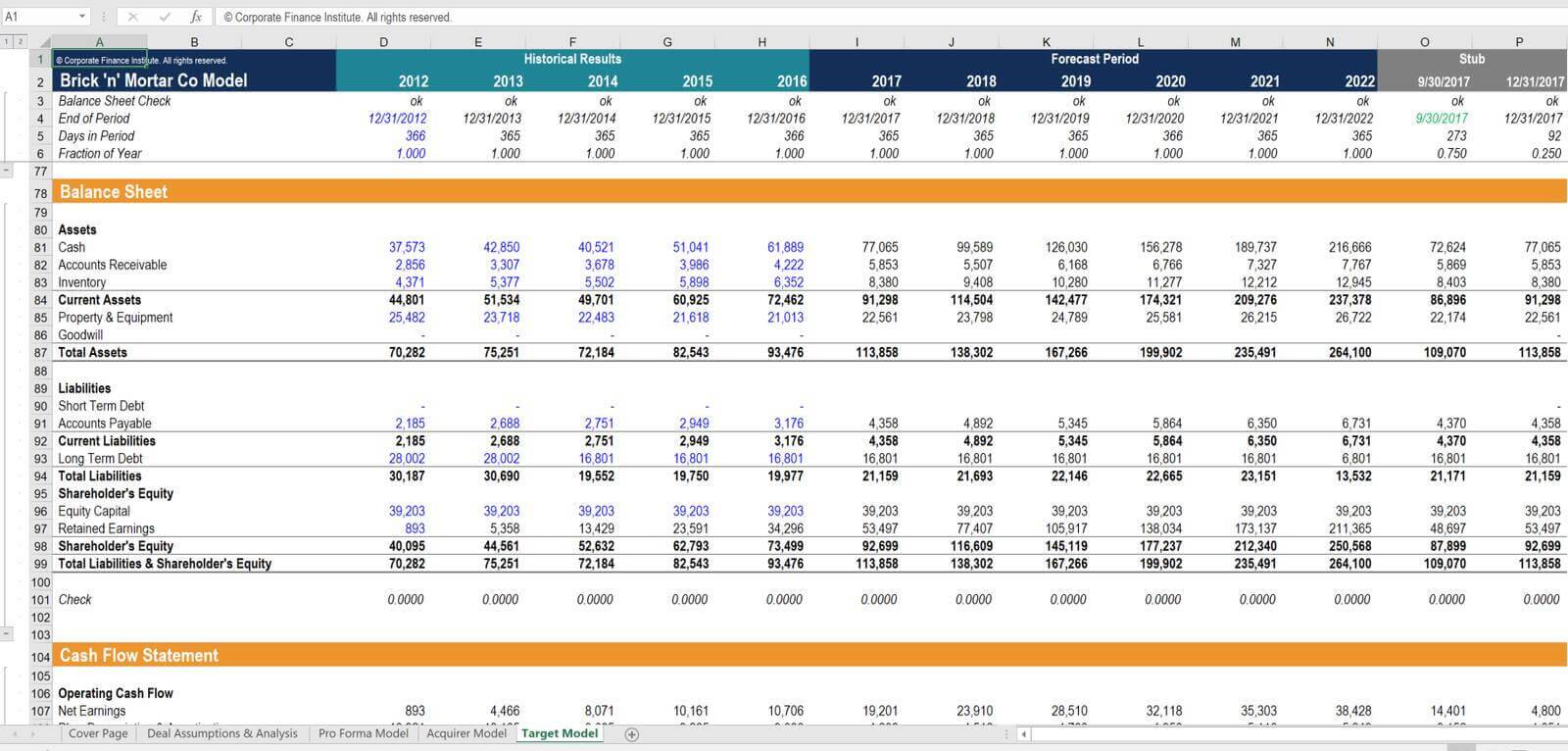

This course is built on a case study of Online Company Inc acquiring Brick ‘n’ Mortar Co. Through the course of the transaction, students will learn about:- The construction of a detailed Pro Forma model

- Analysis of synergies, revenue enhancements, cost structures

- Integration considerations

- Accretion / dilution analysis

- Deal terms and structuring

- The strategic impact of combining the businesses

- Share price impact

What’s included in this M&A course?

This mergers and acquisitions course includes all of the following:- Blank M&A model template (Excel)

- Completed M&A model template (Excel)

- 4+ hours of detailed video instruction

- Certificate of completion

Mergers & Acquisitions (M&A) Modeling Learning Objectives

- Learn how to structure an M&A model in the most efficient way

- Set up all the assumptions and drivers required to build out the M&A model

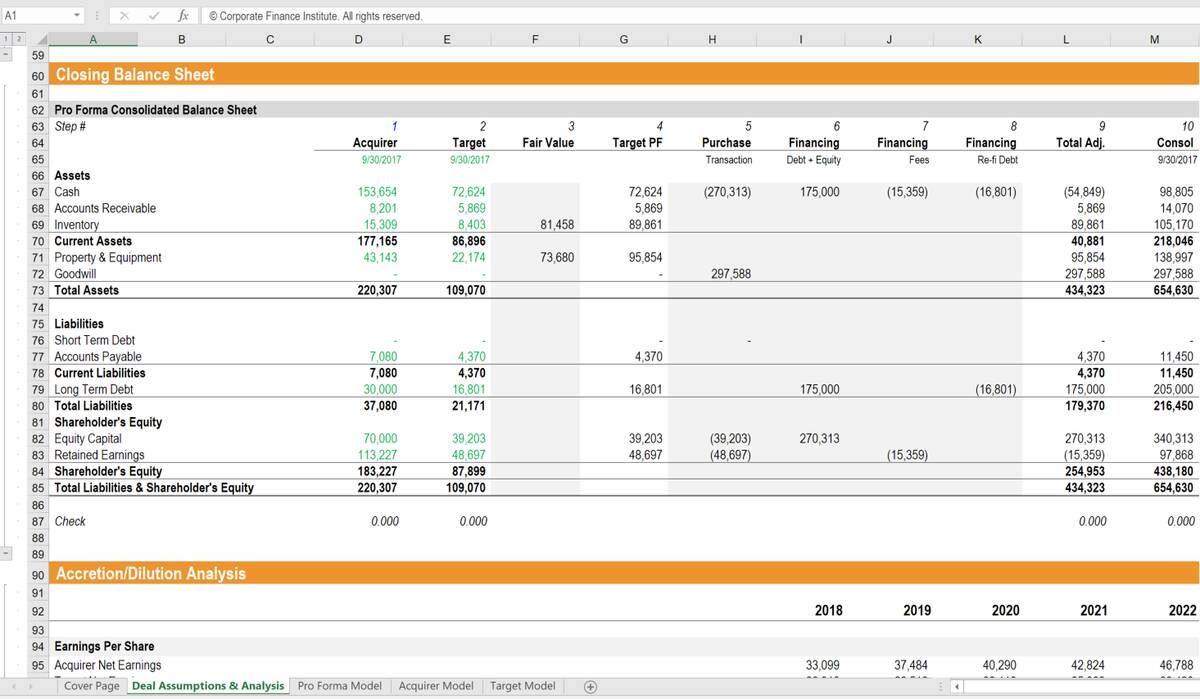

- Calculate all the necessary adjusting entries required to create a post-transaction balance sheet

- Integrate the acquirer and the target into a pro forma model

- Calculate the accretion or dilution of key per-share metrics post-transaction

- Perform sensitivity analysis on key assumptions and assess the overall impact of the transaction

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Financial modelling

- Financial accounting

Level 4

2h 41min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Introduction to M&A Modeling

Acquirer and Target Models

Pro Forma Financial Model

Accretion & Dilution Analysis

Sensitivity Analysis & Share Price Impact

M&A Modeling Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending