Overview

Cash Flow Cycles and Analysis Course Overview

In this Cash Flow Cycles and Analysis course, we look at how companies manage their cash flow. We will explore both the operating cash flow cycle and the investing cash flow cycle. We use real-world examples to calculate a company’s working capital funding gap. Then we will go over important strategies companies can use to optimize their working capital accounts.

Who should take this course?

This Cash Flow Cycles and Analysis course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Cash Flow Cycles and Analysis Learning Objectives

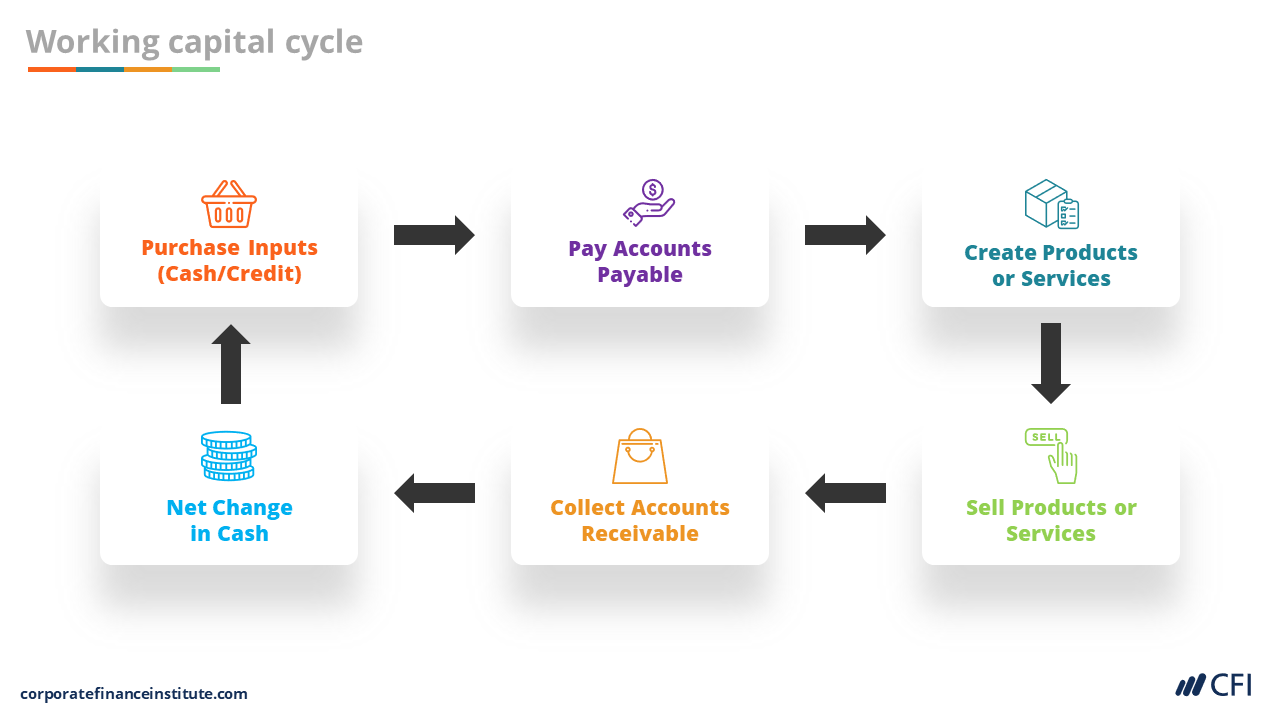

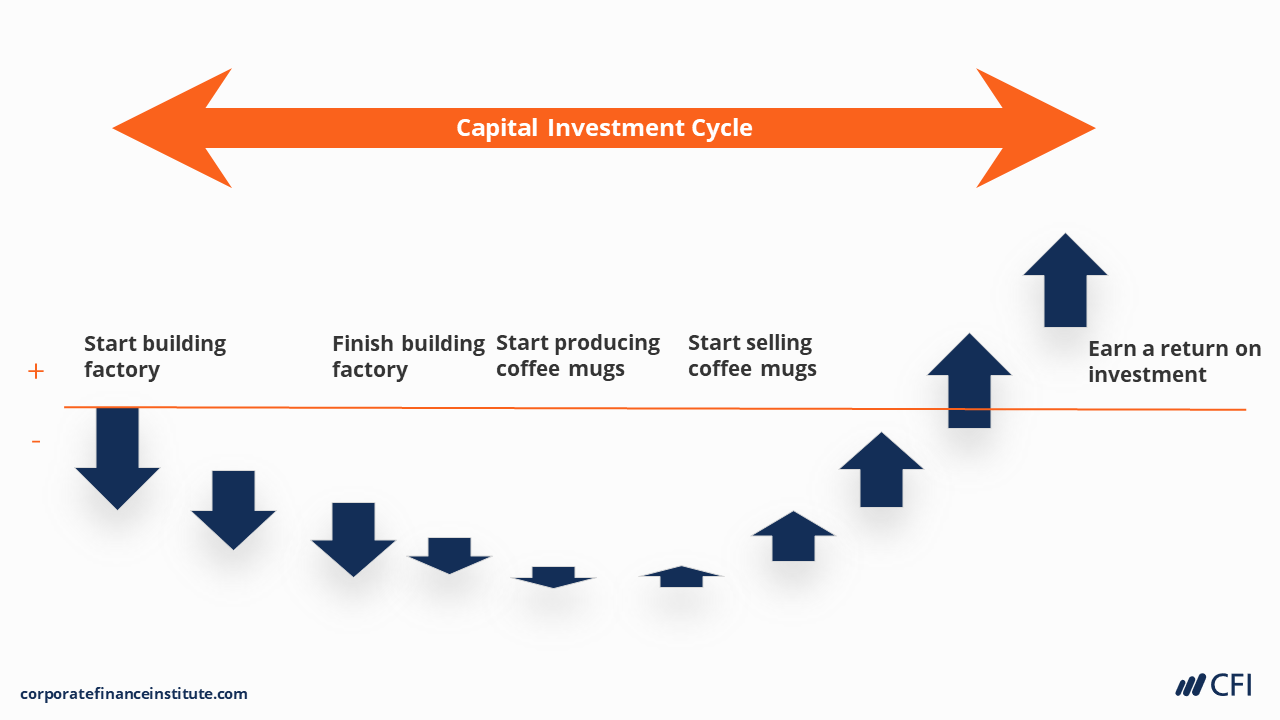

- Discuss the difference between a company's short-term operating cash flow and long-term investing cash flow

- Compare working capital objectives and capital investment objectives

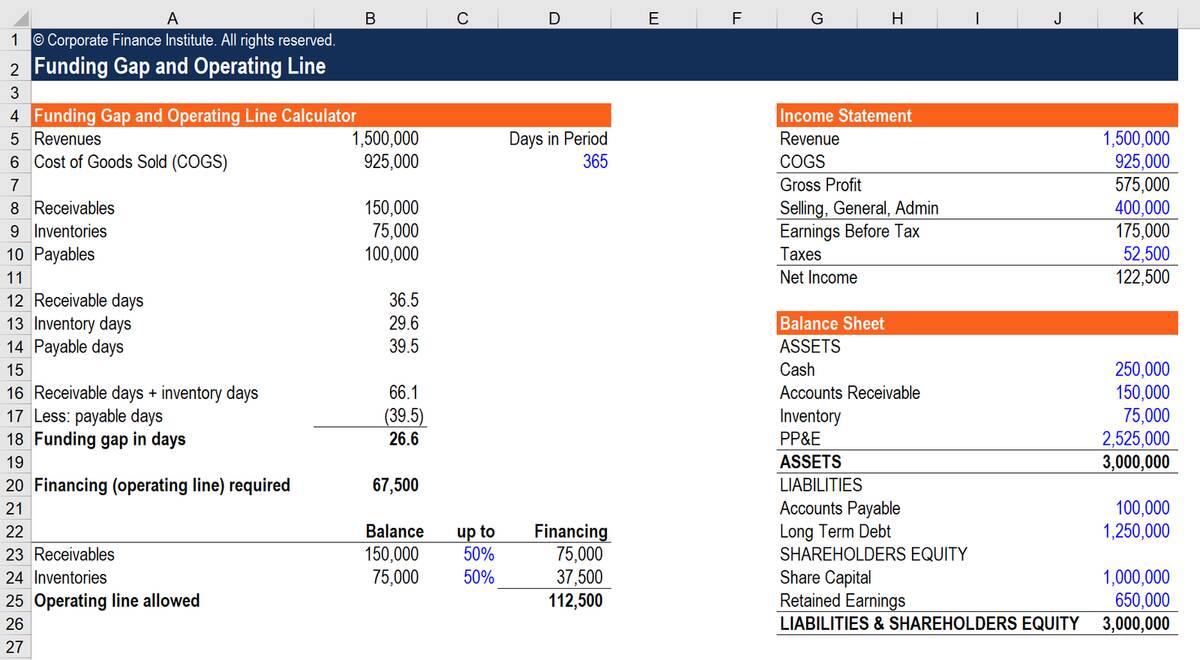

- Calculate working capital funding gap, investment payback and return on investment

- Use a company's financial statement to conduct a cash flow analysis and compare key metrics

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Critical thinking

- Financial accounting

Level 3

1h 2min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Operating Cash Flow Cycle

Investing Cash Flow Cycle

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending